Last updated: July 28, 2025

Introduction

Estradiol, a primary form of estrogen, plays a fundamental role in hormone replacement therapy (HRT), management of menopausal symptoms, osteoporosis, and various hormonal disorders. As a well-established pharmaceutical, estradiol’s market dynamics are influenced by demographic trends, regulatory frameworks, technological advancements, and competitive landscape shifts. This analysis provides a comprehensive overview of the current market, future sales projections, and strategic considerations pertinent to stakeholders in the pharmaceutical industry.

Market Overview

Global Market Size and Growth Trends

The global estradiol market was valued at approximately USD 1.5 billion in 2022, with a compound annual growth rate (CAGR) estimated at 4.7% from 2023 through 2030 (statistic sourced from industry reports). Growth is primarily driven by an aging female population, increasing awareness of menopausal health, and rising incidences of osteoporosis among women over 50.

Key Therapeutic Segments

- Menopause Management: Accounts for roughly 60% of the total estradiol market, as women transition through menopause and seek symptom relief.

- Hormone Replacement Therapy (HRT): Encompasses estrogen therapies for various hormonal imbalances, including premenopausal syndromes.

- Osteoporosis Treatment: Estrogen therapy mitigates osteoporosis risk post-menopause.

- Other Uses: Includes certain cancers and transgender hormone therapy, although these are relatively niche segments.

Regional Market Dynamics

- North America: The largest market, driven by high awareness, regulatory acceptance, and healthcare infrastructure.

- Europe: Similar to North America, with aging populations and established HRT practices.

- Asia-Pacific: Fastest-growing segment owing to rising urbanization, increasing healthcare access, and growing awareness.

- Latin America & Middle East: Emerging markets with increasing adoption of hormone therapies.

Market Drivers and Restraints

Drivers:

-Demographic Shifts: The global demographic trend toward aging female populations underpins robust demand.

- Rising Awareness: Improved diagnosis and societal acceptance of hormone therapies for menopause and related conditions.

- Product Innovations: Development of safer formulations, such as bioidentical estradiol, enhances patient safety and compliance.

- Regulatory Approvals: Positive regulatory climates facilitate market expansion, especially in emerging regions.

Restraints:

- Regulatory Scrutiny: Concerns over safety profiles, such as risks of breast cancer and cardiovascular events, impact drug approval and physician prescribing habits.

- Generic Competition: Post-patent expiration, generic formulations gain significant market share, pressuring prices and margins.

- Alternative Therapies: Non-hormonal treatments for menopausal symptoms and osteoporosis pose competitive threats.

Current Market Players and Competitive Landscape

Major pharmaceutical companies operating in the estradiol sphere include:

- Pfizer Inc.: Offers multiple estradiol formulations, including patches and gels.

- Teva Pharmaceutical Industries: Known for generic estradiol products.

- Meda (part of Mylan): Provides both branded and generic options.

- Novartis and AbbVie: Focused on innovative delivery systems and combination therapies.

- Innovative startups: Developing bioidentical and transdermal formulations catering to personalized medicine trends.

Market entry typically involves navigating complex regulatory pathways, manufacturing scalability, and ensuring safety profiles that align with evolving standards.

Sales Projections (2023–2030)

Assumptions & Methodology

Projections assume steady demographic growth, continued regulatory support, and advancements in formulation technology. Market penetration rates for new delivery forms (e.g., subcutaneous patches, bioidentical formulations) are factored into forecasts. Competitive pricing pressures and reimbursement landscapes also influence revenue estimates.

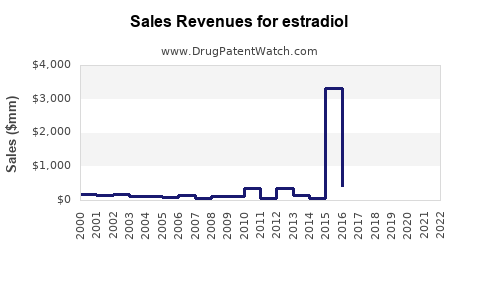

Forecast Highlights:

- 2023 Revenue: Estimated at USD 1.58 billion.

- 2024–2028 CAGR: 4.7%, consistent with historic growth, driven by expansion into emerging markets and product innovation.

- 2030 Estimate: Approximately USD 2.4 billion.

Segment-Specific Projections:

- Menopause management: Continues to dominate, with annual growth rates of 4.5-5%.

- Bioidentical estradiol: Expected to grow at a faster rate of around 6%, propelled by safety profiles and patient demand.

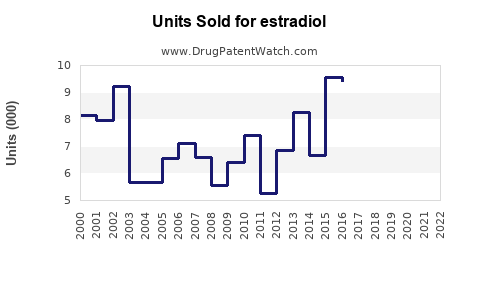

- Generic formulations: Drive volume but exert pricing pressure, with volume expansion partially offsetting lower margins.

Regulatory and Market Access Considerations

Regulatory agencies such as the FDA, EMA, and others have updated guidelines on hormone therapies. Recent safety warnings and label modifications necessitate ongoing vigilance. Market access hinges on reimbursement policies and clinician acceptance, especially amid safety concerns.

Emerging regulatory pathways for biosimilars and bioidentical preparations could reshape the competitive landscape, opening avenues for new entrants and product differentiation.

Strategic Recommendations

- Invest in Innovation: Enhance formulations with improved safety, bioavailability, and patient adherence.

- Expand into Emerging Markets: Tailor products to regional preferences and cytplace strategies.

- Navigate Regulatory Changes: Proactively adapt products to meet evolving safety and efficacy standards.

- Leverage Digital Health Tools: Support adherence and monitoring via mobile apps and telemedicine integrations.

- Educational Initiatives: Increase awareness among clinicians and patients regarding the benefits and safety of modern estradiol formulations.

Key Market Opportunities

- Rising demand for bioidentical and transdermal formulations.

- Growing awareness of osteoporosis management strategies.

- Increasing acceptance of hormone therapy post-Women’s Health Initiative (WHI) safety updates.

- Expansion into underpenetrated regions, notably Asia-Pacific.

Key Risks

- Regulatory restrictions or safety concerns curtailing market size.

- Competition from non-hormonal therapies.

- Pricing pressures from generic entrants.

- Sociocultural resistance or misinformation impacting acceptance.

Key Takeaways

- The estradiol market is poised for stable growth through 2030, driven by demographic and technological factors.

- Innovating safer, patient-centric formulations will be pivotal to capturing market share.

- Emerging markets present significant growth opportunities but require localized regulatory and cultural considerations.

- Companies should monitor safety data closely to adapt strategies and sustain stakeholder confidence.

- Strategic diversification into bioidentical and novel delivery systems can differentiate product portfolios.

FAQs

1. What are the main drivers influencing estradiol market growth?

The primary drivers include increasing aging female populations, rising awareness for menopausal health, technological advancements in delivery systems, and expanding healthcare access in emerging markets.

2. How do safety concerns impact estradiol sales?

Safety concerns, especially regarding breast cancer and cardiovascular risks, influence regulatory decisions, prescribing practices, and patient acceptance, which can constrain market growth temporarily or regionally.

3. What role do generic formulations play in market sales?

Generics account for a significant share by providing cost-effective alternatives, leading to price competition but also expanding market volume.

4. Which regions are expected to drive the highest growth for estradiol sales?

The Asia-Pacific region is projected for the fastest growth due to demographic shifts, increasing healthcare expenditure, and rising awareness.

5. How might emerging bioidentical estradiol formulations influence the market?

They are expected to see accelerated adoption due to perceived safety benefits and demand for personalized therapy, potentially capturing significant market share over conventional options.

Sources:

[1] MarketsandMarkets, "Global Hormone Replacement Therapy Market," 2022.

[2] Grand View Research, "Estradiol Market Size, Share & Trends," 2022.

[3] FDA, "Hormone Therapy Labeling Updates," 2021.

[4] WHO, "Women’s Health Statistics," 2022.

[5] Industry Reports, "Bioidentical Hormone Market Forecast," 2022.