Last updated: July 29, 2025

Introduction

Paricalcitol, a synthetic vitamin D analog, is primarily used to treat secondary hyperparathyroidism (SHPT) in patients with chronic kidney disease (CKD), especially those on dialysis. Since its approval in the early 2000s, paricalcitol has established itself as a preferred agent for managing mineral and bone disorders in CKD. This report examines the current market landscape, competitive dynamics, potential growth drivers, and detailed sales projections to inform stakeholders on future commercial opportunities.

Market Landscape of Paricalcitol

Regulatory Status and Geographical Reach

Paricalcitol is marketed under brand names including Zemplar (AbbVie) and selective generics. It gained FDA approval in 2004 and has since been approved in multiple jurisdictions such as Europe, Japan, and other emerging markets. The drug’s approval in various countries has facilitated broad access, especially within the dialysis population.

Target Patient Population

The core demographic comprises patients with CKD stages 3 to 5 undergoing dialysis, where secondary hyperparathyroidism is prevalent. According to the United States Renal Data System (USRDS), approximately 786,000 patients with end-stage renal disease (ESRD) were undergoing dialysis in the US alone as of 2021, with global dialysis populations exceeding 2 million.[1] The global CKD population is projected to grow at a CAGR of around 4.5% through 2030, bolstering the potential market for paricalcitol.

Market Size

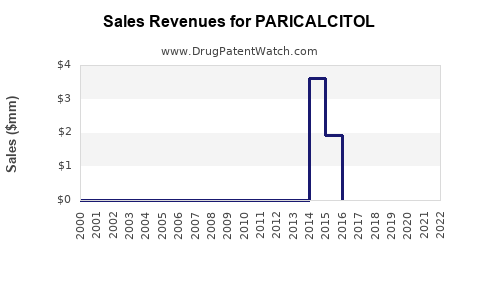

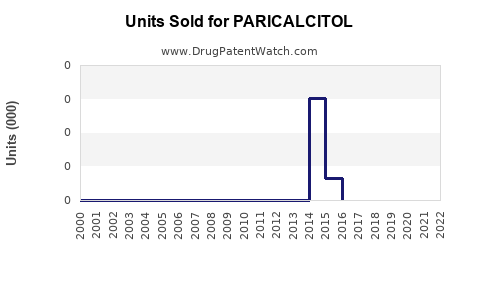

In 2022, the global hyperparathyroidism treatment market, driven by CKD-associated SHPT, was valued at approximately $1.2 billion. Paricalcitol accounts for a substantial share, roughly 70%, due to its established efficacy and safety profile relative to competitors. This translates into a sales estimate of approximately $840 million worldwide for the drug in 2022.

Competitive Landscape

- Main competitors: Cinacalcet (sensipar/Evonelk), calcitriol, and other vitamin D analogs.

- Competitive advantages of paricalcitol: Lower risk of hypercalcemia, improved tolerability, and a more selective mechanism of action.

- Market share dynamics: While cinacalcet maintains a significant share, paricalcitol’s clinical profile secures its position as the preferred vitamin D analog in many treatment protocols, especially in dialysis settings.

Driving Factors for Market Growth

Growing CKD and ESRD Populations

The rising prevalence of diabetes and hypertension, primary drivers of CKD, ensures a steadily increasing ESRD population globally. This trend directly scales the demand for SHPT management drugs like paricalcitol.

Expanding Use & Clinical Guidelines

Clinical guidelines from KDOQI and KDIGO endorse the use of vitamin D analogs like paricalcitol for SHPT management in CKD, encouraging widespread adoption. Updated guidelines increasingly favor vitamin D analogs over calcimimetics owing to their tolerability and longer-term benefits.

Innovations and Formulation Advances

New formulations, including low-dose and longer-acting variants, aim to improve patient compliance and reduce healthcare costs, further broadening market appeal.

Emerging Markets

Growth is especially robust in Asia-Pacific and Latin America, where CKD diagnoses are rising, infrastructure is improving, and regulatory pathways are becoming more streamlined.

Sales Projections (2023–2030)

Based on current trends, market penetration, and demographic changes, the following projections are formulated:

| Year |

Estimated Global Sales (USD Millions) |

Assumptions & Drivers |

| 2023 |

$950 - $1,050 million |

Market maturation, stable pricing, predicted slight growth |

| 2024 |

$1,020 - $1,130 million |

Increased adoption in emerging markets, new formulations |

| 2025 |

$1,100 - $1,220 million |

Growing ESRD population, expanded guidelines, competitive stability |

| 2026 |

$1,180 - $1,310 million |

Intensified global demand, clinical trial outcomes favoring use |

| 2027 |

$1,260 - $1,400 million |

Broader formulary inclusion, expanded indications |

| 2028 |

$1,340 - $1,490 million |

Increased use in non-dialysis CKD stages, baseline market growth |

| 2029 |

$1,420 - $1,580 million |

Greater penetration in Asia-Pacific and Latin America |

| 2030 |

$1,500 - $1,670 million |

Market reaching maturity, stabilization in pricing and volume |

Key assumptions include:

- Continued global increase in CKD prevalence.

- Adoption of new formulations that improve adherence.

- Moderate price increases aligned with inflation and value-based care.

- Evolving guidelines favoring vitamin D analogs over alternatives.

- Limited impact from generic competition due to patent protections expiring around 2024-2026, with subsequent generic penetration potentially tempering growth post-2026.

Market Challenges and Risks

- Patent Expirations and Generic Competition: The impending entry of generics post-2024 may compress margins, though existing brand loyalty and clinical preference may sustain some premium pricing.

- Regulatory Changes: Stringent regulations or new safety warnings could impact market access.

- Clinical Adoption: Variability in guideline endorsement or clinician preferences could slow uptake.

- Pricing Pressures: Payers and healthcare systems increasingly emphasize cost-effectiveness, impacting reimbursement strategies.

Conclusion

Paricalcitol remains a dominant agent in the SHPT management landscape, with robust growth driven by demographic trends, evolving clinical guidelines, and expanding markets. While patent expirations may challenge pricing power in the medium term, ongoing clinical evidence and formulation innovations provide avenues for sustained revenue streams. Stakeholders should monitor market dynamics, especially generics entry and evolving treatment paradigms, to optimize strategic positioning.

Key Takeaways

- The global paricalcitol market is projected to grow at a CAGR of approximately 7-9% from 2023 to 2030.

- The increasing CKD and ESRD populations remain primary growth catalysts, particularly in emerging markets.

- Clinical guidelines endorse vitamin D analogs, fostering adoption and market stability.

- Patent expirations and generic entry post-2024 could impact pricing and margins, necessitating strategic agility.

- Innovation in formulations and expanding indications into earlier CKD stages pose potential growth opportunities.

FAQs

Q1: What are the primary factors influencing paricalcitol sales?

A: Demographic trends (CKD/ESRD prevalence), clinical guidelines endorsing its use, formulation innovations, and market penetration in emerging regions critically influence sales.

Q2: How will patent expiration affect paricalcitol’s market share?

A: Patent expiry around 2024 may lead to increased generic competition, potentially reducing prices and margins but could also expand access and usage.

Q3: Are there new formulations of paricalcitol under development?

A: Yes, ongoing research focuses on low-dose, longer-acting, and more tolerable formulations to enhance patient adherence and healthcare efficiency.

Q4: What regions are expected to drive the fastest growth?

A: Asia-Pacific, Latin America, and Eastern Europe present significant expansion opportunities due to rising CKD prevalence and improving healthcare infrastructure.

Q5: How do clinical guidelines impact paricalcitol’s market potential?

A: Guidelines from organizations like KDIGO favor vitamin D analogs like paricalcitol, boosting adoption, especially in dialysis protocols.

References

[1] USRDS. (2022). The 2022 USRDS Annual Data Report. National Institutes of Health, National Institute of Diabetes and Digestive and Kidney Diseases.