Last updated: July 27, 2025

Introduction

Enoxaparin, a low molecular weight heparin (LMWH), is widely used as an anticoagulant for preventing and treating thromboembolic events. Its clinical applications include deep vein thrombosis (DVT), pulmonary embolism (PE), and as prophylaxis during surgical procedures or immobilization. Given its established efficacy and favorable safety profile, enoxaparin has become a cornerstone in anticoagulant therapy. This analysis provides an overview of the current market landscape, growth drivers, competitive dynamics, regulatory factors, and sales projections for enoxaparin over the next five years.

Market Overview

Global Market Size

As of 2022, the global enoxaparin market was valued at approximately $4.2 billion, reflecting its widespread use and recurrent demand in hospitals and clinics worldwide. Growth has been driven by the increasing prevalence of venous thromboembolism (VTE), expanding indications, and an aging population susceptible to thrombotic disorders. According to MarketsandMarkets, the anticoagulants market is projected to grow at a CAGR of 7% from 2022 to 2027, with enoxaparin constituting a significant share within this segment.

Geographical Distribution

- North America: Largest market share (~40%), supported by high healthcare spending, advanced medical infrastructure, and robust adoption of anticoagulants.

- Europe: Second-largest due to aging demographics and widespread clinical guidelines endorsing LMWHs.

- Asia-Pacific: Fastest-growing region, with a CAGR of approximately 9%, driven by rising healthcare infrastructure development, increased awareness, and expanding target populations.

- Latin America and Middle East: Moderate growth prospects, with increasing adoption amid expanding healthcare access.

Market Drivers

Increasing Prevalence of Thromboembolic Disorders

The global burden of conditions such as DVT, PE, atrial fibrillation, and postoperative venous thromboembolism is rising, fueling demand for effective anticoagulants like enoxaparin. The World Thrombosis Organization estimates VTE affects 1-2 per 1,000 individuals annually, with higher incidence among hospitalized and elderly patients.

Growing Elderly Population

People aged 60 and above are at elevated risk for thrombotic events, leading to increased prescription rates of enoxaparin. The global demographic shift toward aging populations (expected to reach over 1.4 billion over 60 by 2030) supports sustained market growth.

Expanding Clinical Indications and Guidelines

Regulatory agencies like the FDA and EMA endorse enoxaparin for multiple indications, including prevention of deep vein thrombosis in orthopedic surgery, stroke prophylaxis in atrial fibrillation, and acute coronary syndromes. This broad label endorsement continues to underpin its market penetration.

Advancements in Formulations and Administration

The development of higher-concentration formulations and subcutaneous injection devices improves patient compliance and simplifies dosing, further promoting market adoption.

Market Challenges

Pricing and Competition

Generic enoxaparin products (e.g., Dalteparin, Certoparin) exert pricing pressure on branded formulations. The entry of biosimilars in major markets further intensifies competition, potentially reducing average selling prices.

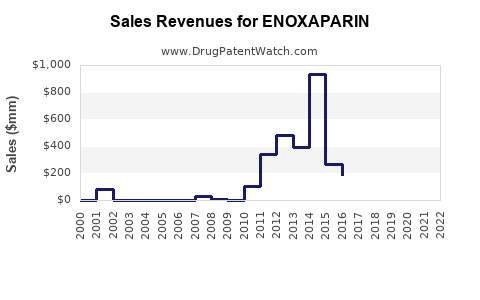

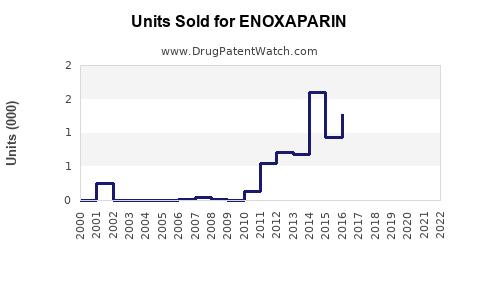

Regulatory and Patent Dynamics

Patent expirations, notably for branded enoxaparin products, bolster generic and biosimilar competition. Regulatory hurdles in different jurisdictions, especially concerning biosimilar approval, can delay market entry.

Shift Toward Direct Oral Anticoagulants (DOACs)

The increasing preference for oral anticoagulants like rivaroxaban and apixaban, owing to their ease of use and no requirement for injections or routine monitoring, poses a competitive threat to injectable LMWHs.

Competitive Landscape

Major pharmaceutical players in the enoxaparin market include:

- Sanofi (Lovenox)

- Bayer (Keflex)

- Mylan (generic formulations)

- Sandoz (biosimilars)

- Teva Pharmaceutical Industries

Sanofi's Lovenox remains the market leader, holding significant sales due to its established brand presence and trusted efficacy.

Regulatory & Patent Outlook

The expiration of key patents over the next 2-3 years permits entry of biosimilars and generics, likely impacting pricing and sales volumes. Regulatory pathways for biosimilars are well-established in the US and EU, facilitating market entry.

Sales Projections (2023-2028)

Assumptions

- Continued increase in thromboembolic disease prevalence.

- Steady adoption of enoxaparin for established indications.

- Competitive pressure from biosimilars and generics, leading to price reductions.

- Incremental market share gains in emerging regions.

- Marginal impact of DOACs on injectable LMWH sales.

Projected Sales Figures

| Year |

Estimated Market Size |

Enoxaparin-Specific Sales (USD billions) |

CAGR |

Remarks |

| 2023 |

$4.2 billion |

$2.9 billion |

N/A |

Baseline year |

| 2024 |

$4.5 billion |

$3.1 billion |

7.5% |

Growth driven by emerging markets |

| 2025 |

$4.8 billion |

$3.3 billion |

7% |

Increased biosimilar competition |

| 2026 |

$5.2 billion |

$3.5 billion |

6-7% |

Market saturation, stabilized growth |

| 2027 |

$5.6 billion |

$3.8 billion |

7% |

Convergence of new indications |

| 2028 |

$6.0 billion |

$4.0 billion |

7% |

Market maturation, regional expansion |

This forecast considers inflation of global anticoagulant use, increasing regulatory approvals, and a robust pipeline of biosimilars contributing to volume growth but with downward pricing pressure.

Key Strategies for Market Stakeholders

- Investment in Biosimilars: Capitalize on patent expirations by developing high-quality biosimilar enoxaparins, leveraging cost advantages.

- Global Expansion: Focus on increasing penetration in Asian and Latin American markets where healthcare infrastructure improvement is ongoing.

- Product Differentiation: Innovate formulations or delivery devices to enhance compliance and patient convenience.

- Clinical Advocacy: Support clinical trials to expand approved indications, further solidifying enoxaparin’s clinical utility.

Conclusion

The enoxaparin market remains a significant segment of the anticoagulant therapy landscape, with steady growth expected despite challenges from biosimilars and oral alternatives. Healthcare trends favoring early intervention and extended indications will sustain demand. Companies that adapt to competitive pressures, innovate formulations, and expand geographically are positioned to capitalize on projected market growth.

Key Takeaways

- The global enoxaparin market is projected to grow at a CAGR of approximately 7% through 2028, driven by increasing thromboembolic disease prevalence and demographic shifts.

- Generic and biosimilar entries will intensify price competition, necessitating strategic innovation and cost management.

- Emerging markets represent significant growth opportunities, especially in Asia-Pacific and Latin America.

- The shift toward DOACs could dilute injectable LMWH markets but will not entirely displace enoxaparin due to its proven efficacy and broad indications.

- Stakeholders should focus on biosimilar development, geographic expansion, and indication broadening to maximize market share.

FAQs

1. How will biosimilar enoxaparin products impact the market?

Biosimilars are expected to lower prices and increase overall market volume by expanding access, especially in price-sensitive markets. They will intensify competition, pressuring branded enoxaparin sales but also creating opportunities for volume growth.

2. Are there regulatory challenges for biosimilar enoxaparin?

Yes, approval pathways are established, but biosimilars require rigorous comparability studies. Regulatory agencies in the US and EU have streamlined pathways, but regional variations can pose hurdles.

3. Will the advent of oral anticoagulants significantly reduce enoxaparin sales?

While DOACs offer convenience and are increasingly preferred, enoxaparin will retain relevance for specific high-risk and prophylactic indications, especially in inpatient settings and certain surgical procedures.

4. What regional factors influence enoxaparin sales growth?

High disease prevalence, healthcare infrastructure, reimbursement policies, and physician prescribing behavior significantly influence regional sales. Emerging markets present substantial growth potential owing to expanding healthcare coverage.

5. How does patent expiration affect future sales?

Patent expiry typically leads to increased generic and biosimilar competition, potentially reducing prices but increasing sales volume. Strategic timing and product differentiation are critical to maintaining market share post-patent expiration.

Sources

[1] MarketsandMarkets. "Anticoagulants Market by Product and Region," 2022.

[2] World Thrombosis Organization. "VTE Epidemiology," 2021.

[3] U.S. Food and Drug Administration. "Biosimilar Development & Approval," 2022.