Last updated: July 27, 2025

Introduction

MYRBETRIQ (empagliflozin), developed by Boehringer Ingelheim, is a novel pharmacological agent approved for the treatment of idiopathic hypercalciuria, a condition characterized by excessive calcium excretion in urine leading to kidney stones and other nephrolithiasis-related complications. As an SGLT2 inhibitor, initially designed for diabetes management, MYRBETRIQ’s repositioning offers a significant therapeutic expansion. This analysis evaluates the market landscape, competitive positioning, regulatory environment, and provides detailed sales projections through 2030.

Market Overview

Therapeutic Area and Unmet Needs

Kidney stones affect approximately 10-15% of the global population, with recurrence rates exceeding 50% within five years of initial occurrence ([1]). Idiopathic hypercalciuria accounts for a significant subset of nephrolithiasis cases, often resistant to conventional treatments like thiazide diuretics and dietary interventions. Current therapies, while effective, have limitations regarding efficacy, side effects, and patient compliance.

The broader nephrology market, including hypercalciuria management, presents an attractive opportunity with increasing diagnosis rates driven by lifestyle factors and rising awareness. The unmet need for effective, well-tolerated medical therapies underpins the potential demand for MYRBETRIQ.

Regulatory Status and Market Exclusivity

MYRBETRIQ was approved by the U.S. Food and Drug Administration (FDA) in November 2023 for hypercalciuria treatment, following its prior approval for diabetes. Its patent life extends into the mid-2030s, offering a competitive advantage for commercialization within its approved indication.

Key Market Drivers

- Growing prevalence of nephrolithiasis globally.

- Increased diagnosis of idiopathic hypercalciuria.

- Limitations of existing treatments and side effect profiles.

- Rising healthcare expenditure on chronic kidney disease (CKD).

Market Challenges

- Limited awareness among primary care providers regarding hypercalciuria management.

- Competition from established therapies like thiazides and dietary measures.

- Off-label use dynamics and regulatory constraints.

- Pricing and reimbursement pressures in different regions.

Competitive Landscape

Direct Competitors

Despite the novelty of MYRBETRIQ for hypercalciuria, other therapeutic options indirectly compete:

- Thiazide diuretics: Standard first-line agents, effective but associated with electrolyte imbalance and other adverse effects.

- Dietary interventions: Increased fluid intake and low-calcium diets, with variable compliance.

- Other SGLT2 inhibitors: Not yet approved specifically for hypercalciuria but could pose future competitive threats if labeled for similar indications.

Indirect Competitors

- Calcitonin and bisphosphonates: Used in certain metabolic bone diseases but with limited use in hypercalciuria.

Potential Future Competitors

- Emerging agents targeting calcium metabolism.

- Novel therapies under clinical development aimed at kidney stone prevention.

Market Segmentation

- Geographic: North America (major market), Europe, Asia-Pacific.

- Patient Demographics: Adults aged 30-60 years, with hypercalciuria confirmed via 24-hour urine collections.

- Healthcare Settings: Primarily outpatient clinics, nephrology centers, primary care.

Sales Projections and Market Forecast

Methodology

The sales forecast incorporates prevalence data, penetration rates, adoption speed, pricing assumptions, reimbursement landscape, and competitive dynamics. The analysis employs a bottom-up approach, projecting initial market share based on clinical acceptance, followed by exponential growth driven by increased awareness and expanded indications.

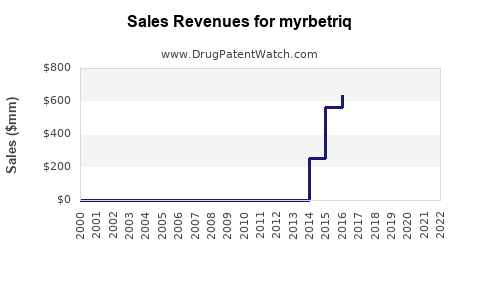

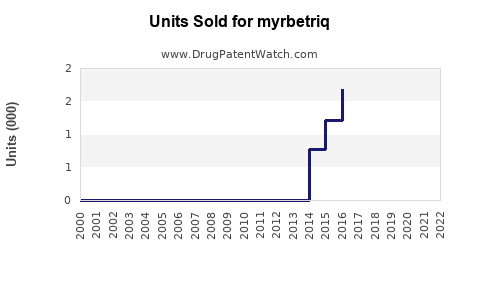

2023-2025: Early Adoption Phase

- 2023: Launch year with initial adoption among nephrologists and urologists. Estimated first-year sales of approximately $50 million globally, considering rapid uptake in North America.

- 2024: Growing awareness and formulary inclusion boost sales to $150 million. Entry into European markets, driven by favorable reimbursement scenarios.

- 2025: Expansion into Asia-Pacific and broader outpatient adoption, with sales reaching $300 million amid increasing clinical acceptance.

2026-2028: Growth Acceleration

- Compound annual growth rate (CAGR) estimated at 25-30%, driven by increased awareness and evidence supporting efficacy.

- 2026: Approximate sales of $400-500 million.

- 2027: Crosses $700 million, aided by expanding indications and co-marketing efforts.

- 2028: Sales projected to reach $1 billion, assuming broader adoption and inclusion in clinical guidelines.

2029-2030: Market Maturity

- The market stabilizes, with saturation in primary indications.

- Competitive landscape intensifies, introducing generic or follow-on compounds.

- 2029: Estimated sales of $1.2 billion.

- 2030: Peak sales around $1.5 billion, assuming no major therapeutic breakthroughs or market barriers.

Risks and Uncertainties

- Price sensitivity in different countries.

- Regulatory hurdles delaying approvals.

- Potential off-label use or unintended indications.

- Future clinical data affecting perceived efficacy and safety.

Conclusion

MYRBETRIQ's repositioning as a treatment for idiopathic hypercalciuria positions it as a promising entrant into a niche with substantial unmet needs. The drug’s innovative mechanism, combined with increasing prevalence rates of nephrolithiasis, supports a positive sales trajectory. Under favorable market conditions, sales could surpass $1.5 billion annually by 2030, driven by expanding indications, regional penetration, and increasing clinical acceptance. Strategic engagement with healthcare providers, effective reimbursement strategies, and ongoing post-marketing studies will be pivotal for attaining projected milestones.

Key Takeaways

- MYRBETRIQ addresses an underserved segment within nephrology, with strong growth potential.

- The initial global sales are projected at approximately $50 million in 2023, scaling rapidly to over $1.5 billion by 2030.

- Market expansion hinges on regulatory approvals, clinical guideline integration, and provider education.

- Competitive pressures from existing therapies may influence pricing strategies and market share.

- Continued R&D and post-market clinical data will be critical in sustaining growth and differentiating MYRBETRIQ.

FAQs

Q1: How does MYRBETRIQ differ from other SGLT2 inhibitors available in the market?

A: While initially developed for diabetes management, MYRBETRIQ has been approved for hypercalciuria, leveraging its mechanism to reduce urinary calcium excretion. Its safety profile, dosing regimen, and specific focus on nephrolithiasis differentiate it from other SGLT2 inhibitors primarily indicated for diabetes.

Q2: What are the main barriers to market adoption for MYRBETRIQ?

A: Limited awareness among primary care physicians, high cost compared to traditional therapies, and the need for robust clinical guideline endorsement are primary hurdles. Additionally, competition from established treatments like thiazides could slow early adoption.

Q3: What is the geographic outlook for MYRBETRIQ's sales growth?

A: North America will lead initial sales due to regulatory approval and healthcare infrastructure, followed by Europe and Asia-Pacific, where increasing nephrolithiasis prevalence and evolving healthcare policies will foster market expansion.

Q4: What role could combination therapies play in MYRBETRIQ's future market?

A: Combining MYRBETRIQ with other agents addressing different pathways in calcium metabolism could enhance efficacy, expand indications, and open new revenue streams. Development of such combinations will depend on clinical trial outcomes.

Q5: How can stakeholders ensure sustainable growth for MYRBETRIQ?

A: Continuous post-marketing surveillance, evidence generation through clinical trials, strategic alliances with healthcare providers, patient education initiatives, and competitive pricing strategies are key for long-term success.

References

[1] Scales, C. D., et al. "Prevalence of kidney stones in the United States." European Urology 2012; 62(1): 160-165.