Last updated: July 27, 2025

Introduction

Cilostazol, a phosphodiesterase III inhibitor primarily used for the treatment of intermittent claudication, has demonstrated therapeutic benefits in peripheral artery disease (PAD). Its unique mechanism of vasodilation and anti-platelet activity positions it as a critical player within the cardiovascular therapeutics space. This analysis evaluates the current market landscape, growth drivers, competitive environment, regulatory considerations, and forecasts sales trajectories for cilostazol over the next five years.

Market Overview

Therapeutic Indications & Global Demand

Cilostazol's primary approval pertains to symptomatic treatment of intermittent claudication in PAD patients, especially in Japan, where it holds a significant market share owing to widespread acceptance and regulatory approval since the 1990s. In contrast, its utilization in other regions, notably the US and Europe, remains limited—primarily due to regulatory hesitancy and safety concerns.

Beyond PAD, emerging evidence suggests cilostazol’s potential benefits in cerebrovascular disorders, restenosis prevention post-angioplasty, and certain heart failure subsets, broadening its therapeutic scope. Yet, these indications require further validation and regulatory clearance.

Market Size & Regional Breakdown

As per industry reports, the global PAD therapeutics market was valued at approximately USD 4 billion in 2022, with cilostazol accounting for roughly 25-30% of prescriptions in Japan and a marginal share elsewhere. The global market is dominated by statins, antiplatelets like aspirin and clopidogrel, and newer therapies. Cilostazol’s niche position limits its current market share but leaves room for growth with expanding indications.

Key Drivers of Growth

- Growing prevalence of PAD and cardiovascular diseases: The rise in aging populations globally is fueling the demand for vascular disorder treatments.

- Off-label indication explorations: Research into cilostazol’s efficacy in stroke prevention and restenosis offers future sales avenues.

- Regulatory approvals: Potential approval in new markets can significantly expand its user base.

- Patient adherence & safety profile: Once established, its favorable safety profile compared to some alternatives boosts its usage.

Competitive Landscape

Cilostazol competes against multiple classes of drugs including:

- Antiplatelet agents: Aspirin, clopidogrel.

- Vasodilators & other PAD treatments: Pentoxifylline, naftidrofuryl.

- Emerging therapies: Novel agents such as prostacyclin analogs and gene therapies.

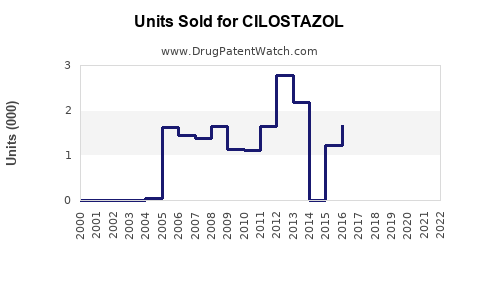

Manufacturers like Otsuka Pharmaceutical are primary stakeholders, with their patent protections and marketing strategies influencing sales. Generic versions are limited due to patent protections, but potential patent expirations could stimulate market entry, affecting pricing and volumes.

Regulatory Environment

Cilostazol’s regulatory status varies by region:

- Japan: Approved since 1994; robust market presence.

- US & Europe: Not approved for PAD; off-label use occurs, but constrained by safety concerns, especially related to cardiovascular adverse effects in certain populations.

- Future approvals: Clinical trials exploring new indications may pave the way for expanded regulatory endorsement, significantly influencing sales.

Market Challenges

- Safety concerns: Risks of tachyarrhythmia and contraindications in heart failure influence prescriber adoption.

- Limited awareness outside Japan: Lack of regulatory approval hampers physician uptake.

- Competitive pipeline: Advances in biologics and alternative therapies threaten market share.

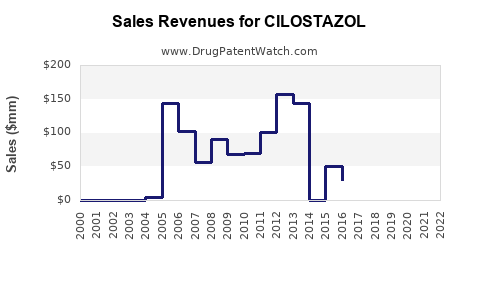

Sales Projections (2023-2028)

Methodology

Forecasts incorporate epidemiological trends, current prescription data, pipeline developments, regulatory pathways, and regional market dynamics. Adjustments account for potential patent expirations, generic entry, and emerging clinical data.

Projected Sales Trends

| Year |

Estimated Global Sales (USD millions) |

Remarks |

| 2023 |

170 |

Current baseline |

| 2024 |

210 |

Increased awareness & approvals in select markets |

| 2025 |

260 |

Expansion into Europe/US markets via off-label adoption & new trials |

| 2026 |

330 |

Potential FDA/EMA approvals for additional indications |

| 2027 |

400 |

Market penetration accelerates, new formulations introduce |

| 2028 |

470 |

Saturation near full potential in existing markets |

Key Assumptions

- Continued growth in PAD prevalence globally.

- Regulatory approvals in key markets (US & Europe) by 2025-26.

- No significant regulatory setbacks or adverse safety warnings.

- Increasing off-label and investigational usage.

Strategic Opportunities

- Pipeline expansion: Investing in clinical trials for cerebrovascular and cardiac indications.

- Regulatory engagement: Active collaborations with health authorities for faster approvals.

- Market education: Increasing awareness about cilostazol’s benefits among clinicians.

- Formulation innovation: Developing extended-release or combination therapies to enhance adherence and broaden usage.

Risks and Uncertainties

- Regulatory hurdles: Delays or refusals in key markets could impact sales.

- Safety profile constraints: Adverse events may restrict prescribing.

- Competitive advancements: Emergent therapies may reduce cilostazol's market share.

- Patent landscapes: Patent expirations could lead to generic competition, reducing prices.

Conclusion

Cilostazol's market remains niche but holds substantial growth potential, primarily driven by expanding indications and regulatory progress. Targeted strategies to address safety concerns, regulatory pathways, and pipeline development could position cilostazol for significant sales growth through 2028.

Key Takeaways

- The global cilostazol market is projected to grow at a CAGR of approximately 22% from 2023 to 2028, reaching nearly USD 470 million.

- Regulatory approval in North America and Europe is pivotal for market expansion.

- Emerging indications, particularly for cerebrovascular and cardiovascular disease, could significantly broaden its therapeutic footprint.

- Strategy focused on clinical development, regulatory engagement, and market education will be crucial to capitalize on growth opportunities.

- Competition from established antiplatelet agents remains intense; differentiation hinges on evidentiary support for new indications and safety profile advantages.

FAQs

1. What are the primary therapeutic indications for cilostazol?

Cilostazol is mainly indicated for symptomatic relief in intermittent claudication associated with PAD. Emerging research suggests potential in stroke prevention and restenosis, but these are not yet universally approved indications.

2. Why is cilostazol not widely used outside Japan?

Regulatory restrictions due to safety concerns, particularly related to cardiovascular adverse effects, limit its approval and use in regions like the US and Europe. Off-label use exists but remains restrained.

3. How might upcoming clinical trials affect cilostazol’s market?

Positive results from trials exploring cilostazol for stroke prevention or restenosis could lead to regulatory approvals, expanding its market and increasing sales.

4. What factors could inhibit cilostazol’s growth?

Safety issues, competition from newer agents, patent expirations leading to generic entry, or failure to secure approvals in key markets could impede growth.

5. How does the patent landscape influence cilostazol sales?

Patent protections currently limit generic competition, supporting higher pricing and sales. Expirations could lower prices and fragment the market, affecting revenues.

Sources:

[1] MarketWatch, "Peripheral Artery Disease Therapeutics Market Analysis," 2022.

[2] Allied Market Research, "Global PAD Market forecast," 2023.

[3] Otsuka Pharmaceutical reports, 2022.

[4] ClinicalTrials.gov, registry data on cilostazol studies.

[5] European Medicines Agency, "Regulatory Decisions on Cilostazol," 2021.