Last updated: July 29, 2025

Introduction

Metoprolol, a selective beta-1 adrenergic receptor blocker, is integral in managing cardiovascular conditions such as hypertension, angina pectoris, and heart failure. Since its introduction, it has maintained a prominent market position owing to its proven efficacy and favorable safety profile. This analysis evaluates the current market dynamics, competitive landscape, regulatory environment, and future sales projections for Metoprolol over the next five years.

Market Overview

Global Market Size

The global beta-blocker market was valued at approximately USD 4.8 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of around 3.8% through 2028 (Research and Markets). Metoprolol accounts for an estimated 45-50% of this market segment, making it one of the most prescribed beta-blockers worldwide.

Indications and Usage

Metoprolol is primarily prescribed for:

- Hypertension (high blood pressure)

- Angina pectoris

- Heart failure

- Myocardial infarction post-attack

- Arrhythmias

It is available in various formulations, including immediate-release (Metoprolol Tartrate) and extended-release (Metoprolol Succinate), broadening its clinical application and market reach.

Key Market Drivers

- Rising Cardiovascular Disease (CVD) Prevalence: According to WHO, CVDs remain the leading cause of death globally, driving the demand for effective management drugs.

- Growth in Elderly Population: Aging populations increase the prevalence of hypertension and heart failure, boosting Metoprolol sales.

- Clinical Guidelines: Endorsed in multiple international guidelines (e.g., ACC/AHA), reinforcing its prescription frequency.

- Patent Expiry & Generics: Patent expirations of branded versions have expanded access via generics, catalyzing sales and market penetration.

Market Challenges

- Availability of Alternatives: Other beta-blockers and antihypertensive agents (e.g., ACE inhibitors) compete with Metoprolol.

- Side Effects & Contraindications: Bradycardia, hypotension, and respiratory issues in some populations limit universal applicability.

- Regulatory and Patent Landscape: Patent expiries have led to increased generic competition, impacting branded sales.

Competitive Landscape

Key players include:

- Novartis: Original patent holder for Metoprolol Tartrate (Lopressor).

- Teva Pharmaceuticals and Mylan: Major generic manufacturers.

- AstraZeneca: Previously marketed formulations of Metoprolol before patent sunset.

- Other Beta-Blockers: Bisoprolol, Atenolol, Carvedilol, which vie for market share.

Generic versions typically capture over 80% of the prescription volume in mature markets, exerting pricing pressures on branded formulations.

Regulatory Environment

Metoprolol is approved by major health authorities worldwide, including the FDA, EMA, and other regional agencies. Ongoing post-marketing surveillance confirms its safety profile, although recent guidelines emphasize personalized medicine approaches.

Regulatory pathways for biosimilars and generics have facilitated market expansion, with strict quality and bioequivalence standards ensuring widespread acceptance.

Sales Projections

Assumptions

- Continued high prevalence of CVDs.

- Steady growth in aging populations.

- Increased adoption of generic formulations.

- No significant regulatory barriers or safety concerns emerging.

Forecast (2023-2028)

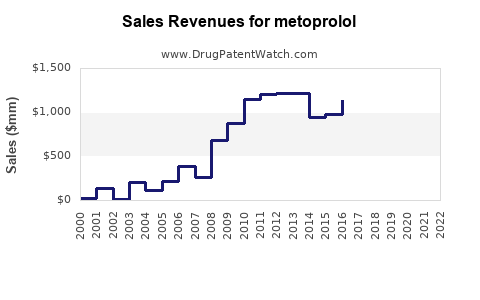

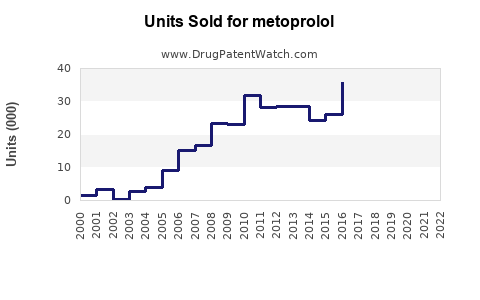

Based on current trajectory and market dynamics, global sales of Metoprolol are projected to increase from approximately USD 2.4 billion in 2022 to around USD 3.2 billion by 2028, representing a CAGR of 5.1%. This growth reflects increased prescription volumes driven by genericization and expanding indications.

In North America and Europe, mature markets will see stable but slow growth, predominantly powered by generic sales and adherence to clinical guidelines. Emerging markets, such as Asia-Pacific and Latin America, will experience higher growth rates (~7-8%) owing to expanding healthcare infrastructure and disease burden.

Market Share Projections

- Branded formulations: Will decline to less than 15% of total sales due to patent expiries.

- Generics: Will dominate, accounting for over 85%, with regional variations.

Impact of Future Innovations

Emerging therapies, such as vasodilating beta-blockers and novel antihypertensives, could influence long-term market dynamics; however, their adoption is projected to be gradual, with Metoprolol remaining a cornerstone therapy for the foreseeable future.

Strategic Opportunities

- Formulation Innovation: Developing new delivery systems (e.g., transdermal patches) can enhance adherence.

- Market Penetration: Targeting underserved regions and chronic disease management programs.

- Combination Therapies: Collaborations to combine Metoprolol with other agents (e.g., diuretics) for comprehensive care.

Conclusion

Metoprolol’s robust efficacy, well-established safety, and widespread clinical acceptance underpin its sustained demand. The shift towards generics amplifies access and volume but pressures pricing and profit margins for branded products. Overall, the market is poised for steady growth, with emerging markets and increasing indications serving as primary drivers.

Key Takeaways

- The global Metoprolol market is projected to grow at approximately 5.1% CAGR through 2028, reaching USD 3.2 billion.

- Generic formulations dominate sales, representing over 85% of the market, with significant regional growth in Asia-Pacific and Latin America.

- The prevalence of cardiovascular diseases and aging demographics are primary growth catalysts.

- Competition from other beta-blockers and antihypertensive agents presents ongoing challenges.

- Strategic focus on formulation innovation, geographic expansion, and combination therapies can capitalize on market opportunities.

FAQs

Q1. How does patent expiration affect Metoprolol sales?

Patent expiration allows generic manufacturers to enter the market, significantly reducing prices and increasing accessibility. While branded sales decline, overall volume sales tend to rise, sustaining revenue growth but compressing profit margins for original patent holders.

Q2. Are there new formulations of Metoprolol in development?

Currently, most innovation focuses on delivery systems and combination drugs rather than new formulations. Transdermal patches and sustained-release formulations continue to be explored to improve adherence.

Q3. Which regions offer the greatest growth opportunities for Metoprolol?

Emerging markets in Asia-Pacific, Latin America, and Africa present the highest growth potential, driven by increasing cardiovascular disease burden and expanding healthcare infrastructure.

Q4. How do clinical guidelines influence Metoprolol sales?

Guidelines endorsed by organizations like the American College of Cardiology (ACC) and European Society of Cardiology (ESC) promote Metoprolol as a first-line therapy, maintaining high prescription rates.

Q5. What are the main competitive threats to Metoprolol market sustainability?

The primary threats include competition from newer, more selective beta-blockers and alternative antihypertensives offering improved safety profiles or better patient tolerability.

Sources:

- Research and Markets, "Global Beta-Blockers Market," 2022.

- WHO Cardiovascular Diseases Fact Sheet, 2022.

- American College of Cardiology/American Heart Association Guidelines, 2022.