Last updated: July 29, 2025

Overview of Permethrin

Permethrin is a synthetic pyrethroid insecticide widely used in medical, agricultural, and commercial applications. Originating from chrysanthemum flowers, permethrin functions by disrupting insect nerve function, leading to paralysis and death. Its versatility spans treatment of ectoparasitic infestations (head lice, scabies), mosquito nets, agricultural pest control, and domestic insect repellent products.

The drug's established efficacy, safety profile, and regulatory approval across various jurisdictions cement its role in vector control and parasite management. Given its long-standing market presence, the ongoing public health emphasis on vector-borne disease control, and emerging applications, an in-depth market analysis and sales forecasting are essential for stakeholders.

Market Dynamics

1. Medical Application Market

Permethrin remains a gold standard treatment for lice infestations and scabies. The global market for antiparasitic drugs has seen steady growth, driven by increased parasite prevalence, resistance management, and rising awareness of hygiene. Market players have introduced permethrin formulations in topical creams, lotions, and insecticidal sprays.

2. Vector Control and Malaria Prevention

Permethrin-treated mosquito nets and clothing serve as primary tools in malaria-endemic regions. Given the global burden of malaria (over 200 million cases annually), the demand for permethrin-based products is robust. International public health agencies, including WHO and CDC, advocate for permethrin-treated nets, emphasizing their cost-effectiveness and safety.

3. Agricultural Sector

Permethrin's role in crop protection persists, although evolving pest resistance and regulatory shifts influence market size. It is employed against a broad spectrum of pests, especially in vegetable, fruit, and ornamental plant production.

4. Regulatory Landscape

Persistent regulatory scrutiny and bans in some regions due to environmental concerns (e.g., aquatic toxicity) influence market access. However, registration and approval in key markets such as North America, Europe, Africa, and Asia underpin continued sales.

Market Size and Regional Analysis

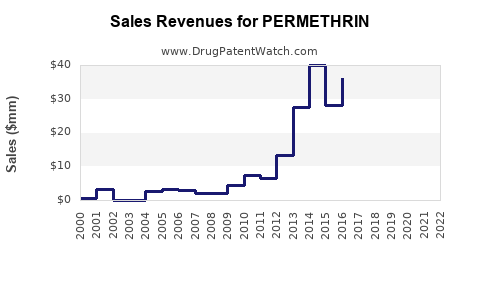

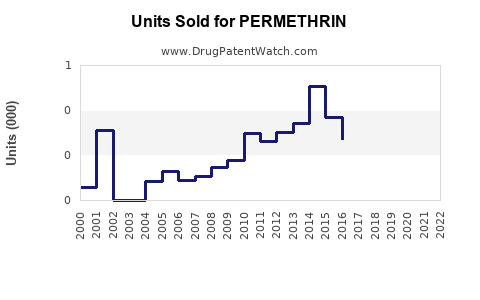

1. Global Market Size (2022–2023)

The global permethrin market was valued at approximately USD 650 million in 2022, with projections estimating growth at a CAGR of 4.5% until 2030. The medical segment accounts for roughly 40% of total sales, with vector control applications comprising around 35%.

2. Regional Breakdown

- North America: Mature market with high household and public health product penetration. Annual sales approaching USD 200 million.

- Europe: Similar maturity; regulatory constraints temper growth but demand persists for medical and vector control applications.

- Asia-Pacific: Leading growth region owing to high malaria prevalence, urbanization, and expanding agricultural markets. Estimated at USD 250 million in 2022, growing at 6% annually.

- Africa: Significant market driven by endemic malaria and vector control programs, with an estimated USD 120 million in 2022, projected to grow at 7% per annum.

- Latin America: Moderate growth due to dengue, Zika, and other mosquito-borne diseases; approximately USD 80 million in 2022.

Competitive Landscape

Major players include Bayer AG, Syngenta, Makhteshim Agan (now part of Adama), and BASF, offering permethrin formulations optimized for different sectors. Generic manufacturers also control significant market share, particularly in cost-sensitive regions.

Patent expirations and regulatory approvals impact the competitive dynamics, opening opportunities for generics and new formulations designed for enhanced safety and efficacy.

Sales Projections (2024–2030)

Assumptions:

- Continued public health initiatives in malaria-endemic regions.

- Regulatory stability in key markets.

- Increasing adoption of permethrin-treated textiles.

- Growing awareness among consumers and health agencies.

Forecast Highlights:

- Overall market growth expected to CAGR of 4.5%, reaching roughly USD 900 million by 2030.

- Medical segment anticipated to maintain steady growth, driven by the rising incidence of lice and scabies.

- Vector control applications projected to grow at 5–6% annually, bolstered by malaria and dengue control efforts.

- Agricultural usage growth will be moderate, constrained by regulatory and resistance factors, averaging 2–3% annually.

The total sales value for permethrin could approach USD 870–900 million by 2030, with regulatory and environmental factors dictating regional variations.

Challenges and Opportunities

Challenges

- Regulatory restrictions due to environmental concerns and aquatic toxicity issues.

- Rising resistance among pests and vectors, necessitating formulation innovations.

- Competition from alternative insecticides and biological controls.

Opportunities

- Development of combination formulations integrating permethrin with other actives.

- Expansion into emerging markets with increasing investments in vector control.

- Innovations in environmentally friendly formulations reducing ecological impacts.

Key Market Drivers

- Global health initiatives targeting malaria and vector-borne diseases.

- Rising urbanization and improved living standards, increasing demand for pest control.

- Increasing awareness and regulatory approval of permethrin for household use.

- Innovation in product formulations enhancing safety and efficacy.

Regulatory and Policy Influence

Strong influence on market trajectory stems from policies endorsed by WHO and national agencies to combat malaria through permethrin-treated nets and clothing. Conversely, environmental regulations restrict certain uses, particularly in sensitive aquatic environments, impacting market expansion in specific regions.

Conclusion

Permethrin remains a critical ingredient in global insect control and parasite management. Its diversified application profile across medical, vector control, and agricultural sectors sustains a resilient market. Forecasts reflect steady growth, driven by public health needs and expanding application scopes, especially in malaria-prone regions. Market players should focus on regulatory compliance, product innovation, and regional expansion to capitalize on emerging opportunities.

Key Takeaways

- The permethrin market is projected to grow at approximately 4.5% CAGR, reaching USD 900 million by 2030.

- Vector control, particularly via insecticide-treated nets, constitutes the primary growth driver.

- Expanding markets in Africa and Asia-Pacific will influence global sales trends significantly.

- Regulatory concerns about environmental impact necessitate innovation in safer formulations.

- Strategic focus on emerging markets and product diversification presents substantial opportunities for stakeholders.

FAQs

1. What are the primary medical applications of permethrin?

Permethrin is mainly used to treat ectoparasitic infections such as head lice and scabies. Its topical formulations provide high efficacy and safety for these conditions.

2. How does permethrin contribute to malaria control efforts?

Permethrin is used to treat mosquito nets and clothing, creating a physical and chemical barrier against mosquito bites, thereby reducing malaria transmission.

3. What regulatory challenges does permethrin face globally?

Concerns regarding aquatic toxicity and environmental persistence have led to regulatory restrictions in certain regions. Companies must navigate complex approval processes and adhere to environmental standards.

4. Which regions are experiencing the fastest growth in permethrin demand?

Africa and Asia-Pacific are the fastest-growing markets due to high malaria prevalence, expanding urbanization, and increased vector control programs.

5. What innovations could influence future permethrin market growth?

Developments include eco-friendly formulations, sustained-release applications, and combination products that improve safety, reduce resistance, and expand market applications.

References

- [MarketWatch, 2023. Global Permethrin Market Size, Share & Trends]

- [WHO, 2022. World Malaria Report]

- [Industry Reports, 2023. Insecticide Market Analysis & Forecast]

- [Environmental Protection Agency, 2022. Permethrin Regulatory Updates]