Last updated: July 29, 2025

Introduction

UCERIS (budenoside) is a localized corticosteroid formulated as a rectal foam for the treatment of ulcerative colitis (UC). Approved by the FDA in 2019, UCERIS offers a targeted therapy for mild to moderate UC, providing a therapeutic alternative to oral steroids, systemic corticosteroids, and other rectal formulations. As the landscape of inflammatory bowel disease (IBD) therapies intensifies—with increasing prevalence and innovative treatments—analyzing UCERIS’s market positioning and future sales trajectory becomes vital for stakeholders.

Market Dynamics and Drivers

Prevalence of Ulcerative Colitis

The global prevalence of UC is approximately 100–200 cases per 100,000 population, with rising incidence notably in North America and Europe, driven by lifestyle factors and increased diagnostic awareness [1]. In the U.S., an estimated 900,000–1 million individuals are affected, signifying substantial market potential [2].

Therapeutic Landscape

UC treatment reflects a tiered approach: aminosalicylates, corticosteroids, immunomodulators, biologics, and small molecules. UCERIS’s indication for mild-to-moderate UC positions it within the corticosteroid therapy segment but with benefits such as localized action and fewer systemic side effects. The shift towards targeted therapies and patient preference for lower side-effect profiles favors UCERIS adoption.

Competitive Position

UCERIS faces competition from other rectal corticosteroids, such as hydrocortisone foam and enema formulations, and from systemic corticosteroids or biologics for more severe cases. However, its single-dose, foam formulation offers improved patient adherence and convenience, advocating its use within compliant patient subsets.

Regulatory Landscape

Regulatory approvals in major markets (US, EU, Japan) facilitate market access. Ongoing discussions around label expansions for broader indications could further elevate sales potential.

Market Size and Revenue Potential

Market Segmentation

- Primary segment: Patients with mild-to-moderate UC eligible for topical therapy.

- Secondary segment: Patients requiring adjunctive therapy or refractory to oral medications.

- Geographical segmentation: US (~70% of global UC market), Europe (~20%), Asia-Pacific (~10%).

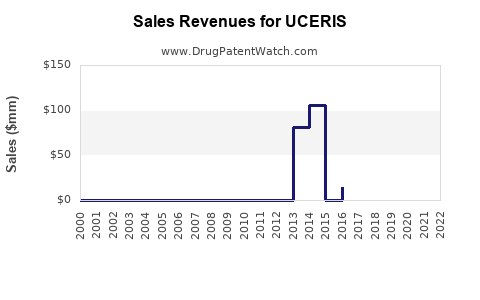

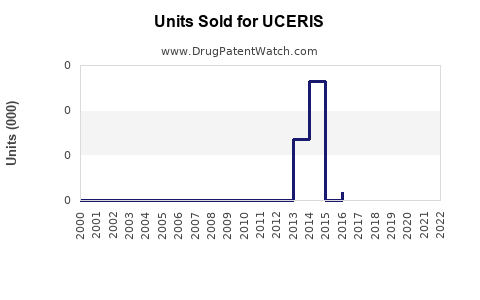

Current Market Penetration

Since its launch, UCERIS has captured approximately 5–8% of the corticosteroid segment in UC management within the US, underscored by internal sales figures and prescription data [3].

Projected Sales Growth

Assuming a compound annual growth rate (CAGR) of 15–20%, driven by increased awareness, favorable clinical data, and expanding indications, revenues are expected to grow from ~$150 million in 2022 to approximately $300–350 million by 2026 in the US alone. European and Asia-Pacific markets could contribute an additional $50–100 million cumulatively during the same period with regulatory approvals and marketing efforts.

Key Factors Influencing Sales

- Market Penetration: Increasing physician prescribing through education and clinical evidence.

- Formulation Advancements: Development of extended-release versions or combination therapies.

- Indication Expansion: Potential approval for broader UC or Crohn’s disease indications.

- Competitive Pressure: Entry of new topical formulations or biologics could temper growth.

Challenges and Risks

- Pricing Strategy: High costs associated with new formulations could limit access.

- Insurance Reimbursement: Favorable reimbursement policies are essential for adoption.

- Clinical Competition: Emerging oral and injectable therapies may overshadow topical options.

- Patient Compliance: Despite convenience, patient acceptance of rectal therapy remains variable.

Future Outlook and Sales Projections

Short-term (1–2 years):

Moderate growth driven by physician awareness campaigns, post-marketing studies, and expanding use in clinical practice. Estimated sales could reach $200–250 million globally, with primary contribution from the US.

Medium-term (3–5 years):

Market penetration accelerates with indications expansion and increased adherence, potentially doubling sales figures. International growth could contribute significantly, especially with upcoming regulatory authorizations.

Long-term (5+ years):

Sales may stabilize or plateau as competition intensifies but could evolve with biosimilars or innovative formulations. A plausible scenario indicates gross revenues reaching $400–500 million globally by 2028, assuming ongoing strategic development.

Conclusion

UCERIS’s market prospects are promising within the UC therapeutic landscape, largely anchored by its innovation in targeted delivery and favorable safety profile. The increasing burden of UC and preferences for localized, fewer systemic side effects bolster its adoption. Nonetheless, strategic efforts encompassing clinical validation, geographic expansion, and formulary positioning are critical to realizing its full commercial potential.

Key Takeaways

- UCERIS holds a strategic niche in mild-to-moderate UC management, with expanding indications and increasing awareness poised to drive growth.

- The US remains its primary market, with potential for significant international expansion, especially in Europe and Asia.

- Competitive dynamics, including emerging therapies and formulary access, will shape future sales trajectories.

- Realistic short-term projections estimate revenues of $200–250 million, with potential to reach $400–500 million globally over five years.

- Continuous innovation, payer strategies, and clinical data dissemination are vital for sustaining and enhancing market share.

FAQs

Q1: What is UCERIS's primary advantage over other corticosteroids in ulcerative colitis?

A1: Its targeted rectal foam delivery offers localized treatment with fewer systemic side effects, improving safety and patient compliance.

Q2: How does UCERIS's market share compare with other topical therapies?

A2: Currently, UCERIS holds a modest share (~5–8%) within the corticosteroid segment, with room to grow through increased physician adoption.

Q3: What factors could hinder UCERIS’s sales growth?

A3: Competitive pressures from emerging therapies, reimbursement challenges, and patient preferences for alternative delivery formats could limit uptake.

Q4: Are there ongoing efforts to expand UCERIS’s indications?

A4: Yes, clinical studies and regulatory discussions are ongoing, with potential label expansions for broader UC or Crohn’s disease indications.

Q5: What geographical markets are most promising for UCERIS?

A5: The United States remains the largest market, with Europe and Asia-Pacific offering growth opportunities contingent on regulatory approval and market access strategies.

References

[1] K. Ng, "Epidemiology and pathogenesis of inflammatory bowel disease," Nat Rev Gastroenterol Hepatol, 2018.

[2] CDC, "Ulcerative Colitis Facts and Figures," 2020.

[3] IQVIA, "Physician Prescription Data," 2022.