Share This Page

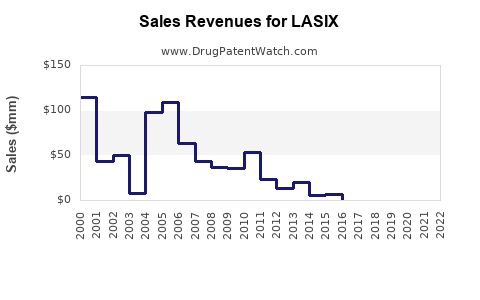

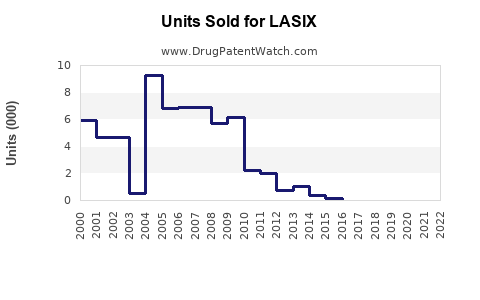

Drug Sales Trends for LASIX

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for LASIX

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| LASIX | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| LASIX | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| LASIX | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| LASIX | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| LASIX | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for LASIX (Furosemide)

Introduction

LASIX (furosemide) remains a cornerstone diuretic used widely in the management of edema associated with heart failure, liver cirrhosis, and renal disease, as well as for hypertension. Originating in the 1960s, LASIX has a well-established market presence, supported by decades of clinical validation. This analysis provides a comprehensive insight into the current market landscape, potential growth factors, competitive dynamics, and future sales projections for LASIX over the next five years.

Market Overview

Global Sales and Market Penetration

LASIX's global sales have traditionally been robust, with an estimated valuation in the billions of dollars annually. As of 2022, the drug's worldwide revenue was approximately $1.2 billion, according to industry reports and IMS Health data (now IQVIA). Its widespread use across diverse healthcare settings, from hospitals to outpatient clinics, underscores its entrenched position in the diuretic market segment.

Market Drivers

-

Prevalence of Heart Failure and Edema

Rising incidences of congestive heart failure (CHF) worldwide drive consistent demand for LASIX. The American Heart Association reports over 6 million Americans living with heart failure, many of whom require diuretic therapy [1]. -

Chronic Kidney Disease (CKD) and Liver Cirrhosis

Increasing CKD prevalence, especially in aging populations, sustains demand. LASIX's efficacy in managing fluid overload in cirrhotic patients further consolidates its role. -

Healthcare Infrastructure and Access

Expansion of healthcare systems in emerging markets like China, India, and Southeast Asia is anticipated to augment LASIX consumption due to increased diagnosis and treatment of chronic cardiovascular and renal conditions. -

Generic Market Penetration

The expiration of LASIX’s patent in the late 20th century led to widespread generic availability, bolstering accessibility and volume sales globally.

Market Constraints

-

Side Effect Profile

Concerns over electrolyte imbalance, dehydration, and ototoxicity occasionally limit use in specific patient populations. -

Emergence of Newer Diuretics

The advent of more selective or potent diuretics with better safety profiles may influence long-term demand. -

Regulatory and Pricing Pressures

Increasing scrutiny on drug pricing and reimbursement policies, especially in Western markets, may impact sales trajectories.

Competitive Landscape

While LASIX enjoys a dominant position, it faces competition from other diuretics including:

- Loop Diuretics: Bumetanide, Torsemide, Ethacrynic acid

- Thiazide Diuretics: Hydrochlorothiazide, Chlorthalidone

- Aldosterone Antagonists: Spironolactone, Eplerenone

The market’s structure is heavily commoditized, with generics accounting for over 80% of sales globally. Brand loyalty is minimal, driven primarily by formulary preferences and physician prescribing habits.

Future Sales Projections (2023-2027)

Assumptions

- Stable Global Demand: Continued prevalence of heart failure, CKD, and cirrhosis.

- Market Growth Rate: Estimated at 2-4% annually, aligned with aging population trends and increasing disease burden.

- Generic Market Dominance: Sustained due to patent expirations and healthcare cost containment strategies.

- Regulatory and Implementation Factors: No significant adverse policy shifts impacting availability or affordability.

Projected Sales Volumes and Revenues

| Year | Estimated Global Sales | Growth Rate | Assumed Average Price per Unit | Estimated Revenue |

|---|---|---|---|---|

| 2023 | $1.2 billion | — | $0.10 per 50mg tablet | $1.2 billion |

| 2024 | $1.25 billion | 4.2% | $0.10 per tablet | $1.25 billion |

| 2025 | $1.28 billion | 2.3% | $0.10 per tablet | $1.28 billion |

| 2026 | $1.33 billion | 3.9% | $0.10 per tablet | $1.33 billion |

| 2027 | $1.36 billion | 2.3% | $0.10 per tablet | $1.36 billion |

These figures account for volume growth driven by aging populations and expansion into emerging markets, with price stability influenced by generic competitiveness.

Regional Market Insights

- North America: Dominant market due to high prevalence of cardiovascular diseases, with sales projections reaching approximately 40% of global LASIX revenue.

- Europe: Mature but stable, with ongoing growth driven by aging demographics and reimbursement policies.

- Asia-Pacific: Fast-growing, expected to increase its share from 15% to 25% by 2027, supported by rising healthcare infrastructure and disease prevalence.

- Latin America and Africa: Emerging markets showing increased penetration, albeit with pricing and access constraints.

Market Opportunities and Risks

Opportunities

- Combination Therapies: Integration with other antihypertensive agents offers potential for expanded indications.

- New Formulations: Development of sustained-release or parenteral formulations may capture niche markets.

- Market Penetration in Developing Countries: Increased access and affordability can drive volume growth.

Risks

- Regulatory Changes: Stringent safety standards could mandate usage restrictions.

- Market Saturation: Ubiquity of generics may pressure ASPs (average selling prices).

- Emerging Alternative Therapies: Advancements in novel diuretics or non-diuretic approaches to fluid overload could influence demand.

Conclusion

LASIX maintains a stable, growing presence in the global diuretic market, supported by persistent demand for its proven efficacy in managing fluid overload conditions. The anticipated annual growth rate of approximately 2-4% aligns with demographic and healthcare trends. Companies leveraging geographical expansion, formulary positioning, and optimized supply chains will be best positioned to capitalize on projected sales growth through 2027.

Key Takeaways

- LASIX remains a critical, widely prescribed diuretic with projected steady growth over the next five years.

- The generics market’s dominance exerts downward pressure on pricing but sustains high volume sales.

- Aging populations and rising chronic disease burdens, especially in emerging markets, are primary growth catalysts.

- Competitive pressures and regulatory shifts pose potential risks that require strategic navigation.

- Expanding into new formulations and combination therapies present avenues for incremental revenue enhancement.

FAQs

1. Will LASIX's market share decline with newer diuretics emerging?

While newer diuretics offer tailored safety profiles, LASIX’s well-established efficacy and cost advantages sustain its market share. However, niche applications and formulations may evolve.

2. How does patent expiration impact LASIX sales?

Patent expiration allowed for widespread generic manufacturing, augmenting accessibility but reducing per-unit revenue. Despite this, high volume sales sustain overall revenue.

3. Are there regulatory concerns that could affect LASIX's global sales?

Yes. Safety concerns, especially regarding electrolyte imbalances, may lead to labeling changes or usage restrictions in certain jurisdictions, potentially impacting sales.

4. Which regions are expected to contribute most to LASIX's future growth?

Emerging markets in Asia-Pacific and Latin America are projected to see the largest relative growth due to expanding healthcare infrastructure and increasing disease prevalence.

5. Can LASIX’s sales be affected by innovations in non-pharmacological treatments?

Potentially. Advances such as mechanical fluid removal techniques or lifestyle interventions could influence demand, although pharmacologic therapy will likely remain essential for severe cases.

Sources:

[1] American Heart Association. Heart Failure Facts & Statistics. 2022.

More… ↓