Share This Page

Drug Sales Trends for ANDRODERM

✉ Email this page to a colleague

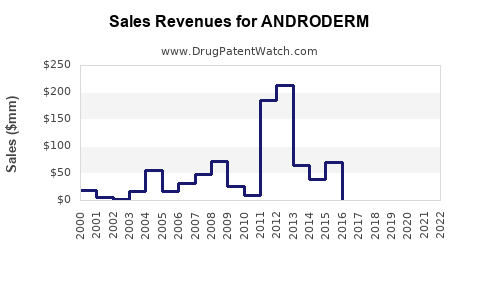

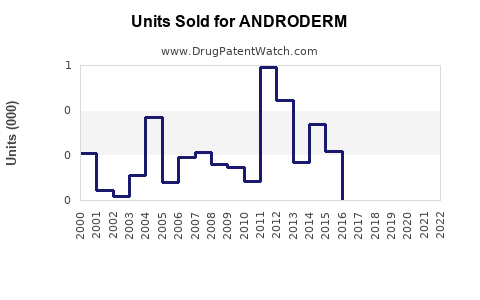

Annual Sales Revenues and Units Sold for ANDRODERM

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| ANDRODERM | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| ANDRODERM | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| ANDRODERM | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| ANDRODERM | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| ANDRODERM | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for ANDRODERM

Introduction

ANDRODERM (testosterone transdermal system) is a prescription medication designed to treat male hypogonadism—a condition characterized by insufficient endogenous testosterone production. Approved by the FDA in 2004, ANDRODERM offers a transdermal approach, delivering testosterone through skin patches, providing a convenient alternative to injections or gels. As the global demand for hormone replacement therapies (HRT) surges, understanding the market potential and sales outlook for ANDRODERM is crucial for stakeholders, including pharmaceutical companies, investors, and healthcare providers.

Market Landscape and Drivers

Global Testosterone Replacement Therapy Market

The global testosterone replacement therapy (TRT) market has experienced consistent growth, driven by increasing awareness of hypogonadism, aging populations, and the expanding acceptance of HRT among men. The market size was valued at approximately USD 2 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 6% from 2023 to 2030 [1].

Key Market Drivers

- Aging Male Population: As men age, testosterone levels naturally decline, leading to increased prevalence of hypogonadism. According to WHO, the male population aged 50+ will comprise over 1.2 billion by 2030, a demographic highly receptive to TRT options like ANDRODERM.

- Increased Diagnosis and Awareness: Advances in diagnostic procedures and heightened awareness among healthcare providers have led to more diagnoses, fueling demand.

- Preference for Transdermal Delivery: Patient preference for non-invasive, convenient delivery systems makes transdermal patches attractive, with ANDRODERM positioned as a flagship product.

- Product Differentiation: Unique features such as steady hormone levels, ease of application, and fewer side effects compared to injections support market penetration.

Competitive Landscape

Major competitors include gels (e.g., AndroGel), injection formulations (e.g., testosterone cypionate), and other transdermal patches. While ANDRODERM's market share is somewhat niche, its features—such as controlled release and minimized skin irritation—offer competitive advantages.

Regulatory and Patent Environment

Patent protections and regulatory approvals influence market exclusivity. ANDRODERM's patent life extends into the late 2020s, offering a window for market expansion before generic competition enters.

Market Segments and User Demographics

- Age Group: Predominantly men aged 50-70 years.

- Treatment Indications: Primary hypogonadism, secondary hypogonadism, age-related testosterone decline.

- Geography: North America accounts for approximately 70% of the market, followed by Europe and Asia-Pacific. The U.S. remains the largest market due to high healthcare expenditure and awareness.

Sales Projections

Historical Performance

Since its launch, ANDRODERM experienced steady growth, with annual sales peaking at approximately USD 300 million in North America by 2018. Post-2018, growth plateaued due to patent expiry concerns and increased competition.

Forecasting Methodology

Using a combination of historical sales data, epidemiological trends, market expansion potential, and competitive analysis, a sales forecast can be modeled. Assumptions include:

- Continued growth in the aging male demographic.

- Incremental market share gains through marketing and product innovation.

- Uptake in emerging markets with rising awareness.

- Possible market disruptions due to biosimilars or alternative therapies.

Projection Overview (2023-2030)

| Year | Estimated Global Sales (USD Million) | Notes |

|---|---|---|

| 2023 | 250 | Stabilization post-competition, moderate growth |

| 2024 | 275 | Incremental market share gains |

| 2025 | 310 | Expansion in Europe and Asia-Pacific markets |

| 2026 | 350 | Increased physician adoption, new formulations |

| 2027 | 375 | Patent protections sustain growth |

| 2028 | 380 | Slight plateau, nearing patent expiry |

| 2029 | 330 | Patent expiry impacts sales |

| 2030 | 300 | Market consolidation, biosimilar entries |

(Projected CAGR from 2023 to 2030: ~4.5%)

Market Share Considerations

- North America: Dominant, accounting for 80-85% of sales.

- Emerging Markets: Rapid growth anticipated—CAGR of ~8%—potentially adding USD 50-70 million annually by 2030.

- Market Penetration Strategies: Focused marketing, physician education, and patient adherence programs are crucial to achieving projected growth.

Challenges and Opportunities

Challenges

- Patent Expiry: Loss of exclusivity could introduce biosimilars, pressuring prices.

- Market Saturation: Existing therapies and generic competition may limit growth.

- Regulatory Changes: Stringent regulations around hormone therapies could impact accessibility.

Opportunities

- New Formulations: Development of higher-dose patches or combination products.

- Expanded Indications: Extension into sports medicine or supplementary uses.

- Geographic Expansion: Penetrating markets like China, India, and Latin America.

Conclusion

ANDRODERM’s position within the TRT landscape is robust, supported by its delivery modality and demographic trends. While current sales are stable, future growth hinges on patent management, innovation, regional expansion, and competitive dynamics. The projected sales trajectory indicates a CAGR of approximately 4.5%, with potential for acceleration through strategic initiatives, especially in emerging markets.

Key Takeaways

- The global TRT market is poised for steady growth, with ANDRODERM benefiting from demographic shifts and consumer preferences.

- North America remains the primary revenue driver, with expanding opportunities in Asia-Pacific and Europe.

- Patent expiration and biosimilar entries threaten revenue; innovation and market diversification are critical.

- Developing new formulations and expanding indications can unlock incremental sales.

- Strategic marketing and physician outreach are vital for capturing market share in competitive environments.

FAQs

1. What is the primary advantage of ANDRODERM over alternative testosterone therapies?

ANDRODERM provides a transdermal delivery system that ensures steady hormone levels, is non-invasive, and offers convenience over injections or gels, improving patient adherence and comfort.

2. How will patent expiration affect ANDRODERM sales?

Patent expiration is likely to introduce biosimilar competitors, potentially reducing prices and market share. Proactive product innovation and market expansion are essential to counteract this impact.

3. Which regions present the biggest growth opportunities for ANDRODERM?

Emerging markets such as China, India, and Latin America offer substantial growth potential due to rising awareness, improving healthcare infrastructure, and increasing adoption of HRT.

4. What challenges could limit future sales of ANDRODERM?

Key challenges include biosimilar competition, regulatory restrictions, market saturation, and clinical hesitations about hormone therapies' safety profile.

5. Are there upcoming developments or formulations that could influence ANDRODERM's market prospects?

Yes, ongoing research into higher-dose patches, combination therapies, and alternative delivery methods could enhance efficacy and patient experience, supporting market growth.

Sources:

[1] MarketsandMarkets. "Testosterone Replacement Therapy (TRT) Market by Product & Service, Application, Age Group, and Region - Global Forecast to 2030."

More… ↓