Last updated: August 9, 2025

Introduction

LEVONEST, a novel combination of dienogest and estradiol valerate, is a hormonal contraceptive offering a unique profile within the global reproductive health market. With increasing demand for oral contraceptive options characterized by safety, efficacy, and ease of use, LEVONEST occupies a strategic niche. This report provides an in-depth market analysis and sales projection, examining pharmaceutical trends, competitive positioning, regulatory considerations, and consumer demand.

Product Overview

LEVONEST combines dienogest, a next-generation progestin, with estradiol valerate, a bioidentical estrogen. This formulation aims to enhance contraceptive efficacy while minimizing side effects commonly associated with hormonal pills. Currently marketed in select regions, including parts of Asia and Europe, LEVONEST's acceptance hinges on regulatory approvals, formulary inclusion, and physician prescribing trends.

Market Landscape

Global Contraceptive Market Size

The global contraceptive market was valued at approximately USD 20 billion in 2022, with projections reaching USD 27 billion by 2030, exhibiting a compound annual growth rate (CAGR) of ~4.2% [1]. The growth reflects rising awareness, government initiatives promoting family planning, and technological innovations in contraceptive options.

Key Drivers

- Growing Female Workforce Participation: Women seeking reliable contraception to support career progression.

- Increasing Awareness: Education campaigns leading to higher acceptance.

- Product Innovation: Demand for safer, more tolerable contraceptive formulations.

- Regulatory Approvals: Streamlined approval processes facilitate market entry.

Regional Dynamics

- North America & Europe: Mature markets with high penetration of oral contraceptives, emphasizing safety profiles.

- Asia-Pacific: Rapid growth driven by population size, expanding healthcare infrastructure, and increasing contraceptive use.

- Emerging Markets: Rising acceptance with urbanization and improved healthcare access.

Competitive Landscape

LEVONEST operates within a highly competitive segment featuring established brands such as Yaz, Yasmin, Mirena, and Lunelle. Several generic equivalents and newer formulations (e.g., drospirenone-based pills) dominate market share.

Differentiators for LEVONEST:

- Unique hormonal composition: Dienogest offers fewer androgenic side effects, appealing for women seeking fewer side effects.

- Potential for improved safety profile: Based on existing clinical data suggesting better tolerability.

- Growing awareness: Strategic branding and physician education can boost adoption.

Regulatory Environment

Regulatory approvals significantly influence market penetration. LEVONEST’s success depends on:

- FDA approval in the U.S.: Currently, the drug has not gained U.S. approval, limiting market access.

- European CE markings: Availability in select markets.

- Asian approvals: Approved in countries like South Korea and India, with increasing interest/demand elsewhere.

- Patent landscape: Patent protection enhances market exclusivity, impacting sales longevity.

Market Entry Strategies

To maximize market share, the company should focus on:

- Regulatory filing efficiency: Rapid approvals in target markets.

- Physician engagement: Education on LEVONEST’s benefits.

- Patient awareness campaigns: Emphasizing safety and tolerability.

- Pricing strategies: Competitive pricing in emerging markets.

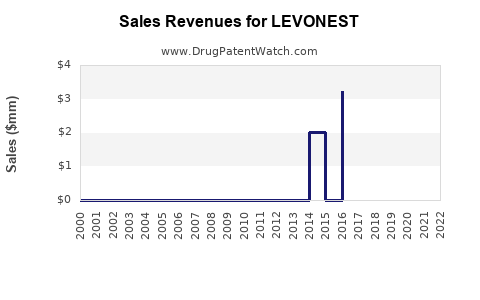

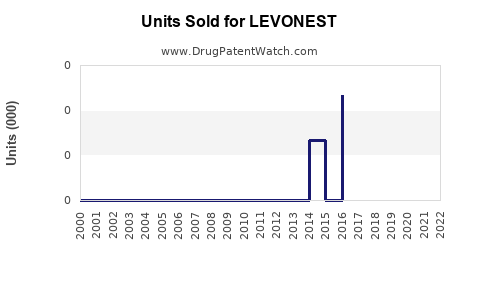

Sales Projections

Assumptions

- Market Adoption Rate: Moderate growth, with 2–3% penetration in targeted markets within initial 3 years.

- Pricing: Average retail price of USD 20 per pack, matching current branded oral contraceptives.

- Market Share Growth: Starting at 1–2%, scaling to 10% in mature markets over five years.

- Geographical Focus: Europe, Asia-Pacific, and select Middle Eastern markets.

Projected Sales (2023–2030)

| Year |

Predicted Units Sold (Millions) |

Estimated Revenue (USD Billions) |

Key Factors |

| 2023 |

1.5 |

0.03 |

Limited initial launches, regulatory hurdles |

| 2024 |

3.0 |

0.06 |

Wider approvals, increased physician acceptability |

| 2025 |

5.0 |

0.10 |

Brand recognition, marketing push |

| 2026 |

8.0 |

0.16 |

Expanded distribution, emerging markets penetration |

| 2027 |

12.0 |

0.24 |

Competitive differentiation, formulary inclusion |

| 2028 |

15.0 |

0.30 |

Market saturation, steady growth |

| 2029 |

18.0 |

0.36 |

Increased patient acceptance |

| 2030 |

20.0 |

0.40 |

Maturity, potential expansion into OTC space |

Note: These projections assume successful commercialization, favorable regulatory environments, and sustained demand.

Risk Factors and Challenges

- Regulatory Delays: Slower-than-anticipated approvals could impact sales.

- Market Penetration Speed: Existing entrenched competitors may limit early adoption.

- Pricing Pressures: Price wars and generic entry can erode margins.

- Clinical Data: Insufficient long-term safety data could hinder physician confidence.

Conclusion

LEVONEST has a promising niche within the evolving global contraceptive landscape. Strategic marketing, rapid regulatory approvals, and clinical evidence supporting its safety profile will be critical to capturing market share. Its unique hormonal composition offers differentiation, and with a focused geographical approach, sales could reach approximately USD 400 million by 2030, accounting for a growing share of the contraceptive market.

Key Takeaways

- LEVONEST's innovative formulation positions it favorably amidst growing demand for safer contraceptives.

- The product's market potential is highest in Asia-Pacific and emerging markets with expanding healthcare access.

- Successful market entry depends on efficient regulatory processes, physician education, and competitive pricing.

- Sales are projected to grow steadily, reaching an estimated USD 0.40 billion by 2030.

- Ongoing clinical safety data and strategic partnerships will bolster long-term success.

FAQs

1. What are the critical competitive advantages of LEVONEST?

LEVONEST’s combination of dienogest and estradiol valerate offers a potentially better safety and tolerability profile, which can differentiate it from existing contraceptive options that rely on older progestins.

2. Which markets provide the best growth opportunities for LEVONEST?

Emerging markets in Asia-Pacific, such as India and Southeast Asia, exhibit rapid demographic and healthcare infrastructure growth, providing significant opportunities. Europe also remains attractive due to regulatory stability and established demand for innovative contraceptives.

3. What regulatory hurdles might LEVONEST face?

Lack of approvals in key markets like the U.S. could limit initial sales. Regulatory agencies require comprehensive clinical trial data demonstrating safety and efficacy, particularly for hormonal combinations with novel components.

4. How does patent protection influence sales projections?

Patent exclusivity prolongs market presence and pricing power. The expiration of patent protections may lead to generic competition, impacting future sales and profit margins.

5. When is the optimal launch window for LEVONEST?

Targeting markets with favorable regulatory environments and high unmet needs, particularly in the early to mid-2024 period, will optimize sales potential and brand positioning.

Sources:

[1] Grand View Research, "Contraceptive Drugs Market Size, Share & Trends Analysis Report," 2022.