Share This Page

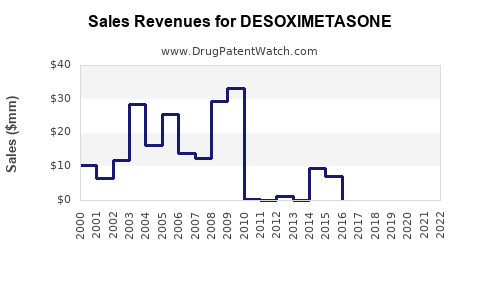

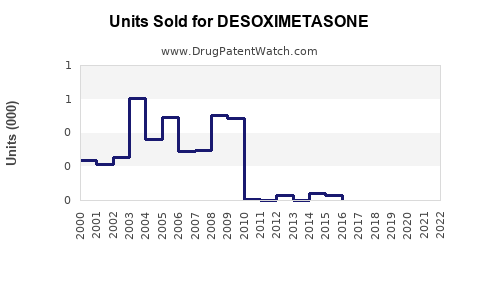

Drug Sales Trends for DESOXIMETASONE

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for DESOXIMETASONE

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| DESOXIMETASONE | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| DESOXIMETASONE | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| DESOXIMETASONE | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Desoximetasone

Introduction

Desoximetasone is a potent topical corticosteroid primarily prescribed for inflammatory skin conditions such as psoriasis, eczema, and dermatitis. Approved by the U.S. Food and Drug Administration (FDA), desoximetasone’s efficacy in managing dermatologic inflammation has established it as a significant player in the topical corticosteroid market. As healthcare providers and consumers increasingly prioritize effective dermatologic treatments, understanding the current market landscape and projecting future sales for desoximetasone are vital for pharmaceutical companies, investors, and healthcare strategists.

This comprehensive analysis explores the market dynamics, competitive landscape, regulatory environment, and sales forecasts for desoximetasone over the coming five years, with a focus on key geographical regions, market drivers, and barriers.

Market Overview

Product Profile

Desoximetasone belongs to the class of high-potency topical corticosteroids. It is available in various formulations, including creams, ointments, and gels, targeting moderate to severe inflammatory dermatoses. Its pharmacological action involves reducing inflammation, swelling, redness, and itching.

Current Market Size

The global topical corticosteroids market was valued at approximately USD 2.3 billion in 2022, with dermatology drugs constituting a substantial segment. Desoximetasone, though not a household name, commands a significant share within this niche, driven by its potency and efficacy in resistant cases. The North American market remains the largest, supported by high incidence rates, advanced healthcare infrastructure, and strong prescription habits.

Market Drivers

- Rising Prevalence of Skin Conditions: The increasing incidence of psoriasis and eczema, driven by environmental factors and urbanization, fuels demand.

- Advances in Dermatological Treatments: Better formulations, ease of application, and physician familiarity with corticosteroids enhance uptake.

- Growing Aging Population: Older adults are more susceptible to dermatological conditions, contributing to higher prescription rates.

- Expanding Awareness and Access: Education on skin health and expanded healthcare coverage facilitate greater treatment adoption.

Market Barriers

- Safety Concerns: Long-term use of corticosteroids can lead to skin atrophy, systemic absorption, and other side effects, prompting cautious prescribing.

- Regulatory Restrictions: Stringent regulations restrict over-the-counter sales, limiting access primarily to prescriptions.

- Competitive Landscape: Availability of lower-potency corticosteroids and non-steroidal alternatives may limit growth.

Competitive Landscape

Major pharmaceutical players involved in the production and distribution of desoximetasone include:

- Meda Pharmaceuticals (a subsidiary of Perrigo)

- Pfizer (under the brand Temovate)

- Sun Pharmaceutical Industries

- Dr. Reddy’s Laboratories

- Other regional and generic manufacturers

The presence of generics has led to significant price competition, impacting overall sales revenue. Patent expirations and the subsequent entry of biosimilars or alternative corticosteroids influence market share and pricing strategies.

Regional Market Analysis

North America

- Market Size (2022): USD 800 million

- Growth Factors: High prevalence of psoriasis (~2-3% of the population)[1], advanced healthcare infrastructure, and aggressive dermatological therapy adoption.

- Market Trends: Preference for high-potency corticosteroids for treatment-resistant cases; expanding use in combination therapies.

Europe

- Market Size (2022): USD 600 million

- Drivers: Similar prevalence to North America, with European regulatory bodies emphasizing safety protocols, influencing prescribing patterns.

Asia-Pacific

- Market Size (2022): USD 400 million

- Factors: Growing awareness, increasing dermatologic disease prevalence, rising disposable income, and expanding healthcare access.

Latin America and Middle East & Africa

- Market Size (2022): USD 300 million

- Trends: Emergence of local manufacturing, price sensitivity, and increased healthcare infrastructure.

Sales Projections (2023–2028)

Forecasting future sales involves considering current trends, market growth rates, and upcoming regulatory or patent landscape changes.

Assumptions

- Global CAGR: Estimated at 4.5%, driven by increasing dermatologic disease burden and rising awareness.

- Market Penetration: Further penetration in emerging markets, with growth in prescriptions for resistant conditions.

- Regulatory Environment: Stable, barring unforeseen restrictive policies or safety concerns.

- Competitive Dynamics: Continued generic competition leading to price erosion but volume growth offsetting revenue losses.

Projected Sales Figures

| Year | Global Market Size (USD Millions) | Notes |

|---|---|---|

| 2023 | 650 | Baseline; stabilization post-pandemic recovery |

| 2024 | 680 | Slight growth with increased adoption |

| 2025 | 720 | Expansion in emerging markets |

| 2026 | 760 | Market penetration deepens |

| 2027 | 800 | Broader usage in combination therapies |

| 2028 | 840 | Sustained growth, steady demand |

CAGR of approximately 4.5% over the forecast period indicates a steady expansion, with potential upticks if new indications or formulations gain approval.

Market Entry and Growth Strategies

- Customization for Emerging Markets: Affordability and localized formulations can drive adoption.

- Innovative Formulations: Developing less irritating or longer-lasting formulations increases market appeal.

- Combination Therapies: Co-formulating desoximetasone with other dermatologic agents could open new revenue streams.

- Enhanced Physician Education: Promoting safety when used properly can improve prescription rates.

Regulatory and Patent Outlook

Desoximetasone’s patent protections have expired or are nearing expiration in several markets, fostering generic competition. Manufacturers focusing on differentiation through formulations, delivery mechanisms, or combination drugs may sustain market share amid generic erosion.

Regulatory Challenges

While safety concerns remain, particularly regarding long-term corticosteroid use, regulatory agencies emphasize prescription-based use, limiting misuse. Ongoing pharmacovigilance and safety data will influence future prescribing guidelines and market access.

Conclusion

Desoximetasone’s market remains robust within the dermatology segment, bolstered by its efficacy and widespread clinical use. Its sales are projected to grow steadily over the next five years, supported by rising dermatologic disease prevalence, expanding healthcare infrastructure, and strategic marketing. However, intense generic competition and safety considerations necessitate continued innovation and tailored market approaches.

Key Takeaways

- Market Size & Growth: Expected to reach USD 840 million globally by 2028, with a CAGR of 4.5%.

- Regional Dynamics: North America dominates, but Asia-Pacific and Latin America present significant growth opportunities.

- Competitive Landscape: Generic producers dominate, emphasizing price competitiveness and formulation differentiation.

- Market Drivers: Growing skin condition prevalence, aging populations, and evolving treatment paradigms.

- Challenges: Safety concerns, regulatory restrictions, and market saturation by generics require strategic adaptability.

FAQs

1. What factors influence the prescribing of desoximetasone over other corticosteroids?

Physicians prefer desoximetasone for its high potency and proven efficacy in resistant or severe skin conditions. Its formulation options also allow for tailored treatment, making it suitable for specific patient needs.

2. How does patent expiration impact the sales of desoximetasone?

Patent expiration typically opens the market to generic competitors, leading to price reductions but increased volume sales. Companies focusing on innovative formulations or combination therapies can mitigate revenue loss.

3. Are there upcoming regulatory changes that could affect desoximetasone sales?

Regulatory agencies continue to monitor corticosteroids' safety profiles. Stricter prescribing guidelines or restrictions can influence sales, especially if long-term use risks become more emphasized.

4. What emerging markets hold the most potential for desoximetasone?

Asia-Pacific and Latin America offer compelling growth opportunities due to rising prevalence of dermatologic conditions and improving healthcare access, provided that affordability and local manufacturing are prioritized.

5. What strategies can pharmaceutical companies adopt to sustain desoximetasone sales?

Innovate with new formulations, explore combination therapies, target emerging markets with affordable pricing, and invest in physician education to promote safe and effective use.

Sources

- [1] National Psoriasis Foundation. Statistics & Epidemiology. Available at: https://www.psoriasis.org

More… ↓