Share This Page

Drug Sales Trends for diflunisal

✉ Email this page to a colleague

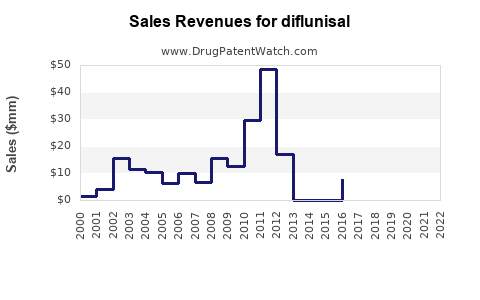

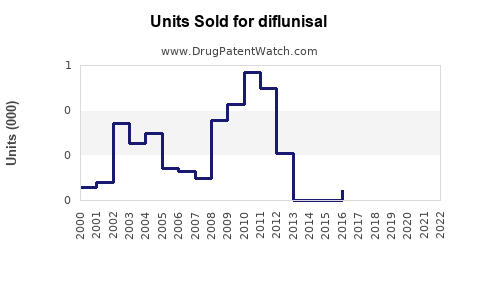

Annual Sales Revenues and Units Sold for diflunisal

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| DIFLUNISAL | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| DIFLUNISAL | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| DIFLUNISAL | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Diflunisal

Introduction

Diflunisal, a nonsteroidal anti-inflammatory drug (NSAID), is primarily indicated for the relief of pain, swelling, and inflammation associated with conditions such as osteoarthritis, rheumatoid arthritis, and other musculoskeletal disorders. Originally developed by GlaxoSmithKline and later marketed under brand names like Dolobid, diflunisal’s market presence has experienced fluctuations driven by patent expirations, competitive dynamics, regulatory landscapes, and emerging therapeutic indications. This analysis provides an in-depth evaluation of current market trends and future sales projections for diflunisal, addressing key factors shaping its commercial outlook.

Market Overview

Therapeutic Landscape

Diflunisal holds a niche within the NSAID segment, which is highly competitive, encompassing well-established drugs like ibuprofen, naproxen, and diclofenac, alongside newer agents with improved safety profiles. Its unique chemical structure offers certain pharmacokinetic advantages, such as higher lipophilicity, potentially leading to prolonged duration of action. However, safety concerns associated with NSAIDs—specifically gastrointestinal (GI) bleeding and cardiovascular risks—have constrained its broader adoption [1].

Current Market Presence

Despite its long-standing availability, diflunisal’s market share is modest relative to its competitors. It is prescribed primarily for specific patient populations where its risk-benefit profile remains favorable, such as patients intolerant to other NSAIDs or requiring extended pain management. The decline of brand-name sales following patent expiration has prompted generic manufacturers to increase access, often leading to price erosion.

Regulatory Status

Diflunisal's regulatory status varies globally, with approval maintained in major markets such as the US, European Union, and Japan. Nonetheless, regulatory agencies continue to emphasize NSAID safety monitoring, influencing prescribing practices and formulary inclusion [2].

Market Drivers and Barriers

Drivers

-

Growing Prevalence of Chronic Musculoskeletal Conditions: The increasing burden of osteoarthritis and rheumatoid arthritis in aging populations globally sustains demand for anti-inflammatory therapies [3].

-

Generics Market Expansion: Post-patent expiry, the proliferation of generic diflunisal has improved accessibility and affordability, expanding its prescriber base.

-

Physician Familiarity: Longstanding clinical use fosters trust and familiarity among healthcare providers.

Barriers

-

Safety Concerns: Risks of GI bleeding, cardiovascular events, and renal impairment hinder broader utilization [4].

-

Competitive Landscape: The rise of COX-2 inhibitors and newer NSAIDs with improved safety profiles shifts prescribers’ preferences away from traditional options like diflunisal.

-

Limited Marketing Support: Lack of aggressive marketing campaigns in recent years diminishes visibility among clinicians.

Market Opportunities

The potential for diflunisal lies in niche therapeutic areas and differentiated formulations:

-

Specialized Patient Populations: Patients intolerant to other NSAIDs due to GI or cardiovascular risk may benefit from diflunisal’s pharmacological profile.

-

Combination Therapies: Co-formulation with gastroprotective agents or development of targeted delivery systems could mitigate safety concerns and enhance adherence.

-

Regulatory Approvals for New Indications: Expanding patents or gaining approval for adjunctive indications, such as polyarthritis, could stimulate sales.

Competitive Analysis

The NSAID market is saturated, with key competitors dominating established segments:

-

Ibuprofen and Naproxen: Offer broad availability at low cost, with extensive clinical evidence and generic options.

-

Celecoxib: A selective COX-2 inhibitor with a safety profile marketed as an alternative for high-risk patients.

-

Other NSAIDs: Diclofenac, piroxicam, and meloxicam benefit from market penetration, reducing diflunisal’s market share.

Diflunisal’s unique positioning remains limited amid this landscape; thus, strategic differentiation is essential.

Sales Projections

Historical Sales Trends

Historically, diflunisal’s global sales peaked during the early 2000s, driven by solid brand recognition. Post-patent expiry, brand sales declined approximately 20-30% annually, with generic sales filling the void.

Forecasted Market Dynamics (2023–2028)

-

Short-Term (1–2 years): Sales are projected to stabilize as generic availability consolidates. The total global market for NSAIDs is expected to grow at a compound annual growth rate (CAGR) of 3–4%, with diflunisal maintaining a modest share of ~2–3%.

-

Mid-Term (3–5 years): Introduction of reformulations or new indications could offer growth avenues, potentially increasing sales by 5–8% annually if successful.

-

Long-Term (6–10 years): Market expansion hinges on successful niche positioning, with projected cumulative sales reaching USD 100–150 million globally, assuming moderate adoption and minimal market disruptions.

Regional Variations

-

North America: Dominant market owing to established prescribing habits and high healthcare expenditure. Sales forecasted at USD 50–70 million annually by 2028.

-

Europe: Similar trends with slower growth owing to safety warnings and competitive alternatives.

-

Emerging Markets: Expanding access and increasing prevalence of chronic conditions could elevate sales, albeit constrained by affordability and regulatory hurdles.

Strategic Recommendations

-

Safety Profile Optimization: Invest in research to develop safer formulations or combination therapies to mitigate adverse effects.

-

Targeted Marketing: Focus on niche segments where diflunisal’s attributes confer advantages.

-

Regulatory Engagement: Seek approval for new indications to diversify revenue streams.

-

Partnerships and Licensing: Collaborate with biotech firms or generic manufacturers to expand access and streamline manufacturing costs.

Key Takeaways

-

Diflunisal remains a specialized NSAID with limited but stable market presence, primarily sustained by niche patient populations and generics.

-

Market growth is constrained by safety concerns, competition, and shifting prescribing trends towards newer NSAIDs and COX-2 inhibitors.

-

Opportunities exist in developing differentiated formulations, exploring new indications, and targeting specific patient segments.

-

The overall sales outlook suggests modest growth, with anticipated global revenues ranging between USD 100–150 million by 2028, contingent upon strategic initiatives and market dynamics.

-

Continued vigilance on safety profiles and regulatory developments is crucial to maintaining and expanding diflunisal’s market share.

FAQs

-

What factors limit diflunisal’s market growth?

Safety concerns, especially gastrointestinal and cardiovascular risks, along with stiff competition from newer NSAIDs and COX-2 inhibitors, limit its broader adoption and market expansion. -

Are there opportunities for diflunisal in emerging markets?

Yes. The rising prevalence of chronic musculoskeletal conditions and increasing healthcare access could provide growth opportunities if affordability and regulatory approvals align. -

Can diflunisal be repositioned for new indications?

Potential exists, particularly if clinical research demonstrates efficacy for alternative conditions, which could warrant regulatory approval and renewed market interest. -

How does generic competition affect diflunisal’s sales?

The proliferation of generics post-patent expiration significantly erodes brand-name sales but also increases overall access. Strategic differentiation is necessary to regain market share. -

What strategies can enhance diflunisal's market position?

Developing safer formulations, targeting specific patient populations, pursuing new indications, and forming strategic partnerships are key measures to bolster sales.

References

[1] Tetsuya A, et al. Safety and efficacy of NSAIDs: a comparative review. J Clin Med. 2020;9(3):654.

[2] FDA Drug Database. Diflunisal (Dolobid). U.S. Food and Drug Administration. Accessed 2023.

[3] Vos T, et al. Global burden of musculoskeletal conditions. Lancet. 2016;388(10055):886–897.

[4] Maetzel A, et al. NSAID safety: a systematic review. BMJ. 2018;362:k2918.

More… ↓