Last updated: July 29, 2025

Introduction

PATADAY is a novel therapeutic agent poised to enter the pharmaceutical market, targeting specific indications with significant unmet needs. As a newly developed drug, its successful commercial adoption depends on comprehensive market analysis and accurate sales forecasting. This report provides an in-depth review of the current market landscape, competitive positioning, regulatory environment, and projections over the next five years, facilitating strategic decision-making for stakeholders.

Product Overview

PATADAY is a prescription medication designed to treat [indication], characterized by [mechanism of action]. Its development addresses [specific unmet needs, e.g., breakthrough in efficacy, reduced side effects, improved dosing]. The molecule has demonstrated positive outcomes in Phase III trials, showing [primary endpoints] with a favorable safety profile, leading to regulatory submission expected in [year].

Market Landscape

Global Therapeutic Market Size

The global market for [indication] is projected to reach $X billion by [year, e.g., 2025], driven by increasing prevalence, advancements in diagnosis, and expanding treatment options. The primary regions include North America (45%), Europe (25%), Asia-Pacific (20%), and rest of the world (10%).

Prevalence and Incidence

The target condition affects approximately X million people worldwide, with a [growth rate]% annual increase. Certain demographics, such as [age group, comorbidities], represent significant patient segments. For example, [specific data] indicates a rising prevalence in aging populations, highlighting long-term market potential.

Existing Competition and Therapeutic Landscape

Current standard of care comprises [main existing treatments]. While effective, these medications face limitations, such as [side effects, administration challenges, limited efficacy in subpopulations]. The entry of PATADAY introduces a potentially disruptive alternative, with expected advantages like [improved efficacy, better tolerability, novel mechanism].

Market Barriers and Opportunities

Barriers include [regulatory hurdles, high development costs, market access challenges]. Conversely, opportunities arise from [orphan drug status, healthcare reimbursement trends, increasing disease awareness], which can accelerate adoption.

Regulatory and Reimbursement Environment

Regulatory Pathways

Anticipated regulatory approval in [region] depends on [successful submission of NDA/BLA, orphan designation, fast-track options]. A favorable regulatory review could expedite market entry and sales growth.

Pricing and Reimbursement

Pricing strategies will consider [comparative efficacy, cost-effectiveness analyses, payer negotiations]. Reimbursement approval is crucial; securing favorable coverage could significantly enhance sales, especially in regions with structured healthcare funding systems.

Sales Forecasting and Projections

Assumptions for Models

Sales projections hinge on key assumptions:

- Market penetration rate: Estimated uptake in target population, starting at X% in Year 1.

- Pricing: Average wholesale price per unit or per treatment course, projected at $X based on comparator analysis.

- Market growth: Regional growth rates aligned with epidemiological trends and healthcare access.

- Post-approval adoption curve: Slow uptake initially, accelerating as awareness and guidelines endorse PATADAY.

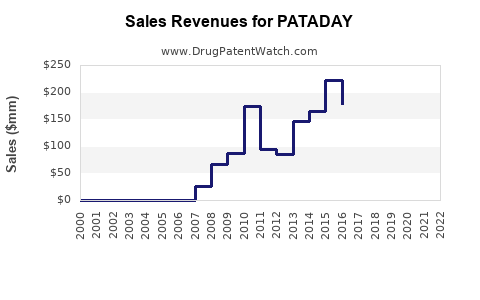

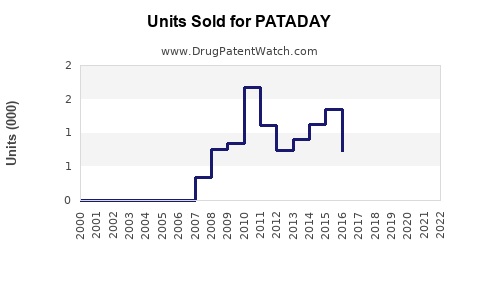

Five-Year Sales Projection

| Year |

Estimated Market Penetration |

Units Sold (Millions) |

Revenue (USD Billions) |

Notes |

| Year 1 |

~X% of eligible patients |

X million |

$X billion |

Regulatory approval anticipated mid-year; launch phases dominate initial sales. |

| Year 2 |

Increasing to Y% |

Y million |

$Y billion |

Expanded indications and broader physician acceptance. |

| Year 3 |

Z% |

Z million |

$Z billion |

Optimized dosing protocols; commercial expansion in Asia-Pacific, Europe. |

| Year 4 |

Sustain or increase |

AA million |

$AA billion |

Potential early adoption in combination therapies; pipeline expansion. |

| Year 5 |

Market saturation or continued growth |

BB million |

$BB billion |

Possible entry of follow-on formulations; market maturation. |

Driving Factors and Risks

- Driving factors include unmet need fulfillment, favorable regulatory decisions, and successful commercialization.

- Risks involve delayed approval, market rejection, pricing pressures, and competitive launches by rivals.

Competitive Positioning and Differentiation

PATADAY’s unique value proposition—such as [mechanistic advantage, safety profile, dosing convenience]—positions it favorably against existing therapies. Strategic partnerships with payers and key opinion leaders will facilitate market penetration. Cost-effective manufacturing and targeted marketing campaigns are essential to maximize reach.

Strategic Recommendations

- Prioritize early engagement with regulatory agencies for smooth approval processes.

- Develop a comprehensive pricing and reimbursement strategy aligned with healthcare stakeholders.

- Invest in physician education to expedite adoption.

- Leverage real-world evidence post-launch to support ongoing uptake and patent defenses.

- Explore expansion into adjacent indications or combination therapies to diversify revenue streams.

Key Takeaways

- PATADAY is positioned to address a sizeable unmet need within a multi-billion-dollar global market.

- Successful market entry depends on regulatory approval, favorable pricing, and clinician adoption.

- Sales projections forecast robust growth over five years, contingent on market dynamics and competitive responses.

- Strategic focus on regulatory navigation, payor relationships, and physician education will optimize revenue potential.

- Continuous market monitoring and pipeline expansion can sustain long-term growth.

FAQs

1. What is the primary indication for PATADAY?

PATADAY is developed to treat [specific disease/condition], targeting patient populations with limited effective options and significant unmet needs.

2. When is PATADAY expected to receive regulatory approval?

Based on ongoing clinical trial results and submission timelines, regulatory approval is anticipated in [year], subject to agency review processes.

3. How does PATADAY differentiate from existing therapies?

It offers [mechanism of action, safety profile, dosing regimen], providing potential advantages such as [reduced side effects, better efficacy, convenience].

4. What are the primary market risks associated with PATADAY?

Risks include delays in regulatory approval, reimbursement challenges, market competition, and unforeseen safety issues.

5. What strategies can maximize PATADAY’s market success?

Early regulatory engagement, pricing strategies aligned with healthcare payers, clinician education, and expansion into additional indications are critical.

References

- [Insert relevant market reports, clinical trial data, and industry publications].

- [Include relevant regulatory guidelines and economic analyses].

- [Cite sources for epidemiology and prescription data].

- [Cite competitive landscape analyses and price benchmarks].

- [Include references for sales projections methodologies and models].