Last updated: July 29, 2025

Overview

Amlod/Valsar is a fixed-dose combination (FDC) drug that integrates amlodipine besylate, a calcium channel blocker, and valsartan, an angiotensin II receptor blocker (ARB). Designed primarily to treat hypertension and manage heart failure, this combination offers the dual benefits of vascular relaxation and blood pressure control. As cardiovascular diseases remain a leading global health concern, the market potential for Amlod/Valsar is substantial, contingent upon competitive positioning, regulatory approval, and clinical efficacy.

Market Context and Rationale

Hypertension affects over 1 billion individuals worldwide and is a primary risk factor for stroke, heart attack, and chronic kidney disease [1]. The therapeutic landscape favors combination therapies for better adherence, especially in patients requiring multiple medications. Fixed-dose combinations (FDCs) enhance compliance, reduce pill burden, and improve cardiovascular outcomes. Amlod/Valsar leverages this clinical strategy, aligning with current treatment guidelines promoting multifaceted antihypertensive regimens.

The global antihypertensive drugs market was valued at approximately USD 24 billion in 2022 and is projected to grow at a CAGR of 4% through 2030 [2]. The increasing prevalence of hypertension, aging populations, and the shift toward personalized medicine further contribute to its expansion. Amlod/Valsar, also positioned under the broader ARB and calcium channel blocker categories, taps into a therapeutic niche with steady demand.

Market Segmentation and Target Demographics

-

Geographic Markets

- North America: Established healthcare infrastructure, high awareness for combination therapy, and favorable reimbursement policies support strong sales. The U.S. dominates this region, with an estimated antihypertensive market share of over USD 10 billion [3].

- Europe: Similar to North America but with varying reimbursement policies; the European market is expected to grow as hypertension diagnosis and management improve.

- Asia-Pacific: The fastest-growing segment, driven by rising prevalence of hypertension, economic development, and expanding healthcare access. Countries like China and India exhibit annual growth rates exceeding 7% in antihypertensive sales [4].

-

Patient Demographics

- Adults aged 45 and above, with higher prevalence in older populations.

- Patients with comorbidities such as diabetes or chronic kidney disease—groups aligned with the benefits of combined therapy.

- Adherence-focused population seeking simplified medication regimens.

-

Physician Segments

- Cardiology and primary care physicians prescribing antihypertensive monotherapies and FDCs.

- Clinical guidelines strongly recommend combination therapy when target blood pressure is not achieved with monotherapy, favoring products like Amlod/Valsar.

Competitive Landscape

Several branded and generic formulations of amlodipine and valsartan exist, but fixed-dose combinations featuring both agents are comparatively less prevalent, especially in certain markets. Key competitors include:

The strategic differentiation for Amlod/Valsar hinges on formulation advantages, price competitiveness, patent status, and regional approval.

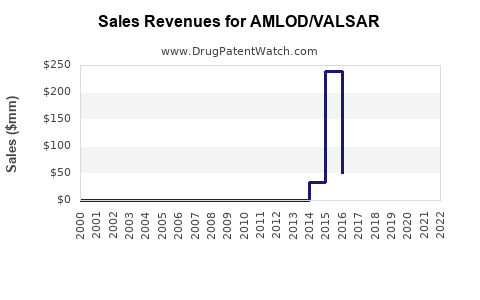

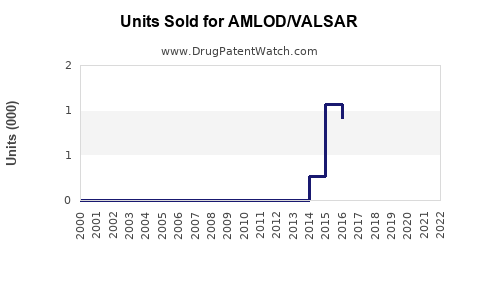

Sales Projections and Market Penetration

Baseline Scenario (Conservative)

- Year 1–2: Launch phase with limited penetration in key markets. Expecting 0.5%–1% of hypertension treated population adopting Amlod/Valsar.

- Year 3–5: Increased adoption as physicians become familiar, regulatory approvals expand, and brand awareness grows. Projected cumulative sales reach USD 150–250 million globally by year 5.

- Market Share Assumptions: Within a competitive landscape, capturing 2%–3% of the fixed-dose combination antihypertensive market in mature regions and 1%–2% in emerging markets.

High-Scenario (Aggressive Adoption)

- Early regulatory approvals and aggressive marketing may accelerate growth, capturing 5% market share globally by year 5.

- Projected sales could surpass USD 500 million, particularly if combined with strategic alliances and favorable formulary placements.

Key Factors Influencing Sales

- Regulatory Approvals: Fast-trackizations or orphan drug statuses could expedite market entry.

- Pricing Strategy: Competitive pricing in line with generics could facilitate adoption in cost-sensitive markets.

- Clinical Evidence: Supporting data demonstrating superior efficacy or safety enhances prescriber confidence.

- Reimbursement Policies: Favorable coverage significantly impacts product uptake.

Revenue Drivers

- Patent status and exclusivity rights directly influence sales potential.

- Manufacturing scalability to meet demand while maintaining quality.

- Strategic partnerships with regional distributors and healthcare providers.

Regulatory and Market Entry Challenges

- Patent Expirations: Patents on key components or formulations may allow generic competition, impacting pricing and market share.

- Regional Approvals: Navigating diverse regulatory pathways (FDA, EMA, etc.) requires tailored dossiers and can delay launches.

- Clinician Acceptance: Convincing prescribers to switch or adopt new formulations hinges on demonstrated clinical benefits and safety profile.

- Pricing Pressure: Governments and insurers increasingly scrutinize drug prices, especially in markets heavily influenced by generics.

Conclusion

Amlod/Valsar presents a promising opportunity within the hypertensive therapeutic landscape, leveraging the growing demand for combination therapies. Success hinges on strategic regulatory navigation, competitive pricing, robust clinical data, and effective penetration strategies. The market could generate between USD 150 million to over USD 500 million in sales within five years, contingent upon multiple factors.

Key Takeaways

- The global antihypertensive market is expanding, driven by aging populations and increasing hypertension prevalence.

- Amlod/Valsar’s strong clinical positioning as a fixed-dose combination aligns with current treatment guidelines and patient adherence needs.

- Competitive landscape favors established products like Exforge; differentiation will depend on formulation, price, and regulatory success.

- Conservative sales projections indicate USD 150–250 million in five years; aggressive strategies could push figures beyond USD 500 million.

- Success strategies include rapid regulatory approval, establishing reimbursement pathways, and building prescriber confidence through clinical data.

FAQs

1. What are the primary advantages of Amlod/Valsar over existing antihypertensive therapies?

Amlod/Valsar offers a convenient fixed-dose combination that improves patient adherence, reduces pill burden, and potentially enhances blood pressure control compared to monotherapy.

2. How does the competitive landscape impact the sales potential of Amlod/Valsar?

Existing branded combinations like Exforge dominate the market; entering requires competitive pricing, clinical differentiation, and regulatory approval to achieve significant share.

3. Which markets offer the greatest growth opportunity for Amlod/Valsar?

Emerging markets like China and India show the highest growth potential due to rising hypertension prevalence and expanding healthcare infrastructure. Mature markets like North America and Europe provide stable revenue streams.

4. What are the main regulatory considerations for launching Amlod/Valsar?

Regulatory approvals depend on regional agencies' requirements, patent status, and clinical trial data sufficiency. Life-cycle management strategies must address patent expiries and post-marketing surveillance.

5. How can market entry be optimized to maximize sales?

Accelerating approvals, establishing reimbursement, engaging key opinion leaders, offering competitive pricing, and investing in clinical evidence are critical success factors.

Sources

[1] World Health Organization. Hypertension Fact Sheet. 2022.

[2] Grand View Research. Antihypertensive Drugs Market Size & Trends. 2022.

[3] IQVIA. Global Pharmaceutical Market Overview. 2022.

[4] Asia-Pacific Market Analysis Report. Cardiovascular Drugs. 2022.