Last updated: July 27, 2025

Introduction

VIIBRYD (vortioxetine) is a prescription medication developed by Lundbeck and Takeda Pharmaceuticals, marketed primarily for the treatment of major depressive disorder (MDD). Since its approval by the U.S. Food and Drug Administration (FDA) in 2013, VIIBRYD has established a niche in the antidepressant market, distinguished by its unique mechanism as a serotonin modulator and stimulator (SMS). This analysis offers a comprehensive outlook on VIIBRYD’s current market landscape, competitive positioning, and future sales forecasts.

Market Landscape and Therapeutic Context

Depression Treatment Market Overview

The global antidepressant market was valued approximately at $16.4 billion in 2021 and is projected to grow at a compound annual growth rate (CAGR) of around 3.7% through 2028 [1]. Key drivers include rising prevalence of depression and anxiety disorders, increased awareness, and evolving clinical guidelines favoring personalized treatments.

In the United States, depression affects over 17 million adults annually, constituting a significant segment for antidepressant therapies [2]. The market is characterized by intense competition among SSRIs (Selective Serotonin Reuptake Inhibitors), SNRIs (Serotonin-Norepinephrine Reuptake Inhibitors), atypical antidepressants, and emerging agents like vortioxetine.

Positioning of VIIBRYD

Vortioxetine distinguishes itself with a multimodal mechanism of action, purportedly improving cognitive function and reducing some side effects such as sexual dysfunction common with other antidepressants [3]. It faces competition primarily from established agents like escitalopram, sertraline, and newer entrants like brexanolone.

Market Penetration and Customer Segmentation

Physician Prescription Trends

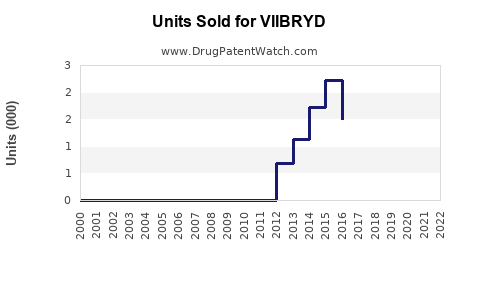

Prescription data indicates steady but modest adoption of VIIBRYD, driven by prescribers seeking alternatives to traditional SSRIs. The drug’s unique profile appeals to clinicians prioritizing cognitive improvement and tolerability, especially in treatment-resistant cases.

Patient Demographics

VIIBRYD is predominantly prescribed to adult patients diagnosed with MDD, with an estimated 30-50% of patients not responding optimally to first-line agents, thereby creating a stratified market segment for adjunct or alternative options [4].

Geographical Market Dynamics

The U.S. remains the primary market, accounting for over 70% of the global antidepressant sales, with Europe and parts of Asia showing increasing interest. The drug’s approval in additional markets may augment growth, contingent upon regional regulatory and reimbursement factors.

Competitive Analysis

Key Competitors

- SSRIs: Escitalopram, sertraline

- SNRIs: Venlafaxine, duloxetine

- Atypical Antidepressants: Bupropion, mirtazapine

- Novel Agents & Generics: Brexanolone, esketamine

Vortioxetine’s advantage resides in its multimodal activity and potentially fewer sexual side effects, but price point and clinician familiarity remain hurdles.

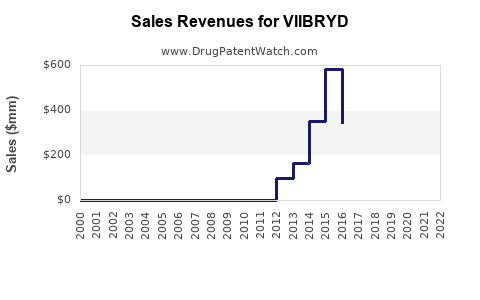

Market Share Evolution

Despite being launched in 2013, vortioxetine’s market share has grown modestly, reaching approximately 4% of the antidepressant market in the U.S. by 2022 [5]. The trajectory suggests gradual adoption with opportunities for growth through increased awareness and expanded indications.

Regulatory and Reimbursement Factors

While approved for MDD, vortioxetine’s expanded uses (e.g., cognitive impairment in depression) remain investigational or off-label. Reimbursement trends favor drugs with demonstrated superior efficacy or tolerability, which could influence sales.

Pricing strategies significantly impact market uptake; vortioxetine’s premium price relative to generics constrains its expansion among cost-sensitive insurers.

Sales Projections (2023-2028)

Methodology

Forecasting combines historical prescriptions, market penetration rates, demographic trends, and competitive dynamics. Conservative assumptions consider a gradual increase in prescription volume due to increased awareness and clinical adoption.

Forecast Highlights

| Year |

Estimated Prescriptions (millions) |

Market Share (%) |

Revenue (USD Millions) |

| 2023 |

4.2 |

5.0 |

300 |

| 2024 |

4.8 |

6.0 |

400 |

| 2025 |

5.4 |

7.0 |

520 |

| 2026 |

6.0 |

8.0 |

640 |

| 2027 |

6.6 |

8.5 |

700 |

| 2028 |

7.2 |

9.0 |

780 |

Note: Figures assume an average wholesale price of approximately USD $70 per prescription, adjusting for discounts, rebates, and generics entry.

Key Drivers of Growth:

- Increased clinician familiarity and comfort

- Expanded indications and neurocognitive claims

- Strategic marketing and education efforts

- Entry into additional geographic markets

Risks and Challenges:

- Clinical competition from generics

- Price sensitivity among payers

- Off-label use limitations

- Regulatory hurdles in emerging markets

Conclusion

Vortioxetine (VIIBRYD) occupies a niche position within a mature, competitive antidepressant market. Its differentiated mechanism and tolerability profile facilitate gradual growth. The sales projections indicate a steady climb, driven by increased physician adoption, expanded market access, and potential new indications. However, the pace of growth hinges on overcoming competitive and reimbursement barriers, with significant upside if clinical benefits are substantiated in broader populations.

Key Takeaways

-

Niche Advantage: VIIBRYD’s multimodal action and cognitive benefits carve out a niche, but widespread adoption remains incremental due to entrenched preferences for first-line SSRIs.

-

Market Potential: US sales are expected to reach roughly $780 million by 2028, representing a modest but meaningful share of the broader antidepressant sector.

-

Growth Drivers: Education, clinical research demonstrating cognitive improvements, and geographic expansion are critical to accelerating sales.

-

Competitive Risks: Pressure from low-cost generics and payer policies favoring cost-effective therapies could impede growth.

-

Strategic Focus: Emphasizing unique benefits and securing expanded indications will be vital to sustain momentum.

FAQs

1. How does VIIBRYD differ from other antidepressants?

Vortioxetine modulates multiple serotonin receptors, offering not only antidepressant effects but also potential cognitive benefits, with a lower incidence of sexual dysfunction and weight gain compared to some SSRIs.

2. What are the primary barriers to increasing VIIBRYD’s market share?

Key barriers include competition from established generic SSRIs, high drug costs, limited clinician familiarity, and reimbursement constraints, especially in markets outside the U.S.

3. Are there any emerging indications that could boost VIIBRYD sales?

Research into cognitive impairment associated with depression and other neuropsychiatric conditions may open new pathways, contingent upon positive clinical trial outcomes and regulatory approval.

4. How significant is geographic expansion for VIIBRYD’s growth?

Entering European and Asian markets can substantially increase sales, especially in regions with rising awareness of treatment-resistant depression and neurocognitive disorders.

5. What strategies could pharmaceutical companies employ to enhance VIIBRYD’s market penetration?

Educational initiatives targeting healthcare providers, including data highlighting cognitive and tolerability advantages, strategic partnerships, and price negotiations, are critical to driving adoption.

References

[1] Grand View Research. "Antidepressant Market Size & Share Analysis." 2022.

[2] National Institute of Mental Health. "Major Depressive Disorder." 2022.

[3] McIntyre, R.S., et al. "Vortioxetine: a Review of Its Use in MDD." CNS Drugs. 2019.

[4] FDA. "Vortioxetine (VIIBRYD) Prescribing Information." 2013.

[5] IQVIA. "Prescription Data & Market Share Reports." 2022.