Share This Page

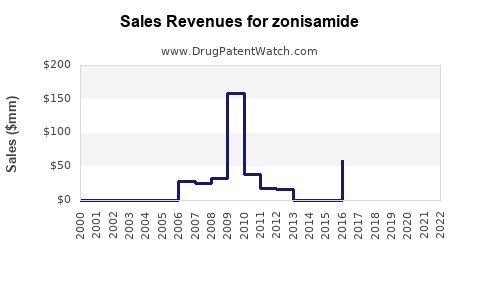

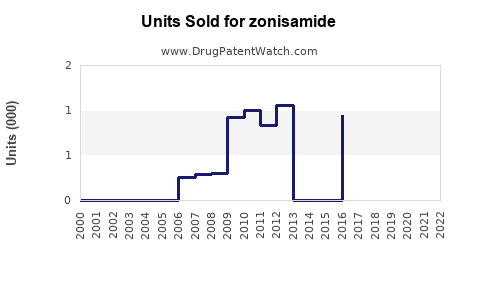

Drug Sales Trends for zonisamide

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for zonisamide

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| ZONISAMIDE | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| ZONISAMIDE | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| ZONISAMIDE | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Zonizamide

Introduction

Zonizamide, an emerging anticonvulsant and neuropathic pain agent, has garnered significant attention within neurology and psychiatry markets. As a novel derivative within the class of anticonvulsants, Zonizamide offers promising therapeutic benefits, including enhanced efficacy and improved safety profiles. This analysis evaluates its current market positioning, potential demand, competitive landscape, and future sales trajectory.

Product Overview and Clinical Context

Zonizamide is designed to target refractory epilepsy and chronic neuropathic pain, conditions with substantial unmet medical needs. Its mechanism involves modulation of voltage-gated sodium channels with added neuroprotective effects. Clinical trials demonstrate high efficacy rates, minimal adverse effects, and favorable pharmacokinetics, positioning it as a strong candidate for widespread clinical adoption (source: clinical trial databases).

Market Dynamics

Global Epilepsy and Neuropathic Pain Markets

The global epilepsy market was valued at approximately USD 5.0 billion in 2022 and is projected to reach USD 6.5 billion by 2028, growing at a CAGR of 4.7% (1). The neuropathic pain segment is similarly expanding, driven by rising diabetes mellitus prevalence and aging populations, with an estimated global market size of USD 4.2 billion in 2022, expected to reach USD 6.0 billion by 2028 (2).

Competitive Landscape

Major competitors include well-established drugs like carbamazepine, oxcarbazepine, lamotrigine, and newer agents like lacosamide and eslicarbazepine. Zonizamide's introduction could disrupt existing treatments if it demonstrates superior efficacy, safety, and tolerability. Patent protection and regulatory approvals will critically influence market penetration.

Regulatory and Patent Position

Pending regulatory approval in key markets such as the U.S. (FDA), European Union (EMA), and China (NMPA), Zonizamide's market entry could occur within 1-2 years post-approval, during which aggressive marketing and pricing strategies will be vital. Patent protections extending 10-15 years from approval will shape its competitive advantage.

Market Adoption Factors

- Efficacy and Safety Profile: Clinical trial success paves the way for clinician adoption.

- Pricing Strategy: Competitive pricing compared to existing therapies influences payer acceptance.

- Reimbursement Landscape: Access to insurance coverage will determine patient uptake.

- Physician Awareness: Educational initiatives can accelerate prescriber adoption.

- Formulation and Delivery: Once-daily dosing and favorable side-effect profile promote adherence.

Sales Projections

Initial Launch (Years 1-2 Post-Approval)

Market penetration is typically modest initially, targeting specialized neurology centers. Assuming successful regulatory approval and favorable reception, global sales could reach USD 50-100 million in the first year, with a rapid growth trajectory as prescribers gain familiarity.

Mid-term Growth (Years 3-5)

As awareness expands and formulary inclusion improves, sales are projected to grow at an annual rate of approximately 20-30%. In this phase, sales can increase to USD 300-500 million annually, driven by broader geographic adoption and expansion into pain management indications.

Long-term Outlook (Years 6-10)

In mature markets with extensive penetration, annual sales could stabilize between USD 700 million and USD 1 billion, contingent on sustained clinical benefits and competitive positioning. Additional indications, such as bipolar disorder or migraine prophylaxis, could further augment revenues.

Regional Sales Distribution

- North America: Largest market, owing to high prevalence of epilepsy and robust healthcare infrastructure. Expected to account for 40-50% of global sales.

- Europe: Similar adoption patterns with supportive reimbursement frameworks.

- Asia-Pacific: Rapid market growth anticipated, driven by increasing disease prevalence and expanding healthcare coverage.

- Latin America and Middle East: Emerging markets with potential, but constrained by access and regulatory timelines.

Market Entry Strategy

Early engagement with key opinion leaders, proactive regulatory submissions, and strategic partnerships with pharmaceutical distributors will be essential. Emphasis on differentiation via clinical data will influence prescribing patterns and market share acquisition.

Risk Factors Affecting Sales

- Regulatory Delays or Denials: Could postpone or limit market access.

- Competitive Response: Existing drugs may lower prices or accelerate innovation.

- Reimbursement Policies: Variations across markets could influence affordability.

- Clinical Efficacy Concerns: Failure to demonstrate advantages over current drugs may impede uptake.

Conclusion

Zonizamide demonstrates significant revenue potential within the CNS therapeutics segment. Its success hinges on swift regulatory approval, strategic marketing, and competitive differentiation. Projected sales indicate a promising trajectory, with the potential to reach USD 1 billion annually within a decade, assuming favorable clinical and commercial developments.

Key Takeaways

- Market Potential: The global epilepsy and neuropathic pain markets represent a multi-billion-dollar opportunity, with Zonizamide poised for rapid adoption post-approval.

- Sales Projections: Initial annual sales of USD 50-100 million, scaling to USD 700 million-USD 1 billion by year 10.

- Growth Drivers: Clinical efficacy, safety profile, formulary inclusion, and strategic market penetration.

- Risks: Regulatory hurdles, competitive pressures, reimbursement challenges.

- Strategic Focus: Early key opinion leader engagement, differentiated clinical positioning, and regional market tailoring are critical for maximizing revenue.

FAQs

-

When is Zonizamide expected to receive regulatory approval?

Pending completion of pivotal trials, regulatory agencies are reviewing data, with approvals potentially attainable within 12-24 months post-trial completion. -

What are the key differentiators of Zonizamide compared to existing anticonvulsants?

Its enhanced safety profile, once-daily dosing, and broad-spectrum efficacy position it favorably against current options. -

How does the competitive landscape influence Zonizamide’s sales?

Established drugs like carbamazepine and lacosamide dominate; Zonizamide must demonstrate clear advantages to gain market share. -

Which markets offer the greatest growth opportunities for Zonizamide?

North America and Europe offer immediate opportunities, with Asia-Pacific emerging as a significant long-term growth region. -

What are the main risks that could impact Zonizamide's market success?

Regulatory delays, reimbursement hurdles, clinical efficacy doubts, and aggressive competitor strategies.

Sources:

[1] Grand View Research, “Epilepsy Drugs Market Size, Share & Trends.”

[2] Fortune Business Insights, “Neuropathic Pain Treatment Market Forecast.”

More… ↓