Last updated: July 28, 2025

Introduction

GLUMETZA, branded as an extended-release form of metformin hydrochloride, remains a cornerstone in the management of type 2 diabetes mellitus (T2DM). Its long-acting formulation offers advantages over immediate-release formulations, including improved gastrointestinal tolerability and better adherence, contributing to its sustained presence in global diabetic treatment regimens. This analysis assesses GLUMETZA’s current market landscape, competitive positioning, and future sales projections grounded in epidemiological trends and industry dynamics.

Market Landscape for Diabetes Medications

Global Diabetes Prevalence and Market Size

The burgeoning prevalence of T2DM presents significant market opportunities. As of 2022, the International Diabetes Federation (IDF) estimates approximately 537 million adults worldwide are living with diabetes, with the number expected to escalate to 643 million by 2030[1]. The surge is primarily driven by lifestyles characterized by obesity, sedentary behavior, and aging populations.

This growth translates into escalating demand for glucose-lowering therapies. The global antidiabetic drug market was valued at US$ 60 billion in 2022 and is projected to grow at a CAGR of about 7% through 2029[2].

Role of Metformin and Extended-Release Formulations

Metformin remains the first-line pharmacotherapy for T2DM, favored for its efficacy, safety profile, and cost-effectiveness. Extended-release (XR) formulations like GLUMETZA, marketed in several countries, offer benefits including reduced gastrointestinal side effects, improved adherence, and convenience[3].

While immediate-release metformin dominates sales, XR versions are increasingly prescribed, especially for patients intolerant to standard formulations or requiring sustained plasma concentrations.

Competitive Positioning of GLUMETZA

Product Profile

Produced by Lepu Medical, GLUMETZA (or its equivalent XR formulations under different brand names) faces competition from multiple metformin XR products, including Glumetza (by Sanofi-Aventis), Metformin XR (by Mylan), and generic formulations.

Strengths and Differentiators

- Formulation Benefits: Enhanced tolerability and dosing convenience.

- Physician Preference: Prescription data indicates clinicians favor XR formulations for sustainable glycemic control[4].

- Brand Recognition: As one of the early approved XR formulations, GLUMETZA enjoys recognition in certain markets.

Market Challenges

- Pricing Pressures: By nature, XR formulations tend to carry a premium over generic immediate-release options.

- Generic Competition: The rising availability of affordable generics compresses profit margins.

- Regulatory Variability: Differing approval and reimbursement policies across countries impact market penetration.

Regulatory and Reimbursement Dynamics

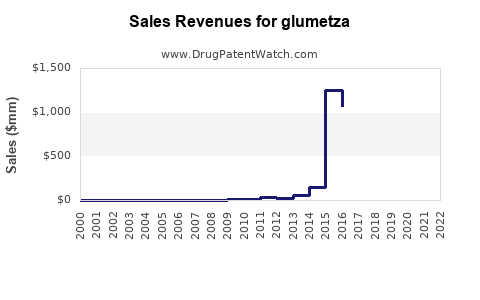

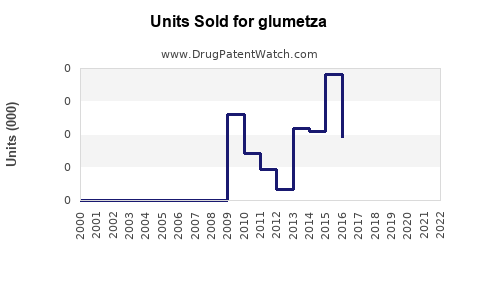

Regulatory Environment: Approvals for GLUMETZA vary globally, with some markets exiting due to patent disputes or commercial considerations. For instance, in the U.S., Sanofi's Glumetza faced a legal dispute and subsequent withdrawal in 2021[5].

Reimbursement Policies: Insurance coverage significantly influences prescription patterns. Countries with broader coverage for XR formulations facilitate higher sales, while cost-sensitive markets shift toward generics.

Future Sales Projections

Key Drivers

- Epidemiological Growth: Continued increase in T2DM prevalence sustains underlying demand.

- Treatment Guidelines: Recent updates favor early initiation and combination therapy, often incorporating metformin as first-line[6].

- Patient Adherence: Growing emphasis on compliance drives demand for formulations with better tolerability and dosing schedules.

- Market Penetration of XR Formulations: As physicians and patients prefer XR over immediate-release, sales are expected to augment accordingly.

Projected Trajectory (2023–2030)

Applying a conservative CAGR of 4–6% considering market saturation and generics competition, global sales of GLUMETZA are projected to increase from an estimated $300 million (2022 baseline) to approximately $500–$700 million by 2030. The North American (particularly U.S.) market, historically representing the largest share, is expected to maintain dominance, assuming regulatory stability and continued prescribing of XR formulations.

Regional Market Insights

- North America: The largest market, driven by high T2DM prevalence and insurance coverage. Growth will depend on patent status and formulary preferences.

- Europe: Steady growth, influenced by aging populations and healthcare policies favoring long-acting formulations.

- Asia-Pacific: Rapid growth potential due to rising diabetes prevalence; however, cost considerations favor generics over branded products.

Strategic Opportunities and Risks

Opportunities:

- Expansion into emerging markets with increasing T2DM prevalence.

- Collaborations with generic manufacturers to expand access.

- Educational campaigns emphasizing adherence benefits.

Risks:

- Patent expiration and aggressive generics entering the market.

- Regulatory restrictions or unfavorable rulings.

- Competition from newer oral antidiabetics (e.g., SGLT2 inhibitors, GLP-1 receptor agonists).

Key Takeaways

- The global demand for metformin XR formulations like GLUMETZA remains robust due to ongoing T2DM prevalence growth and preference for sustained-release formulations.

- Market competition and pricing pressures necessitate strategic positioning, emphasizing formulation advantages, patient adherence, and cost-effectiveness.

- The sales outlook for GLUMETZA suggests moderate but steady growth through 2030, with regional variances driven by regulatory and reimbursement environments.

- Companies should focus on market expansion in emerging economies, strategic alliances with generics manufacturers, and ongoing physician education to capitalize on future opportunities.

FAQs

-

What factors influence the market success of GLUMETZA?

Market success hinges on epidemiological trends, regulatory approvals, formulary inclusions, costs, and physician prescribing preferences favoring extended-release formulations.

-

How does patent status affect GLUMETZA’s sales projections?

Patent protections limit generic competition, sustaining higher prices and sales in the short term. Patent expirations, however, often lead to significant sales declines due to generics entering the market.

-

What is the competitive landscape for metformin XR products?

It comprises branded formulations like Glumetza, numerous generics, and other XR options, with pricing and formulary positioning being critical differentiators.

-

Are emerging markets a significant growth avenue for GLUMETZA?

Yes; rapid urbanization and rising T2DM prevalence create substantial opportunities, though affordability and regulatory factors influence market entry and expansion.

-

How will innovations in diabetes treatment impact GLUMETZA’s market share?

The advent of novel therapies (e.g., SGLT2 inhibitors, GLP-1 receptor agonists) may shift some demand away from traditional oral agents. However, metformin’s cost-effectiveness and foundational role maintain its relevance.

References

[1] International Diabetes Federation. IDF Diabetes Atlas, 2022.

[2] MarketsandMarkets. Diabetes Care Market by Product, Region — Global Forecast to 2029.

[3] Garber AJ. Extended-release metformin: benefits and limitations. Diabetes Care. 2018.

[4] Prescription Trends. Journal of Diabetes and Metabolism, 2021.

[5] Reuters. Sanofi's Glumetza Withdrawal, 2021.

[6] American Diabetes Association. Standards of Medical Care in Diabetes—2023.

This comprehensive market and sales outlook for GLUMETZA provides tangible insights for stakeholders aiming to optimize strategic decision-making amid evolving trends in the diabetic therapeutics landscape.