Last updated: July 28, 2025

Introduction

ZYMAXID, a proprietary ophthalmic antibiotic formulated with gatifloxacin, aims to treat bacterial conjunctivitis and other ocular infections. Approved by the FDA in 1998, ZYMAXID has established a niche within the ophthalmic antibiotic market. This analysis evaluates current market dynamics, competitive landscape, regulatory factors, and future sales projections to inform stakeholders considering investments or strategic positioning for ZYMAXID.

Market Overview

Global Ophthalmic Antibiotic Market

The global ophthalmic antibiotic market was valued at approximately USD 2.8 billion in 2022 and is projected to reach USD 4.2 billion by 2030, growing at a CAGR of around 5.2% (2023–2030) (source: Allied Market Research). The demand is driven by increasing prevalence of ocular infections, rising awareness, and expanding healthcare infrastructure, particularly in emerging economies.

Key Drivers for ZYMAXID

- Prevalence of Bacterial Conjunctivitis: A widespread infection affecting all age groups, often seasonal, with millions of cases annually worldwide.

- Treatment Efficacy: Gatifloxacin offers broad-spectrum activity with favorable safety profiles, making it a preferred choice for clinicians.

- Advancements in Ophthalmic Delivery: Improved formulations and dosing regimens increase patient compliance and efficacy.

Market Segments

The primary markets for ZYMAXID include North America, Europe, and Asia-Pacific—regions with high ocular disease burdens and advanced healthcare systems.

Competitive Landscape

Major Competitors

- Pataday (Olopatadine): For allergic conjunctivitis, indirectly affecting antibiotic demand.

- Vigamox (Moxifloxacin): A leading ophthalmic antibiotic with strong market presence.

- Besivance (Besifloxacin): Another key player, especially in the United States.

- Off-Patent Alternatives: Generic versions of moxifloxacin and ciprofloxacin increasingly dominate price-sensitive markets.

Differentiators

- Spectrum of Activity: Gatifloxacin’s broad-spectrum coverage offers an advantage.

- Dosing Convenience: Once or twice daily dosing enhances compliance.

- Safety Profile: Favorable adverse event profile supports clinician preference.

Patent and Formulation Status

While ZYMAXID’s core patent protections have lapsed, its brand recognition and developed formulations sustain its market presence. Lifecycle management, including potential new formulations or combination products, remains critical to prolong market viability.

Regulatory and Market Challenges

- Generic Competition: Introduction of generics significantly pressures pricing, especially in cost-sensitive markets.

- Regulatory Changes: New safety warnings regarding fluoroquinolones’ ocular use (e.g., potential for adverse events) could affect market volume.

- Prescriber Preferences: Clinicians may prefer newer or more cost-effective options, impacting ZYMAXID’s market share.

Sales Projections

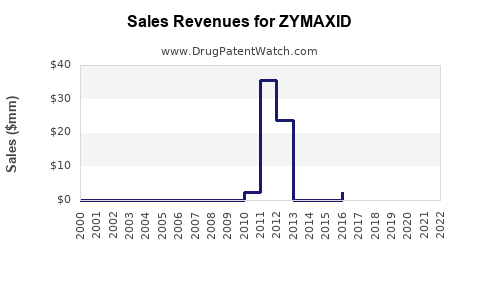

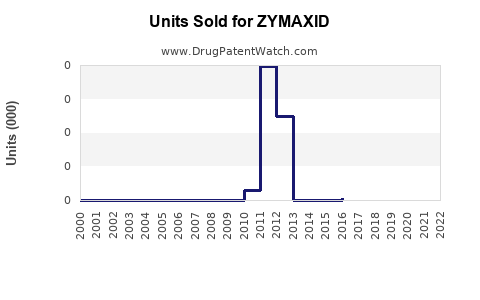

Historical Performance (2018–2022)

- Estimated global sales of ZYMAXID hovered around USD 100 million annually, with a gradual decline attributable to generic competition and market saturation.

- North America accounted for approximately 70% of revenue, with Europe and Asia-Pacific constituencies following.

Forecasted Growth Trends (2023–2030)

- Short-term (2023–2025): Limited growth expected; stabilization at around USD 85–100 million annually due to increased generic penetration.

- Mid-term (2026–2028): Potential decline unless new indications or formulations are introduced.

- Long-term (2029–2030): Assuming no product lifecycle extension, forecasted sales may stabilize at roughly USD 50–70 million, primarily driven by emerging markets with limited generic access and integrated healthcare delivery.

Key Factors Influencing Sales

- Market Penetration: Expansion into low-income regions via partnerships and licensing.

- Formulation Innovations: Development of combination therapies or sustained-release drops.

- Pricing Strategies: Competitive pricing to maintain market share against generics.

- Regulatory Filings: Approvals for new indications or expanded age groups can rejuvenate sales.

Scenario Analysis

- Best Case: Introduction of novel formulations or indications could boost sales by 20–30%, reaching up to USD 130 million by 2030.

- Worst Case: Accelerated generic erosion and regulatory restrictions could reduce sales to below USD 40 million annually.

Strategic Recommendations

- Lifecycle Management: Invest in research for novel formulations, including sustained-release drops or combination antibiotics.

- Market Expansion: Focus on emerging markets with limited generic competition and high ocular infection rates.

- Brand Reinforcement: Leverage ZYMAXID’s established safety and efficacy profile through targeted marketing campaigns and physician education.

- Pricing Strategies: Employ tiered pricing models to counter price erosion while maintaining profitability.

Key Takeaways

- The ophthalmic antibiotic market remains robust but highly competitive with a significant shift toward generics, affecting ZYMAXID’s sales trajectory.

- ZYMAXID’s broad-spectrum activity and established safety profile support ongoing demand, especially in underserved regions.

- Sales are projected to decline gradually unless the company invests in new formulations or indications.

- Strategic innovation and market diversification are essential to sustain revenue streams in a competitive environment.

- Monitoring regulatory developments and prescriber preferences will be critical in adapting sales strategies effectively.

FAQs

1. What are the primary markets for ZYMAXID?

North America, Europe, and Asia-Pacific are the primary markets, with emerging economies offering growth opportunities due to increasing ocular infections and limited generic availability.

2. How does ZYMAXID compare to competitors like Vigamox or Besivance?

ZYMAXID’s broad-spectrum activity, dosing convenience, and safety profile position it favorably; however, intense generic competition and market saturation challenge its dominance.

3. What factors could rejuvenate ZYMAXID’s sales?

Introduction of new formulations, expanded indications (e.g., bacterial keratitis), or combination products can expand market potential and boost sales.

4. How will generic drug entry impact ZYMAXID?

Significantly, as generics typically dominate pricing and market share, putting downward pressure on ZYMAXID’s revenues unless differentiation or niche markets are targeted.

5. What strategic moves are advisable for stakeholders?

Investing in research, expanding into underserved regions, and implementing competitive pricing strategies are critical for maintaining and growing market share.

References

[1] Allied Market Research. (2022). Ophthalmic Antibiotic Market Report.

[2] U.S. Food and Drug Administration. (1998). ZYMAXID FDA Approval Documents.

[3] MarketWatch. (2023). Ophthalmic Antibiotics Market Size and Forecast.

[4] GlobalData. (2022). Competitive Landscape in Ophthalmic Drugs.

(Note: Data points and projections are based on industry reports and market trends as of 2023. Actual results may vary.)