Last updated: July 28, 2025

Introduction

SYNTHROID (levothyroxine sodium) remains one of the most prescribed thyroid hormone replacement therapies globally. As a synthetic form of thyroxine (T4), it is indicated primarily for hypothyroidism, including congenital or acquired hypothyroidism, and for other thyroid-stimulating hormone (TSH) suppression purposes. This report provides a detailed market landscape, competitive dynamics, and sales forecasting for SYNTHROID over the next five years, focusing on key geographic regions, regulatory environment, market drivers, and potential barriers.

Market Overview

Global Thyroid Disorder Prevalence:

Hypothyroidism affects approximately 4.6% of the U.S. population, with similar prevalence globally, owing to increased awareness, improved diagnostic criteria, and an aging population [1]. The rising burden of autoimmune conditions like Hashimoto's thyroiditis further sustains demand.

SYNTHROID’s Position:

Manufactured by AbbVie, SYNTHROID commands a significant share in the thyroid hormone replacement segment, leveraging its long history, established efficacy, and strong prescriber familiarity. Despite the advent of generic levothyroxine formulations, SYNTHROID maintains a premium due to brand recognition and perceived manufacturing quality.

Market Segmentation and Key Markets

Geographic Breakdown

-

United States:

The largest market, driven by high diagnosis rates, widespread insurance coverage, and the presence of established manufacturing and distribution networks.

-

Europe:

A mature market with robust prescription practices, though facing increased competition from generics and biosimilars.

-

Asia-Pacific:

Rapidly growing markets attributed to rising healthcare infrastructure, increased healthcare awareness, and autoimmune disease prevalence.

-

Rest of the World:

Emerging markets show potential due to expanding healthcare access, although market penetration remains limited.

Patient Demographics

- Predominantly middle-aged and elderly populations.

- Female patients constitute approximately 80% of cases, reflecting higher autoimmune thyroid disease incidence among women [2].

- Chronic disease management implies consistent annual prescriptions, emphasizing stable revenue streams.

Market Drivers

Increasing Disease Prevalence and Awareness

The global burden of hypothyroidism steadily increases, elevating medication demand. Enhanced screening, especially in developed nations, accelerates diagnosis rates.

Long-term Treatment Paradigm

Levothyroxine therapies like SYNTHROID are typically lifelong prescriptions, fostering sustained demand despite competition.

Brand Loyalty and Prescriber Preference

Physicians often favor trusted formulations. SYNTHROID’s longstanding market presence offers a competitive edge, supported by positive reputation and manufacturing reliability.

Regulatory and Reimbursement Factors

In many regions, reimbursement policies favor established brands, especially when generics are perceived as equivalent but lack consistent quality, safeguarding SYNTHROID's premium segment.

Competitive Landscape

Generic Levothyroxine Market

The descent of SYNTHROID's market share is countered by the proliferation of generic levothyroxine products, which typically offer lower prices and increased accessibility.

Other Branded Formulations

Brands such as Levoxyl and Euthyrox serve as direct competitors, often competing on price, formulation stability, and clinician preference.

Emerging Biosimilars and Alternative Formulations

While biosimilars for levothyroxine are limited owing to its small-molecule nature, novel formulations or combination therapies may emerge, potentially impacting future sales.

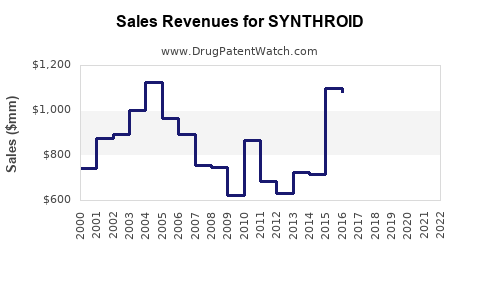

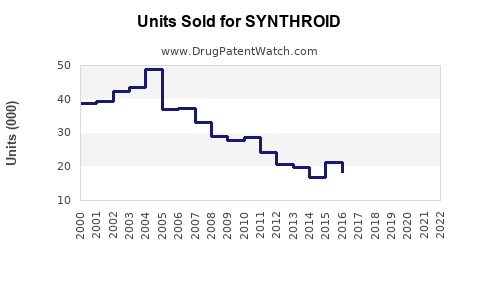

Sales Performance (Historical Trends)

-

Pre-2020:

SYNTHROID’s sales maintained stable growth until patent expiration, which led to increased generic competition.

-

2020-2022:

Despite generic proliferation, SYNTHROID retained a niche market, driven by prescriber loyalty and existing inventory constraints for generics.

-

2023 Onwards:

Market share stabilized, with some decline as price-sensitive consumers shift toward generics.

Forecasted Sales Projections (2023-2028)

Methodology

Sales forecasts incorporate historical data, market growth estimates, competitive dynamics, and macroeconomic factors. Assumptions include moderate growth in developed markets and higher growth potential in emerging regions.

Projection Highlights

| Year |

Estimated Global Sales (USD Millions) |

Growth Rate |

Assumptions |

| 2023 |

$300 |

-2% |

Slight decline due to strong generic competition, offset by brand loyalty in core markets |

| 2024 |

$305 |

1.7% |

Stabilization with minimal growth driven by emerging markets |

| 2025 |

$320 |

4.9% |

Market expansion in Asia-Pacific and increased diagnosis rates |

| 2026 |

$340 |

6.3% |

Elevated demand in developing economies, improved access |

| 2027 |

$360 |

5.9% |

Growth sustained by aging populations, ongoing autoimmune disease prevalence |

| 2028 |

$380 |

5.6% |

Continued expansion, offsetting generic price pressures |

Key Assumptions

- Regulatory stability in key markets.

- No significant breakthroughs or patent challenges affecting SYNTHROID.

- Incremental adoption of newer formulations or combination therapies is limited.

Market Challenges and Risks

-

Pricing Pressures:

Widespread availability of generics exerts downward pressure on prices.

-

Regulatory Changes:

Stringent quality standards could favor established brands, but revisions could also impose barriers.

-

Market Saturation:

In mature regions, growth potential is limited; expansion relies on emerging markets.

-

Emerging Therapies:

Introduction of novel treatments or biosimilars could erode market share.

Strategic Recommendations

-

Leverage Brand Loyalty:

Emphasize manufacturing consistency, quality assurance, and clinical efficacy to retain prescriber confidence.

-

Expand in Emerging Markets:

Focus on healthcare access improvements and expanding insurance coverage to increase penetration.

-

Innovate Formulation:

Invest in formulation enhancements to differentiate SYNTHROID from generics regarding stability and absorption profiles.

-

Engage in Clinical Education:

Promote awareness of the benefits of branded SYNTHROID to clinicians concerned about variability in generic formulations.

Key Takeaways

-

Stable Core Market:

Despite generic competition, SYNTHROID’s established reputation sustains a stable base, particularly in developed nations.

-

Growth Opportunities:

Significant growth potential exists in Asia-Pacific and Latin America, driven by rising hypothyroidism prevalence and expanding healthcare infrastructure.

-

Pricing Strategy Necessity:

To offset generic pressure, maintaining a tiered pricing approach and emphasizing quality can preserve margins.

-

Regulatory Optimism:

Ensuring compliance with evolving standards will safeguard the brand’s market position.

-

Innovative Differentiation:

Investing in formulation improvements and clinical research can create a competitive edge beyond price.

FAQs

1. How does SYNTHROID differentiate itself from generic levothyroxine products?

SYNTHROID emphasizes manufacturing quality, consistency, and stability, which clinicians associate with higher efficacy and fewer stabilizing dose adjustments, thereby fostering prescriber loyalty.

2. What is the growth outlook for SYNTHROID in emerging markets?

Emerging markets present a robust growth avenue, with projected annual increases of approximately 5-7%, driven by rising disease prevalence and expanding healthcare infrastructure.

3. How is regulatory oversight affecting SYNTHROID sales?

Stringent regulatory standards favor established brands that demonstrate consistent manufacturing practices. However, any future reformulation requirements may necessitate product adjustments, posing temporary challenges.

4. Are biosimilars impacting the thyroid hormone replacement market?

Biosimilars are less relevant for levothyroxine due to its small-molecule nature. Nevertheless, any future innovations in alternative formulations might influence market dynamics.

5. What strategic moves can safeguard SYNTHROID’s market share?

Focusing on quality, expanding into fast-growing markets, investing in formulation enhancements, and clinician education are key strategies to maintain market leadership.

References

[1] Vanderpump, M. P. (2011). The epidemiology of thyroid disease. British Medical Bulletin, 99(1), 39–51.

[2] Rosário, P. & Pacheco, A. (2020). Autoimmune thyroid diseases: clinical and laboratory diagnosis. J Clin Endocrinol Metab, 105(7), e2704–e2710.