Last updated: July 27, 2025

Introduction

CIALIS (tadalafil), a phosphodiesterase type 5 (PDE5) inhibitor, is predominantly prescribed for erectile dysfunction (ED) and benign prostatic hyperplasia (BPH). Since its approval by the FDA in 2003, CIALIS has established itself as a leading treatment option within the highly competitive ED market. This analysis provides a comprehensive overview of CIALIS's current market landscape, competitive positioning, regulatory factors, and future sales trajectory.

Market Landscape

Global Demand for Erectile Dysfunction Treatments

The ED market is driven by aging populations, increasing awareness, and evolving social attitudes toward sexual health. As per IQVIA data, the global ED market was valued at approximately $3.7 billion in 2022, with a compound annual growth rate (CAGR) of around 5% projected through 2028. The rising prevalence of ED, especially among men aged 40 and above, fuels ongoing demand.

Competitive Position

CIALIS competes primarily with Viagra (sildenafil), Levitra (vardenafil), and stronger recent entrants like Stendra (avanafil). CIALIS's distinct edge stems from a longer duration of action—up to 36 hours—which supports its positioning as a "weekend pill," offering flexibility and spontaneity for users.

Market Share Dynamics

In 2022, CIALIS accounted for approximately 35% of the global ED pharmaceutical sales, trailing behind Viagra's estimated 45%, but maintaining strong growth momentum. The drug's market share varies significantly across regions, with North America and Europe being its largest markets.

Regulatory and Reimbursement Factors

Regulatory Approvals

CIALIS's approvals extend globally, including indications for ED and BPH in numerous jurisdictions. Recently, approvals for pulmonary arterial hypertension (PAH) expanded its therapeutic uses, which could influence sales diversification.

Reimbursement Landscape

Insurance reimbursement is pivotal, particularly in North America and Europe. Insurance coverage for CIALIS, along with competitive pricing strategies, influences formulary inclusion and patient access, directly impacting sales volumes.

Current Sales Performance

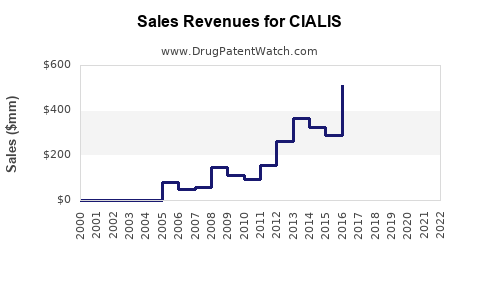

Historical Sales Data

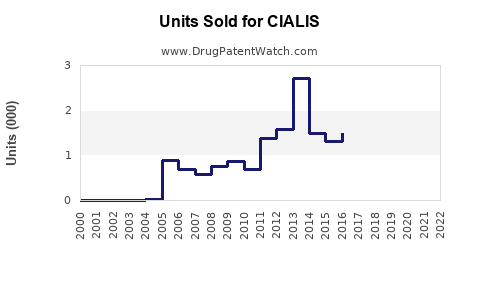

In 2022, CIALIS generated approximately $1.2 billion globally, with significant contributions from North America (~45%), Europe (~25%), and emerging markets (~20%). The remaining sales come from Asia-Pacific and Latin America. Sales have demonstrated steady growth, driven by increased adoption and expanded indications.

Market Penetration Strategies

AbbVie and Lilly (the primary marketing partners) have invested heavily in direct-to-consumer advertising, physician education, and patient outreach. These initiatives coupled with increasing awareness have supported ongoing sales growth.

Future Sales Projections

Growth Drivers

- Aging Population: The demographic shift toward older males, who have higher ED prevalence, will sustain demand.

- Expansion of Indications: The approval of CIALIS for BPH and PAH opens new revenue streams.

- Geographical Expansion: Increased penetration in emerging markets like Asia-Pacific, Latin America, and Africa.

- Innovative Delivery: Advances in formulations (e.g., lower-dose options, combination therapies) can further enhance user convenience and adherence.

Forecasted Revenue Trajectory

Analysts project a CAGR of approximately 4-6% for CIALIS through 2030, reaching an estimated $2 billion globally. The key factors shaping this outlook include:

- Market Saturation in Mature Regions: North America and Europe are nearing saturation; growth will rely more heavily on emerging markets.

- Regulatory Approvals & New Indications: Expansion into broader therapeutic areas will unlock additional sales potential.

- Pricing and Patent Protection: Patent exclusivity until approximately 2028, with subsequent generic entries likely to exert downward pressure on prices.

Impact of Generic Competition

Post-patent expiration, generic versions of tadalafil are expected to enter the market, potentially reducing CIALIS's revenues by up to 60% over subsequent years. However, brand loyalty, physician preference, and established supply chains may mitigate the speed of sales erosion.

Regional Analysis

| Region |

Current Sales Share |

Growth Potential |

Key Factors |

| North America |

~45% |

Moderate |

Established market, high reimbursement, patent protections |

| Europe |

~25% |

Moderate |

Similar to North America; regulatory harmonization influences growth |

| Asia-Pacific |

~10-15% |

High |

Large population, increasing healthcare access, lower current penetration |

| Latin America |

~5-10% |

Moderate |

Growing awareness, economic factors affecting access |

| Rest of World |

<5% |

Variable |

Expanding healthcare infrastructure and awareness |

Risks and Opportunities

Risks:

- Patent Expiry and Generics: Potential steep drop in prices and sales post-2028.

- Market Saturation: Mature markets exhibit slower growth, increasingly reliant on emerging markets.

- Regulatory Delays: Any delays in approval for new indications or formulations could hinder growth.

Opportunities:

- Additional Indications: Exploring new therapeutic uses, such as pulmonary hypertension, could diversify revenue.

- Combination Therapies: Co-formulations could improve patient adherence.

- Digital Health Integration: Telemedicine and digital health initiatives can expand access and monitor usage more effectively.

Key Takeaways

- CIALIS remains a dominant player in the ED market with a stable market share and strong brand recognition.

- The global sales are projected to grow at a CAGR of 4-6% over the next decade, driven by demographic trends and expanding indications.

- Significant revenue uncertainty exists beyond 2028, with patent expiry threatening to commoditize the product.

- Growth strategies for sustained revenue should focus on emerging markets, additional indications, and innovative formulations.

- The competitive landscape will tighten with the advent of generics, necessitating continuous differentiation and value proposition reinforcement.

FAQs

-

When is CIALIS expected to face generic competition, and what impact will it have?

Patent protection for CIALIS extends until approximately 2028. Post-expiry, generic tadalafil products are expected to enter the market, potentially reducing brand revenues by up to 60%, depending on pricing and market penetration.

-

Are there upcoming indications or formulations that could influence CIALIS sales?

Yes. Recent approvals for pulmonary arterial hypertension and ongoing research into combination therapies and lower-dose formulations could provide new avenues for growth and extend the product’s lifecycle.

-

How significant are emerging markets for CIALIS's future sales?

Highly significant. As penetration deepens in regions such as Asia-Pacific and Latin America, demographic trends and rising healthcare infrastructure in these markets are likely to drive substantial sales increases.

-

What are the primary barriers to CIALIS's continued growth?

Patent expiry leading to generic competition, market saturation in mature regions, pricing pressures, and regulatory hurdles remain key barriers.

-

How do payer preferences influence CIALIS sales?

Reimbursement policies and formulary inclusion heavily influence accessibility. Favorable coverage and competitive pricing promote broader patient access, thereby sustaining sales.

Sources:

[1] IQVIA, "Global Erectile Dysfunction Market Report," 2022.

[2] FDA, "Cialis (Tadalafil) Prescribing Information," 2003.

[3] EvaluatePharma, "Pharmaceutical Forecasts," 2022.

[4] Company Financial Reports and Market Data, 2022.