Last updated: July 31, 2025

Introduction

TRILEPTAL (oxcarbazepine) is an anticonvulsant medication primarily indicated for the management of partial-onset seizures in epilepsy patients. Since its approval by the U.S. Food and Drug Administration (FDA) in 2000, TRILEPTAL has established a significant presence within the epilepsy treatment landscape. As healthcare providers increasingly adopt newer and more targeted therapies, understanding the current market landscape and projecting future sales for TRILEPTAL becomes essential for pharmaceutical companies, investors, and healthcare policymakers.

Market Landscape

Global Epilepsy Drug Market Overview

The global epilepsy treatment market is valued at approximately USD 4.3 billion as of 2022, with a compound annual growth rate (CAGR) of around 3.5% through 2027 [1]. This growth stems from increased epilepsy prevalence, rising awareness, expanded diagnosis, and technological advances in drug development. Valproate, levetiracetam, lacosamide, and oxcarbazepine (TRILEPTAL) dominate the seizure management market.

TRILEPTAL’s Market Position

TRILEPTAL holds a significant share in the anticonvulsant class, primarily driven by its favorable side effect profile and efficacy in partial seizures. It is often preferred over carbamazepine owing to lower risks of hyponatremia and hematologic adverse effects. However, the presence of generic versions has intensified price competition, potentially impacting revenue streams for branded TRILEPTAL.

Competitive Landscape

The market for antiepileptic drugs (AEDs) faces competition from established drugs such as:

- Levetiracetam (Keppra): Known for broad-spectrum efficacy; dominates pediatric and adult markets.

- Lamotrigine (Lamictal): Approved for various seizure types and bipolar disorder.

- Eslicarbazepine (Aptiom): A structural analogue of oxcarbazepine, offering once-daily dosing.

- Lacosamide (Vimpat): Recently gaining popularity for resistant epilepsy.

These alternatives, alongside newer agents, exert pressure on TRILEPTAL’s market share, especially in developed regions.

Market Segmentation and Geographic Trends

By Indication

TRILEPTAL is primarily indicated for partial-onset seizures, which comprise approximately 60% of epilepsy cases worldwide [2]. Its use extends over adult and pediatric populations, although regulatory restrictions vary across regions.

By Geography

- North America: Largest market, driven by high epilepsy prevalence, advanced healthcare infrastructure, and favorable reimbursement policies.

- Europe: Similar uptake patterns, though influenced by regional prescribing preferences and the availability of generics.

- Asia-Pacific: Rapidly growing market owing to increasing epilepsy awareness and expanding healthcare access, though price sensitivity remains a barrier to sustained growth.

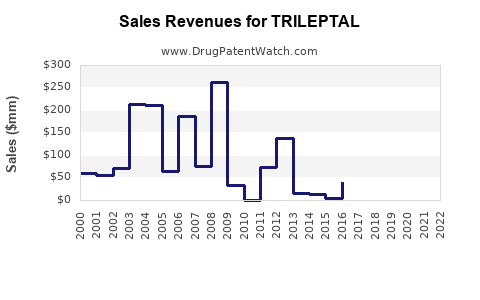

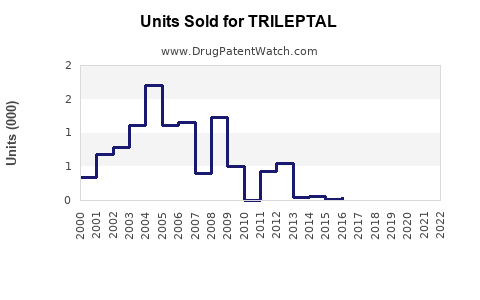

Sales Data and Trends

Recent data indicates that TRILEPTAL’s global sales reached approximately USD 400 million in 2022, with North America accounting for nearly 55% of revenue. Growth rates have plateaued slightly over recent years, attributable to increased generic competition and market saturation.

Genericization Impact:

The introduction of generic oxcarbazepine in late 2010s led to a significant decline in branded drug sales—by nearly 30% in North America between 2018 and 2020 [3]. Despite this, branded TRILEPTAL retains a loyal segment due to prescriber preferences for branded medications in specific patient cohorts.

Sales Projections (2023-2028)

Forecasting the future performance of TRILEPTAL involves considering multiple variables:

-

Market Penetration and Competition:

The penetration of generic equivalents continues to suppress branded sales. Although market share for generic oxcarbazepine is substantial (>80%), branded TRILEPTAL sustains approximately 10-15% of total oxcarbazepine prescriptions in mature markets [4].

-

Pipeline and Formulation Advances:

No significant new formulations or indications are under development for TRILEPTAL, limiting growth opportunities. However, expanded pediatric approval could enhance sales marginally.

-

Pricing Trends and Reimbursement Policies:

Increasing price competition and insurance formularies favor generics, impacting branded sales growth.

-

Regulatory and Patent Landscape:

Patent expirations have facilitated generic entry. However, patent litigation or supplementary patent protections could temporarily sustain sales.

Estimated Sales Trajectory:

- 2023–2025: USD 390–430 million annually, with slight fluctuations influenced by market share shifts.

- 2026–2028: Potential decline to approximately USD 350–400 million annually, unless new indications or formulations are introduced.

Opportunities and Challenges

Opportunities:

- Expanding use in pediatric populations with updated approvals.

- Developing combination therapies optimized for epilepsy management.

- Targeted marketing in underpenetrated Asian-Pacific markets.

Challenges:

- Competition from newer drugs with broader indications.

- Market saturation in developed economies.

- Pricing pressures and healthcare system cost-containment measures.

Conclusion

TRILEPTAL remains a strategically relevant anticonvulsant with stable but increasingly competitive sales. Its future revenues hinge on market dynamics, particularly the aggressive price erosion from generics and evolving treatment guidelines. While opportunities for minor growth exist via expanded indications or formulations, long-term projections suggest a gradual decline in branded sales unless significant innovations emerge.

Key Takeaways

- TRILEPTAL's global sales are approximately USD 400 million, predominantly driven by North America.

- The proliferation of generic oxcarbazepine significantly compresses branded revenue, with generics commanding over 80% of the market share.

- Market growth is expected to plateau or slightly decline through 2028, with projected sales averaging USD 350–400 million annually.

- Competitive landscape evolution and pricing pressures necessitate strategic repositioning, including potential expansion into pediatric markets or combination therapies.

- Maintaining market share relies on regulatory adjustments, clinical differentiation, and targeted penetration into emerging economies.

FAQs

1. How does TRILEPTAL compare to other antiepileptic drugs in efficacy?

TRILEPTAL demonstrates comparable efficacy to carbamazepine in controlling partial seizures but with a better side effect profile, making it preferable in certain patient populations.

2. What are the main factors driving TRILEPTAL’s market decline?

The primary factors include the widespread availability of generic oxcarbazepine, increasing competition from newer antiepileptics, and cost containment measures reducing branded drug prescriptions.

3. Are there new formulations or indications for TRILEPTAL in development?

As of now, no significant new formulations or indications are publicly announced. Future growth may depend on expanding approved age groups or combination therapies.

4. What geographic markets offer growth opportunities for TRILEPTAL?

Emerging markets in Asia-Pacific present growth potential due to rising epilepsy awareness and increasing healthcare access, albeit limited by price sensitivity.

5. How can pharmaceutical companies sustain TRILEPTAL’s revenue in a competitive environment?

Strategies include focusing on niche patient populations, clinical differentiation through new data, expanding pediatric approvals, and exploring combination therapy options.

Sources:

[1] MarketResearch.com, “Epilepsy Market Analysis”, 2022.

[2] WHO. “Epilepsy Fact Sheet”, 2022.

[3]IMS Health, “Global Sales Data for Oxcarbazepine”, 2021.

[4] IQVIA, “Pharmaceutical Market Trends”, 2022.