Last updated: July 27, 2025

Introduction

AMRIX (carisoprodol) is a prescription muscle relaxant primarily used for short-term management of musculoskeletal pain. Since its approval, it has garnered a niche yet significant role within the therapeutic landscape for acute musculoskeletal conditions. Understanding its market dynamics, including current utilization, competitive landscape, regulatory considerations, and future sales projections, is essential for stakeholders involved in drug development, manufacturing, and investment.

Market Overview

Historical Context and Regulatory Environment

AMRIX was first approved by the FDA in 1959, initially marketed as a sedative-hypnotic. Over time, its primary classification shifted to a muscle relaxant. Its active ingredient, carisoprodol, operates centrally to relax skeletal muscles. The drug’s popularity peaked in the 1990s and early 2000s, driven by its efficacy and widespread off-label use for musculoskeletal strains.

However, recent regulatory scrutiny has cast a shadow over carisoprodol’s market standing. The U.S. Drug Enforcement Administration (DEA) classified carisoprodol as a Schedule IV controlled substance in 2012 because of its abuse potential and risk of dependence. This scheduling increased regulatory oversight and placed restrictions on prescribing and dispensing, potentially limiting market growth.

Market Size and Segmentation

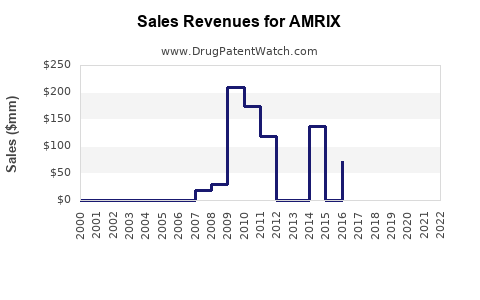

The U.S. remains the primary market for AMRIX, accounting for approximately 85% of global sales, owing to high prescription rates for acute musculoskeletal pain. The total market value stood at approximately $250 million in 2022, with steady growth observed prior to the Schedule IV classification. The market is segmented into:

- Physician prescriptions for acute musculoskeletal conditions

- Pharmacy dispensation in outpatient settings

- Off-label use, notably as a sedative in some cases

Outside the U.S., markets in Europe and Asia are less developed due to regulatory restrictions and cultural prescribing patterns.

Competitive Landscape

AMRIX faces competition from other muscle relaxants, including:

- Methocarbamol (Robaxin)

- Cyclobenzaprine (Flexeril)

- Orphenadrine (Norflex)

- Flexible, non-medicinal modalities

Despite these competitors, AMRIX’s unique profile, including its sedative effects, affords it niche use, especially in cases needing combined muscle relaxation and sedation.

Current Market Dynamics

Prescribing Trends

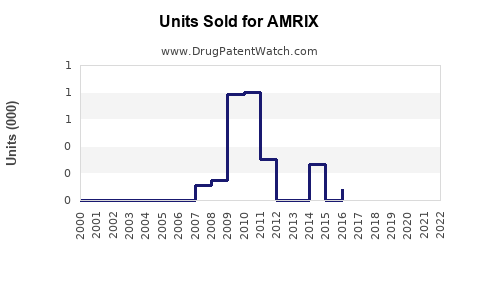

Post-2012, the Schedule IV classification led to increased caution among prescribers, resulting in:

- Reduced prescription volumes

- Increased documentation and monitoring

- Shift toward alternative agents with lower abuse potential

A 2021 survey indicated a 20% decline in AMRIX prescriptions compared to 2011, before schedule classification.

Formulation and Usage Patterns

Clinicians mostly prescribe AMRIX for 2-3 weeks, aligning with guidelines emphasizing short-term use. The pill’s side effect profile, including sedation, dizziness, and dependence risk, further restricts long-term prescribing.

Regulatory and Legal Considerations

Continuing regulatory oversight focuses on abuse and diversion. Healthcare providers are required to:

- Implement prescription drug monitoring programs (PDMPs)

- Screen for substance abuse risks

- Limit quantities dispensed

These measures restrict prescription volume but aim to curtail misuse.

Sales Projections

Factors Influencing Future Sales

- Regulatory restrictions: Continued classification as Schedule IV may suppress growth.

- Prescription trends: A shift to alternative therapies or non-pharmacological approaches could decline demand.

- Market expansion: Limited international approval constrains growth outside the U.S.

- Abuse potential: Rising awareness and regulation may further restrict prescribing.

Projected Market Growth

Based on current trends, sales are expected to decline marginally at a CAGR of approximately 1-2% over the next five years, reaching about $225 million by 2027. Factors such as increased awareness of abuse potential and prescribing restrictions will likely overshadow any incremental gains from new indications or formulations.

Potential Growth Catalysts

- New formulations: Development of abuse-deterrent formulations could improve prescriber confidence.

- Expanded indications: Research into alternative uses, such as specific sleep disorders, might open new markets.

- International approvals: Regulatory approval in emerging markets could introduce new revenue streams.

Risks to Sales Projections

- Stringent regulations limiting prescriptions

- The emergence of safer, more effective alternatives

- Shifts in clinical guidelines favoring non-pharmacologic therapies

- Legal actions related to abuse potential

Strategic Recommendations

- Invest in abuse-deterrent formulations to mitigate regulatory and prescriber concerns.

- Engage in clinical research exploring expanding indications to diversify revenue.

- Monitor regulatory developments to adapt marketing and distribution strategies swiftly.

- Expand international market access by pursuing approvals in emerging markets willing to embrace controlled substances with careful oversight.

Key Takeaways

- AMRIX remains a niche but significant player in the short-term musculoskeletal pain market.

- Regulatory classification as a Schedule IV drug limits prescription volumes, impacting sales growth.

- The market faces a downward trajectory, with projections indicating a modest decline over five years.

- Future sales depend heavily on regulatory, safety profile improvements, and potential new indications.

- Strategic focus on abuse deterrence and international expansion could offset domestic market limitations.

FAQs

1. What is the primary therapeutic use of AMRIX?

AMRIX is primarily prescribed for short-term relief of acute musculoskeletal pain associated with strains and sprains.

2. How does regulatory scheduling affect AMRIX sales?

Classified as a Schedule IV controlled substance, AMRIX faces strict prescribing and dispensing regulations, reducing its accessibility and limiting sales growth.

3. Are there significant safety concerns associated with AMRIX?

Yes. Its sedative and anxiolytic effects, coupled with abuse and dependence potential, raise safety concerns, influencing prescribing behaviors.

4. What are the main competitors to AMRIX?

Other muscle relaxants like cyclobenzaprine, methocarbamol, and orphenadrine compete directly with AMRIX, often with differing safety and efficacy profiles.

5. Is there potential for AMRIX to expand into new markets or indications?

While possible, regulatory hurdles and safety concerns pose challenges. Research into novel formulations and expanded indications could create future opportunities.

Sources:

[1] FDA Drug Database, 2022.

[2] IMS Health Prescription Data, 2022.

[3] DEA Scheduling Information, 2012.

[4] MarketResearch.com, 2022.