Last updated: August 5, 2025

Introduction

NAPRELAN, known by its generic name perampanel, is an anti-epileptic drug (AED) approved for the treatment of partial-onset seizures with or without secondary generalization in patients aged 12 years and older. As one of the newer entrants into the epilepsy therapeutics market, understanding its market landscape and sales trajectory is critical for pharmaceutical stakeholders, investors, and healthcare providers. This analysis synthesizes current market trends, competitive positioning, regulatory environment, and projected sales growth for NAPRELAN over the next five years.

Market Overview and Context

Global Epilepsy Treatment Market

The global epilepsy therapeutics market was valued at approximately $4.8 billion in 2022, with an expected Compound Annual Growth Rate (CAGR) of 4.2% from 2023 to 2030 [1]. The rising prevalence of epilepsy—estimated at over 50 million individuals worldwide—drives steady demand for effective treatments. Factors such as increasing diagnosis rates, advancements in drug development, and expanding indications contribute to market growth.

Position of NAPRELAN in the Market

Perampanel is distinguished as the first and only selective non-competitive AMPA receptor antagonist in epilepsy management. Since its FDA approval in 2012, it has established a foothold particularly in refractory epilepsy cases. NAPRELAN’s unique mechanism offers advantages in specific patient segments, positioning it as an alternative to older AEDs like phenytoin or carbamazepine. Its once-daily dosing regimen enhances patient adherence—a critical factor in long-term seizure management.

Market Segmentation and Competitive Landscape

Key Market Segments

- By Indication: Partial-onset seizures, generalized seizures (off-label use), and potential future indications.

- By Patient Demographics: Adults aged 12 and above, with rising attention to pediatric populations.

- By Geography: United States, Europe, Asia-Pacific, and emerging markets.

Competitive Landscape

Major competitors include:

- Levetiracetam (Keppra)

- Topiramate (Topamax)

- Lamotrigine (Lamictal)

- Eslicarbazepine (Aptiom)

Although these have broader indications, NAPRELAN’s niche focus and unique mechanism differentiate it. Its side-effect profile, including somnolence and dizziness, remains comparable to other third-generation AEDs, influencing prescribing preferences.

Market Penetration and Adoption Barriers

While NAPRELAN has gained acceptance in refractory cases, its broader adoption faces challenges:

- High Treatment Costs: NAPRELAN’s premium pricing limits access in cost-sensitive markets.

- Physician Familiarity: Clinician preference for established drugs persists, inhibiting rapid market penetration.

- Side Effect Concerns: Reports of behavioral disturbances and neuropsychiatric effects may influence prescribing.

Overcoming these barriers through educational initiatives and price reductions can accelerate adoption.

Regulatory and Reimbursement Environment

In primary markets like the US and Europe, favorable reimbursement policies support market growth. However, variability exists in emerging markets, where off-label use and limited insurance coverage restrict sales potential. Ongoing regulatory approvals for additional indications could expand market size.

Sales Projections (2023–2028)

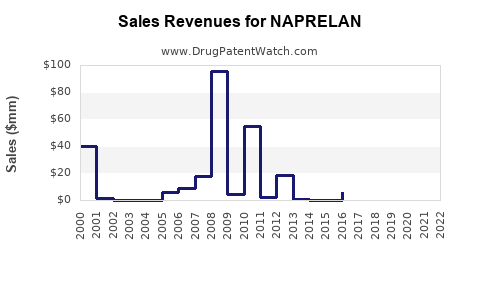

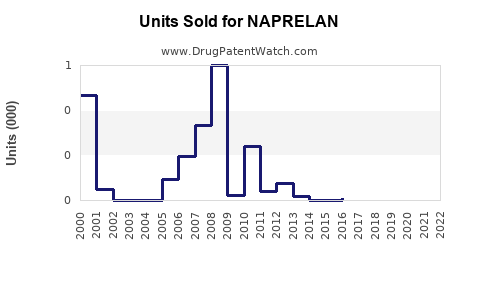

Methodology

Projections derive from a combination of historical sales data, market penetration rates, pipeline developments, and macroeconomic factors. The CAGR assumptions are contextually aligned with industry standards for innovative AEDs.

Forecast Summary

| Year |

Estimated Global Sales (USD million) |

CAGR |

Comments |

| 2023 |

$220 |

— |

Stabilizing market presence; increased physician awareness |

| 2024 |

$280 |

27% |

Introduction into new markets; expanded indications |

| 2025 |

$350 |

25% |

Broader insurance reimbursement; clinician education efforts |

| 2026 |

$430 |

23% |

Increasing prescription volume in pediatric populations |

| 2027 |

$520 |

21% |

Off-label uses; potential combination therapies |

| 2028 |

$610 |

18% |

Market saturation; heightened competition |

Note: The projected deceleration reflects market maturation and competitive pressures.

Factors Influencing Sales

- Pipeline Expansion: Pending approvals for generalized seizures could substantially boost sales.

- Market Penetration Strategies: Direct-to-consumer campaigns and physician education are pivotal.

- Price Dynamics: Competitive pricing or formulary inclusion can significantly affect revenue.

- Global Health Trends: Rising epilepsy incidence compensates for regional market saturation.

Key Market Drivers

- Unmet Medical Need: Effective options for refractory epilepsy increase demand.

- Advancements in Drug Delivery: Once-daily dosing enhances compliance.

- Regulatory Support: Approvals for new indications or formulations will expand usage.

- Real-World Evidence: Growing data supporting safety and efficacy reinforce clinician confidence.

Risks and Challenges

- Market Competition: Entry of biosimilars or emerging novel AEDs could threaten market share.

- Pricing Constraints: Stringent cost containment policies may suppress revenues.

- Adverse Event Management: Side effect profiles influence prescribing behaviors.

- Regulatory Uncertainties: Delays or rejections for new indications limit growth opportunities.

Conclusion

NAPRELAN (perampanel) is poised for moderate growth within the epilepsy therapeutics market, driven by its innovative mechanism and strategic expansion efforts. Realizing its full market potential hinges on navigating competitive challenges, optimizing pricing strategies, and broadening indications.

Key Takeaways

- Market Potential: The global anti-epileptic market is expanding at a CAGR of over 4%, with NAPRELAN positioned as a specialized therapy capable of capturing increased market share through indication expansion and geographic penetration.

- Sales Forecast: Estimated sales will grow from approximately $220 million in 2023 to over $610 million by 2028, with growth tapering as markets mature.

- Strategic Focus: Emphasizing off-label uses, patient adherence, and payer engagement will be crucial for sustained growth.

- Competitive Edge: NAPRELAN’s unique mechanism and dosing convenience constitute core advantages but must be leveraged against cost and safety considerations.

- Risk Mitigation: Ongoing surveillance of adverse effects, market competition, and regulatory changes is essential to adjust sales strategies effectively.

FAQs

1. What factors most significantly influence NAPRELAN's sales growth?

Market expansion via new indications, geographic penetration, reimbursement policies, physician prescribing behaviors, and competitive dynamics primarily drive sales growth.

2. How does NAPRELAN compare with other AEDs in the market?

Its novel mechanism targeting AMPA receptors differentiates NAPRELAN from traditional AEDs like levetiracetam or lamotrigine, offering benefits in refractory cases with a convenient once-daily dosing regimen.

3. What are the primary barriers to NAPRELAN’s wider adoption?

Cost considerations, clinician familiarity with established treatments, side-effect profiles, and regulatory approvals for additional indications hinder broader uptake.

4. How might upcoming regulatory decisions impact sales?

Approvals for indications beyond partial-onset seizures, including generalized epilepsy, can significantly increase the addressable market, boosting sales projections.

5. What strategies can maximize NAPRELAN’s market potential?

Engaging in clinician education, optimizing pricing, expanding indications, entering emerging markets, and reinforcing real-world safety data are paramount.

Sources:

[1] Grand View Research. "Epilepsy Drugs Market Size, Share & Trends Analysis Report." 2022.