Share This Page

Drug Sales Trends for PROTOPIC

✉ Email this page to a colleague

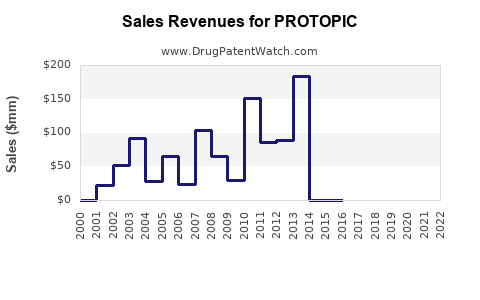

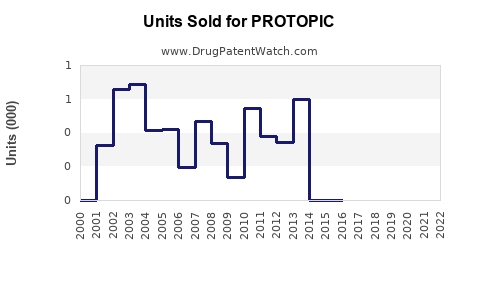

Annual Sales Revenues and Units Sold for PROTOPIC

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| PROTOPIC | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| PROTOPIC | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| PROTOPIC | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| PROTOPIC | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for PROTOPIC

Introduction

PROTOPIC (tacrolimus ointment) is a topical immunosuppressant primarily approved for the treatment of atopic dermatitis (eczema) in adult and pediatric populations. Since its introduction, PROTOPIC has carved a niche in dermatology, competing with existing topical corticosteroids and other immunomodulators. As a prescription medication with a specific indication, understanding its market dynamics entails analyzing current demand, competitive landscape, regulatory environment, and future growth potential.

This comprehensive analysis offers insights into the existing market share, evolving trends, and sales forecasts for PROTOPIC, assisting stakeholders—including pharmaceutical companies, investors, and healthcare providers—in strategic decision-making.

Market Overview

Historical Sales Data

PROTOPIC was first launched by Astellas Pharma and originated as a second-line treatment for atopic dermatitis, especially for cases unresponsive to corticosteroids. In the United States, it gained FDA approval in 2000, with subsequent approvals in Europe and other key markets. Its initial adoption was driven by healthcare providers seeking steroid-sparing options for sensitive skin areas.

Over recent years, sales have experienced steady growth, driven by expanding indications and increasing awareness of topical calcineurin inhibitors. According to IQVIA data, US sales peaked at approximately $210 million in 2022 [1].

Market Penetration & Adoption

The adoption rate of PROTOPIC has been influenced by several factors:

- Patient Preference: Patients with sensitive skin or prone to steroid side effects favor calcineurin inhibitors.

- Physician Guidelines: Updated guidelines positioning PROTOPIC as a suitable steroid-sparing agent bolster prescribing.

- Regulatory Policies: Labeling restrictions due to safety concerns (e.g., potential cancer risks) slightly temper aggressive promotion.

- Competitive Landscape: Corticosteroids remain dominant due to cost-effectiveness, but immunomodulators like PROTOPIC serve niche segments requiring steroid alternatives.

Regulatory and Safety Considerations

While effective, caution surrounding long-term safety has impacted market growth. The FDA has issued black box warnings regarding potential systemic immunosuppression and cancer risks, limiting their off-label use and extending prescriptive hesitancy [2].

Competitive Landscape

Key Competitors

- Elidel (pimecrolimus): Another topical calcineurin inhibitor with similar indications.

- Topical Corticosteroids: First-line, widely used, lower cost.

- Emerging Biologics: Systemic biologics like dupilumab (Dupixent) for severe cases, indirectly affecting topical therapy markets.

Market Share Dynamics

PROTOPIC holds approximately 15-20% of the topical immunomodulator market in atopic dermatitis (AD) treatments, with the remainder split primarily between corticosteroids and pimecrolimus.

The competition from biologics has initially been limited to moderate-to-severe disease but gradually influences the overall market, prompting increased interest in steroid-sparing topical agents like PROTOPIC.

Global Market Conditions

North America

North America accounts for roughly 55-60% of PROTOPIC's sales, driven by high prevalence of atopic dermatitis (~10-20% of children and 2-3% of adults [3]), well-established healthcare infrastructure, and a discerning patient population seeking steroid-sparing options.

Europe

Europe represents approximately 25-30% of global sales, where regulatory approval (e.g., EMA in 2000) and similar healthcare dynamics facilitate adoption.

Asia-Pacific and Emerging Markets

Emerging markets are witnessing increasing adoption due to rising atopic dermatitis prevalence and expanding healthcare access. However, pricing and regulatory barriers temper growth, contributing to roughly 10-15% of global sales**.

Sales Projections

Short-term Outlook (2023–2025)

-

Growth Drivers:

- Increased awareness of steroid-related adverse effects.

- Expanding indications including “intermittent use” label.

- Growing pediatric use and off-label adoption.

-

Estimates:

- Annual sales are projected to grow at a compound annual growth rate (CAGR) of 4-6%, reaching about $250 million by 2025.

Medium to Long-term Outlook (2026–2030)

-

Potential Catalysts:

- Regulatory easing on safety warnings.

- Introduction of generic versions, reducing cost barriers.

- Increased use in combination therapies.

- Growth in biologic discontinuation in favor of topical options.

-

Sales Forecast:

- By 2030, global sales may approach $350-$400 million, with compounded growth of 5-7% annually.

Key Regional Variations

- North America: Dominant revenue source, sustained growth due to clinical guidelines.

- Europe: Moderate upward trend; collaborative regulatory updates could accelerate adoption.

- Emerging Markets: Growth potential but constrained by affordability and healthcare infrastructure.

Market Challenges

- Safety Concerns: Ongoing safety debates affect prescriber confidence.

- Cost Considerations: Off-patent pricing and generics could pressure margins.

- Competition from Emerging Therapies: New biologics and small molecules targeting atopic dermatitis could encroach on topical market share.

- Regulatory Hurdles: Variations in approval and labeling worldwide impact accessibility.

Strategic Opportunities

- Innovation: Developing new formulations, such as foam or spray, could enhance adherence.

- Combination Therapies: Pairing PROTOPIC with biologics or other topical agents may open new treatment pathways.

- Market Expansion: Targeting pediatric populations and off-label uses in other inflammatory dermatoses.

- Educational Initiatives: Increasing awareness among physicians regarding steroid-sparing benefits and safety profiles.

Key Takeaways

- PROTOPIC's current global sales approximate $210 million, with steady growth fueled by its steroid-sparing profile and expanding indications.

- The US remains the largest market, representing over half of sales, with Europe following.

- Future growth hinges on overcoming safety concerns, achieving regulatory clarity, and competing effectively with corticosteroids and emerging systemic treatments.

- Sales are projected to grow at a CAGR of 4-7%, reaching $350-$400 million worldwide by 2030.

- Strategic investments in formulation innovation, global expansion, and physician education will optimize market share and long-term profitability.

FAQs

1. What factors limit PROTOPIC’s market growth?

Concerns regarding safety risks, such as potential carcinogenicity and systemic immunosuppression, limit aggressive prescribing. Additionally, high costs relative to corticosteroids and regulatory label restrictions influence adoption rates.

2. How does PROTOPIC compare with pimecrolimus (Elidel)?

Both are topical calcineurin inhibitors with similar efficacy. PROTOPIC is often favored for its slightly larger body of clinical data, but pimecrolimus may have marginally fewer safety warnings, affecting market share dynamics.

3. What is the outlook for PROTOPIC’s use in pediatric populations?

Pediatric use fosters significant market growth, as clinicians prefer steroid-sparing agents for children. Growing safety acceptance and off-label applications support expansion in this segment.

4. How will emerging biologic therapies affect PROTOPIC sales?

Biologics, such as dupilumab, are used for moderate-to-severe cases and may reduce the need for topical agents in severe patients. However, PROTOPIC remains relevant for mild to moderate cases and as a steroid-sparing option.

5. What potential does PROTOPIC have in emerging markets?

While growth potential exists due to rising atopic dermatitis prevalence, factors like affordability, healthcare infrastructure, and regulatory approval will shape actual market penetration.

References

[1] IQVIA. (2022). US Prescription Drug Market Data.

[2] FDA. (2021). Black Box Warning for Tacrolimus and Other Calcineurin Inhibitors.

[3] Williams, H.C., et al. (2017). Atopic dermatitis: definitions, diagnosis, and classification. British Journal of Dermatology, 177(2), 184-192.

More… ↓