Last updated: July 28, 2025

Introduction

Mupirocin, a topical antibiotic primarily used to treat skin infections and nasal carriage of Staphylococcus aureus, including methicillin-resistant strains (MRSA), has secured a vital place in antimicrobial therapy. As antibiotic resistance escalates globally, the role of mupirocin gains increased strategic importance. This analysis explores market dynamics, current demand, competitive landscape, and projections for mupirocin sales over the next five years, serving as a critical resource for pharmaceutical stakeholders and investors contemplating strategic positioning in this segment.

Market Overview

Therapeutic Applications and Indications

Mupirocin's primary indications include:

- Impetigo, caused by Staphylococcus aureus and Streptococcus pyogenes.

- Nasal decolonization of MRSA in healthcare settings.

- Treatment of secondarily infected eczema and other skin infections.

The rise in MRSA prevalence, particularly in hospital-acquired infections, propels demand for mupirocin’s nasal formulations. According to the CDC, approximately 40-50% of patients in healthcare settings harbor S. aureus, with MRSA colonization rates ranging from 20-30% in some regions[1].

Regulatory Landscape

While mupirocin is approved globally, regulatory environments influence market access. The U.S. Food and Drug Administration (FDA) approved Bactroban (generic mupirocin) for topical use in 1983. Recent approvals and off-label uses, coupled with increased focus on antimicrobial stewardship, shape the regulatory environment. Emerging concerns over resistance warrant ongoing oversight.

Competitive Landscape

The market comprises several branded and generic formulations. Key players include:

- GlaxoSmithKline (Bactroban)

- Meda Pharmaceuticals

- Sandoz and Teva (generics)

Innovative formulations, such as mupirocin nasal ointments and combination products, are emerging to address resistance issues and improve compliance.

Market Drivers

- Rising MRSA Prevalence: The increasing incidence of MRSA infections intensifies demand for effective decolonization agents like mupirocin.

- Healthcare-Associated Infections (HAIs): Efforts to reduce HAIs through nasal decolonization protocols bolster mupirocin’s usage.

- Regulatory Support: Approvals for new formulations and indications expand the market scope.

- Growing Dermatology and Wound Care Needs: An aging population with compromised skin integrity sustains topical antibiotic use.

Market Challenges

- Antimicrobial Resistance Concerns: Growing resistance, including mupirocin-resistant MRSA strains, threaten long-term efficacy.

- Generic Competition: Cost pressures drive the commoditization, impacting branded product sales.

- Limited New Product Development: Innovation pipeline stagnation constrains growth potential.

Regional Market Dynamics

North America

Leading the market driven by high MRSA prevalence, advanced healthcare infrastructure, and robust regulatory support. The U.S. accounts for over 50% of global mupirocin sales, with steady growth predicted due to expanded hospital protocols[2].

Europe

Growing adoption driven by antimicrobial stewardship policies and Hospital Infection Prevention Programs. Regulatory frameworks facilitate market access, fostering moderate growth.

Asia-Pacific

Rapidly expanding healthcare infrastructure and increasing antibiotic resistance amplify demand. Market growth is projected to be robust, though pricing and regulatory hurdles slow adoption in some nations.

Rest of the World

Emerging markets benefit from increasing awareness of infection control, but infrastructural and regulatory challenges temper growth prospects.

Sales Projections and Forecasting

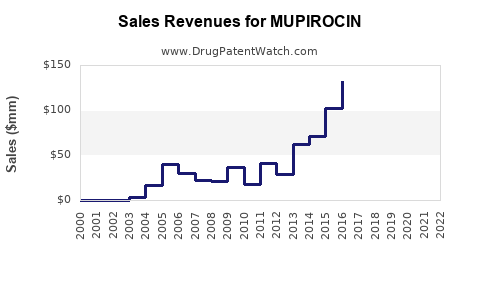

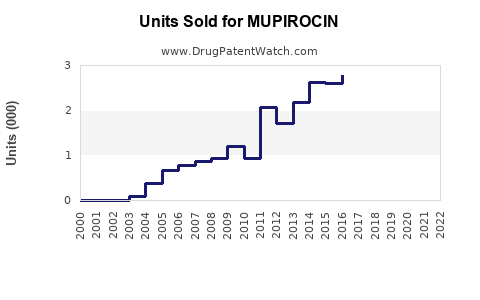

Historical Market Trends

The global mupirocin market was valued at approximately USD 300 million in 2020, with an annual growth rate (CAGR) of about 4%. The market expanded congruently with escalating MRSA cases and hospital protocols emphasizing decolonization[3].

Projection Assumptions

- An annual CAGR of approximately 5-6% over the forecast period (2023-2028).

- Increased adoption in inpatient and outpatient settings.

- Introduction of new formulations or combination therapies bolstering sales.

- Resistance levels influence prescribing patterns, potentially modulating growth.

Forecasted Market Size (2028)

By 2028, global mupirocin sales are estimated to reach USD 450-500 million. North America and Europe will comprise approximately 70% of total revenues, driven by mature healthcare markets and established protocols. Asia-Pacific is expected to experience the fastest growth (CAGR 7-8%), fueled by expanding healthcare infrastructure.

Market Segmentation

| Segment |

2022 Market Share |

Projection 2028 Market Share |

Drivers |

| Topical Mupirocin (OTC) |

70% |

65% |

Established indications, safety profile |

| Nasal Mupirocin |

30% |

35% |

MRSA decolonization, hospital protocols |

Strategic Opportunities

- Development of resistant Mupirocin formulations to extend efficacy.

- Expanding indications into community-acquired skin infections.

- Novel delivery systems (e.g., once-daily formulations, combination products).

- Collaboration with healthcare providers to expand usage protocols.

Market Risks and Mitigation Strategies

- Antimicrobial Resistance: Implement stewardship to prevent resistance escalation.

- Pricing Pressures: Focus on value-based offerings and cost-effective formulations.

- Regulatory Challenges: Early engagement with regulators and adaptive development strategies.

Regulatory and Patent Landscape

While most formulations are off-patent, patent protections may restrict generic entry in certain jurisdictions. Companies investing in patent extension strategies for innovative formulations or delivery systems can sustain competitive advantage.

Conclusion

The mupirocin market remains robust amid rising antimicrobial resistance and infection control initiatives. Strategic investments in formulation innovation, resistance management, and expanding indications will shape growth trajectories. Stakeholders must navigate the evolving regulatory landscape and resistance challenges to capitalize on the projected market expansion.

Key Takeaways

- Increasing MRSA prevalence boosts demand for mupirocin, particularly in hospital settings.

- Market growth projection (2023-2028) suggests a CAGR of approximately 5-6%, reaching USD 500 million globally.

- North America dominates the market with strong adoption of decolonization protocols; Asia-Pacific presents significant growth opportunities.

- Resistance concerns pose risks, emphasizing the importance of antimicrobial stewardship and innovation.

- Future growth hinges on development of novel formulations and expanded clinical indications to sustain revenue streams.

FAQs

1. What factors are influencing mupirocin's growth in the global market?

The rise in MRSA infections, increased adoption of infection control protocols, healthcare system expansion, and regulatory approvals of new applications are key drivers.

2. How does antimicrobial resistance impact mupirocin sales?

Resistance, especially mupirocin-resistant MRSA strains, could decrease efficacy and prescriber reliance, potentially dampening sales unless innovations or combination therapies are developed.

3. What are the main regulatory considerations for mupirocin?

Regulatory agencies evaluate safety, efficacy, and resistance patterns. Off-label use and emerging formulations may require new approvals, influencing market entry strategies.

4. Which regions present the most significant growth opportunities for mupirocin?

Asia-Pacific and Latin America offer high-growth potential due to expanding healthcare infrastructure but may face regulatory and pricing challenges.

5. Are there any upcoming developments poised to impact the mupirocin market?

Innovative formulations, combination products, and expanded indications for resistant infections are anticipated to influence market dynamics significantly.

Sources:

[1] Centers for Disease Control and Prevention (CDC). "Antibiotic Resistance Threats in the United States, 2019."

[2] MarketResearch.com. "Global Mupirocin Market Trends & Forecasts."

[3] Grand View Research. "Antimicrobial Market Size & Forecast."