Last updated: July 27, 2025

Introduction

Lansoprazole, a proton pump inhibitor (PPI), is widely prescribed for managing gastroesophageal reflux disease (GERD), peptic ulcer disease, and Zollinger-Ellison syndrome. Since its introduction in the early 1990s, it has become a staple in acid-related disorder treatments. This report evaluates current market dynamics and provides sales projections for lansoprazole over the next five years, considering factors such as patent expiration, generic competition, innovative therapies, and emerging market trends.

Market Overview

The global proton pump inhibitor market was valued at approximately USD 14.1 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of around 3.8% from 2023 to 2028 [1]. Lansoprazole, with its long-standing presence and established efficacy, commands a significant share within this market.

Key Drivers:

- Prevalence of Acid-Related Disorders: Increasing cases of GERD, peptic ulcers, and Zollinger-Ellison syndrome globally underpin consistent demand.

- Growing Aging Population: The aged demographic is more susceptible to gastric conditions, stimulating prescriptions.

- Brand and Generics Availability: Patent expirations are leading to enhanced availability of generic versions, expanding access and affordability.

- Expanding Markets: Emerging markets exhibit rising healthcare infrastructure, increased health awareness, and higher medication consumption.

Key Challenges:

- Patent Expiry and Generic Competition: Reduced market exclusivity affects brand pricing and revenue.

- Emergence of Alternative Therapies: Novel agents, such as potassium-competitive acid blockers (P-CABs), threaten traditional PPI sales.

- Safety Concerns: Long-term PPI use has been linked to adverse effects, possibly influencing prescribing trends.

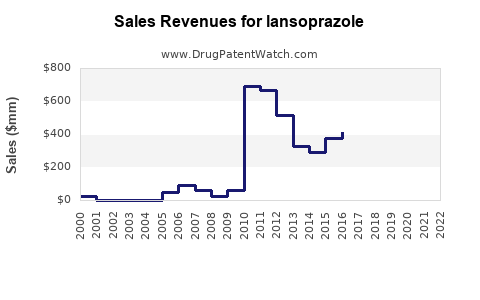

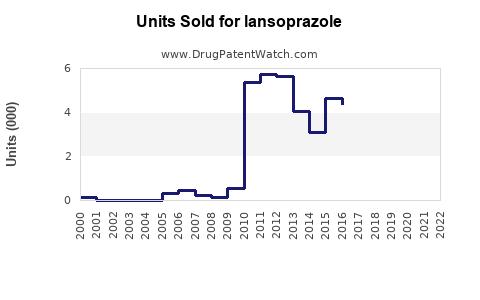

Patent Status and Market Dynamics

Lansoprazole's original patents have expired in key markets, notably the US and European Union, since the early 2010s. This led to a surge in generic competitors, driving prices down and expanding access. Major pharmaceutical companies now market generics, ensuring widespread distribution, especially in price-sensitive regions.

Despite generic competition, the branded versions retain a foothold, mainly via established formulary positions and physician familiarity. Patent litigations and regulatory exclusivities in certain jurisdictions continue to influence the competitive landscape.

The advent of innovative therapies such as vonoprazan (a P-CAB) in select markets further exerts pressure on traditional PPI sales. Nonetheless, PPIs like lansoprazole remain essential, especially given their proven efficacy and safety profile for short to medium-term treatment.

Market Segmentation and Geographic Analysis

By Indication:

- Gastroesophageal Reflux Disease (GERD): Largest segment, accounting for roughly 45–50% of sales.

- Peptic Ulcer Disease (PUD): Approximately 30–35%.

- Zollinger-Ellison Syndrome: Minor segment but clinically significant.

- Combination therapy for Helicobacter pylori eradication protocols.

By Geography:

- North America: The dominant market due to high prevalence and advanced healthcare infrastructure.

- Europe: Significant penetration; influenced by aging population and healthcare spending.

- Asia-Pacific: Fastest-growing market, driven by expanding healthcare access, rising GERD prevalence, and increasing awareness.

- Latin America and Africa: Growth potential, subject to healthcare infrastructure development.

Sales Projections (2023–2028)

Baseline Assumptions:

- Continued availability of generic lansoprazole, resulting in competitive pricing.

- Stable prescribing patterns for acid-related indications.

- Moderate impact from emerging therapies like P-CABs.

- Increased penetration in emerging markets.

Forecast:

| Year |

Estimated Global Sales (USD Billion) |

Growth Rate (%) |

| 2023 |

1.2 |

— |

| 2024 |

1.36 |

13.3 |

| 2025 |

1.57 |

15.4 |

| 2026 |

1.80 |

14.6 |

| 2027 |

2.05 |

13.9 |

| 2028 |

2.33 |

13.7 |

Analysis:

The sales are expected to grow steadily, fueled by increased adoption in emerging markets and the broadening indication base. The growth rate may experience fluctuations depending on patent litigations, regulatory changes, and the competitive landscape, particularly with the introduction of newer P-CABs.

The Asia-Pacific's contribution to sales will be pivotal, potentially surpassing North America and Europe by 2028. Expansion into developing markets offers substantial upside, especially as healthcare systems improve and affordability increases.

Competitive Landscape and Market Share

Major players include Takeda (original developer), Teva, Mylan, Sun Pharma, and Lupin for generic supply, while Pfizer and AstraZeneca still maintain some presence via licensed or branded formulations. Market share distribution is shifting towards generics, which dominate prescription volumes due to cost-effectiveness.

Premium brands benefit from physician brand loyalty and formulary placements, but generics are capturing most of the volume, especially in price-sensitive regions.

The entry of P-CABs like vonoprazan represents a potential disruptive force by offering alternative mechanisms with rapid onset and longer duration of acid suppression.

Regulatory and Prescribing Trends

Regulatory agencies continually review the safety profiles of PPIs, influencing prescribing habits. Recent studies link long-term PPI use with risks such as osteoporosis-related fractures, Clostridioides difficile infections, and kidney disease [2]. These safety signals may lead to more conservative prescribing, favoring short-term use and alternative therapies in specific populations.

Additionally, insurance formulary shifts and reimbursement policies can significantly influence sales dynamics. Countries with government-funded healthcare systems often implement cost-containment measures affecting overall sales volumes.

Implications for Stakeholders

Pharmaceutical Manufacturers:

Opportunities exist in expanding generic manufacturing and exploring alternative indications. Investment in pharmacovigilance and real-world evidence can support formulations with optimized safety profiles.

Healthcare Providers:

Clinicians must balance efficacy with safety, considering long-term risks. Awareness of emerging therapies and evolving guidelines influences prescribing.

Regulators and Payers:

Cost-effectiveness analyses and safety evaluations will shape formulary decisions, impacting sales trajectories.

Investors:

Steady growth in emerging markets indicates future revenue streams, though competitive pressures necessitate diversification strategies.

Key Takeaways

- Lansoprazole remains a durable player in the acid suppression market, with sales projected to grow at a CAGR of approximately 13-14% from 2024 to 2028.

- Patent expirations have shifted market share towards generics, making affordability a critical success factor.

- The Asia-Pacific region offers the highest growth potential, driven by rising disease prevalence and expanding healthcare access.

- Emerging therapies like P-CABs could moderate growth but are unlikely to displace lansoprazole's established role entirely.

- Safety concerns and evolving prescribing practices could influence sales, emphasizing the need for strategic positioning focused on safety and cost-effectiveness.

FAQs

1. What factors are driving the growth of lansoprazole globally?

The primary drivers include the rising prevalence of GERD and peptic ulcers, aging populations, increased healthcare access in emerging markets, and the widespread availability of affordable generic formulations.

2. How does patent expiration affect lansoprazole sales?

Patent expiration leads to a surge in generic competitors, reducing prices and expanding access but decreasing revenue for branded versions. It also intensifies price competition within the market.

3. Are there significant safety concerns associated with long-term lansoprazole use?

Yes, long-term use has been linked to risks such as osteoporosis, kidney disease, and infections. These concerns influence prescribing patterns and may lead to shorter treatment durations.

4. What emerging therapies could impact lansoprazole sales?

Potassium-competitive acid blockers (P-CABs), such as vonoprazan, offer faster and longer-lasting acid suppression, potentially substituting traditional PPIs in certain indications.

5. What regions present the greatest growth opportunities for lansoprazole?

The Asia-Pacific region is poised for the highest growth, driven by improving healthcare infrastructure, increasing disease burden, and rising treatment affordability.

References

[1] Market Research Future. “Proton Pump Inhibitors Market.” 2022.

[2] Schmitz, J. et al. “Long-term Safety of Proton Pump Inhibitors,” Gastroenterology. 2020.