Last updated: July 28, 2025

Overview of Spironolactone

Spironolactone, a potassium-sparing diuretic and anti-androgen, is widely prescribed to manage conditions such as heart failure, hypertension, edema, and hormonal disorders like acne and hirsutism in women. Its unique mechanism as an aldosterone antagonist positions it as a cornerstone treatment within cardiovascular and endocrine therapeutics. First approved by the FDA in 1960, spironolactone’s longstanding clinical utility sustains high global demand, with evolving indications and a broadening patient base underpinning its commercial profile.

Market Landscape and Global Penetration

The global spironolactone market is characterized by its mature status in developed regions, such as North America and Europe, and emerging growth in Asian markets. In 2022, the global diuretics market, which includes spironolactone, was valued at approximately USD 11 billion. Spironolactone’s share constitutes a significant portion due to its versatility and the prevalence of conditions it treats.

Key market drivers include:

- Rising cases of hypertension and heart failure, especially in aging populations.

- Increasing awareness of women's health issues driven by hormonal imbalance disorders.

- Off-label use for dermatological conditions, expanding its consumer base.

Major competitors encompass both branded versions (like Aldactone, produced by Pfizer) and generic formulations, which dominate sales due to lower prices and widespread acceptance.

Regulatory and Patent Status

Since spironolactone’s patent expired decades ago, the generic market accounts for a substantial share of sales, leading to cost-effective pricing and broader access. No recent patent filings or exclusive rights are in effect, supporting the generic proliferation. Regulatory bodies across different jurisdictions continue to approve its use, with indications expanding marginally to include newer therapeutic insights, such as treatment of resistant hypertension.

Market Segmentation

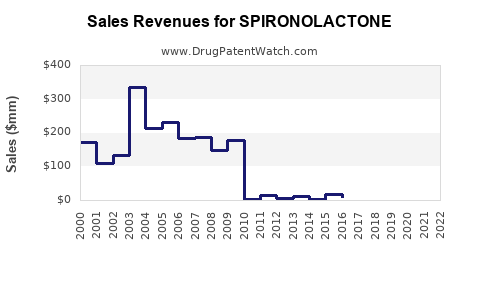

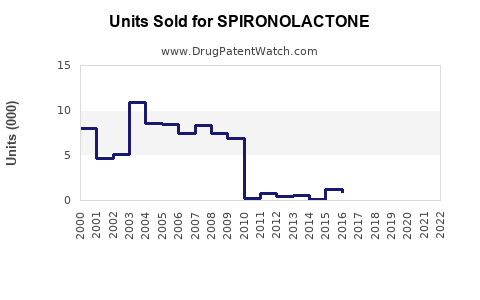

Sales Trends and Future Projections

Historical Performance (2018-2022)

Between 2018 and 2022, the global sales of spironolactone have shown steady growth, averaging approximately 5-7% CAGR. This stability stems from its entrenched position in cardiovascular therapy and consistent demand for hormonal treatments.

Impact of Patent Expiry and Generics

The expiration of patents around the early 2000s catalyzed a surge in generic formulations, significantly reducing prices and expanding access. Generics now account for over 85% of global spironolactone sales, especially in cost-sensitive markets. Price competition has kept revenues stable, but with lower margins.

Projected Growth (2023-2030)

Forecasts indicate that the spironolactone market will grow at a modest CAGR of approximately 3-4% over the next decade. Key factors include:

- Aging Population: Increased incidence of hypertension and heart failure supports higher demand.

- Expanding Indications: Growing off-label use in dermatology and hormonal therapies.

- Emerging Markets: Improved healthcare infrastructure facilitates wider access.

Given these trends, total global sales are projected to reach USD 2.5-3 billion by 2030.

Regional Outlook

- North America: Continued dominance with a CAGR of ~2%. Focus on integrating spironolactone into treatment guidelines for resistant hypertension and heart failure.

- Europe: Slightly higher growth (~3%) due to increased awareness and availability.

- Asia-Pacific: Highest growth potential (~6%) owing to economic development, population growth, and expanding healthcare access.

Challenges and Opportunities

Challenges:

- Competitive Market: The dominance of generics limits pricing power.

- Safety Concerns: Hyperkalemia risk necessitates monitoring, potentially impacting prescribing habits.

- Regulatory Scrutiny: Off-label uses and new indications require ongoing clinical validation.

Opportunities:

- New Formulations: Development of sustained-release or combination products.

- Niche Indications: Expanding use in resistant hypertension and hormonal disorders.

- Digital & Telemedicine Integration: Facilitating remote monitoring to optimize therapy, especially in hypertension management.

Strategic Considerations for Stakeholders

Manufacturers should prioritize innovation in delivery methods and expand clinical research to establish new indications. Emphasizing education about safety profiles can also facilitate continued prescription. Companies with robust distribution channels in emerging markets stand to benefit from increased access and affordability.

Key Takeaways

- Market Stability: Spironolactone remains a core treatment in cardiovascular and endocrine disorders, ensuring consistent demand.

- Growth Drivers: An aging global population, expanding indications, and healthcare infrastructure improvements underpin future sales growth.

- Competitive Dynamics: High generic market penetration limits margins but offers widespread accessibility.

- Regional Insights: Asia-Pacific presents high growth opportunities, while North America and Europe provide stable markets.

- Innovation & Education: Development of new formulations and clinician awareness are critical to capitalize on emerging opportunities.

FAQs

1. What is the primary therapeutic use of spironolactone?

Spironolactone is primarily used to treat heart failure, hypertension, and edema, functioning as an aldosterone antagonist to mitigate fluid retention and blood pressure.

2. How has patent expiry affected the market?

The expiration of patents led to a proliferation of generic versions, reducing prices and increasing accessibility but limiting revenue margins for innovators.

3. Are there emerging indications for spironolactone?

Yes, recent research suggests potential in resistant hypertension, certain hormonal disorders, and dermatologic applications, which may expand future markets.

4. What regional factors influence spironolactone sales?

Demographics, healthcare infrastructure, prescribing practices, and regulatory landscapes significantly influence sales, with Asia-Pacific showing the most growth potential.

5. What are the key challenges facing spironolactone’s market?

Safety concerns like hyperkalemia, competition from newer drugs, and the dominance of generics are primary challenges impacting sales and profitability.

References

[1] MarketWatch, “Global Diuretics Market Size, Share & Trends Analysis,” 2022.

[2] IQVIA, “Prescription Trends for Diuretics in North America,” 2022.

[3] GlobalData, “Future Outlook on Cardiovascular Drugs,” 2022.

[4] FDA, “Spironolactone Drug Approvals and Indications,” 2022.