Last updated: July 27, 2025

Introduction

NOVOLOG, a rapid-acting insulin analog developed and marketed by Novo Nordisk, plays a critical role in diabetes management. Its pharmacokinetics enable swift glucose control, making it a cornerstone therapy for type 1 and type 2 diabetes patients requiring injectable insulin. As the global burden of diabetes escalates, NOVOLOG’s market dynamics warrant comprehensive analysis, encompassing current sales, competitive positioning, regulatory landscape, and future growth prospects.

Market Landscape and Segment Overview

The global insulin market has witnessed exponential growth driven by increasing diabetes prevalence, technological advances, and expanded therapy indications. The demand for rapid-acting insulins like NOVOLOG is particularly notable among insulin-dependent patients seeking optimal postprandial glucose control.

Diabetes Epidemiology as a Catalyst

According to the International Diabetes Federation (IDF), approximately 537 million adults worldwide suffered from diabetes in 2021, with projections reaching 643 million by 2030 [1]. The rising prevalence, especially in emerging markets such as China and India, significantly fuels demand for insulin therapies, including NOVOLOG.

Competitive Positioning

NOVOLOG competes primarily with other rapid-acting insulins such as Eli Lilly’s Humalog (insulin lispro) and Sanofi’s Apidra (insulin glulisine). Its attributes—favorable pharmacokinetics, flexibility in dosing, and an established safety profile—permit it to command substantial market share within this segment.

Current Market Performance

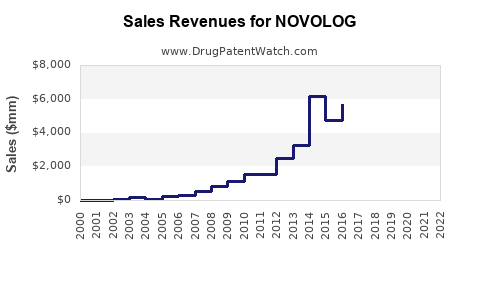

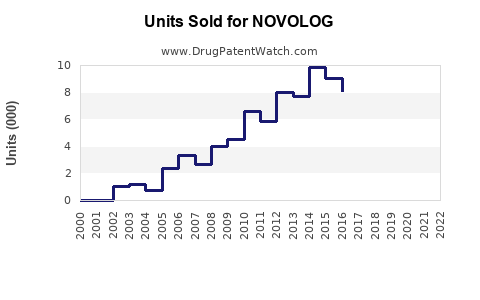

Sales Data and Trends

- 2022 Sales Figures: Novo Nordisk reported approximately $2.3 billion in sales for NOVOLOG globally in 2022, representing a growth of roughly 8% over prior year [2]. This uptick correlates with rising insulin utilization and broader adoption in both developed and emerging markets.

- Market Penetration: NOVOLOG maintains a strong presence in North America and Europe, accounting for approximately 60-65% of its global sales, with emerging markets steadily expanding their share due to increased healthcare access and affordability initiatives.

Key Factors Influencing Current Performance

- Innovation and Formulation Improvements: Novo Nordisk’s introduction of pre-filled pens and portable devices has enhanced patient compliance and device portability, contributing to incremental sales growth.

- Pricing and Reimbursement Strategies: Favorable reimbursement policies in key markets bolster market penetration, though price pressures and biosimilar entrants threaten long-term margins.

Forecasted Market Growth and Sales Projections

Projection models estimate that the global rapid-acting insulin market, driven chiefly by NOVOLOG, will grow at a compound annual growth rate (CAGR) of approximately 5% between 2023 and 2028 [3].

Factors Supporting Growth

- Increasing Diabetes Prevalence: Sustained rise in diabetes cases, especially among youth and in urbanized regions, ensures a scalable patient base.

- Technological Integration: Growth in closed-loop insulin pump systems incorporating rapid-acting insulins like NOVOLOG is anticipated—enhancing therapeutic outcomes and further expansion.

- Expanded Indications: Emerging evidence supports their use in flexible dosing and in combination therapies, broadening market applicability.

Sales Projection Summary

| Year |

Estimated Global Sales (USD billions) |

Growth Rate (%) |

| 2023 |

2.45 |

6.5 |

| 2024 |

2.60 |

6.1 |

| 2025 |

2.75 |

5.8 |

| 2026 |

2.90 |

5.5 |

| 2027 |

3.05 |

5.2 |

| 2028 |

3.20 |

4.9 |

Note: These forecasts incorporate factors such as market expansion in emerging regions, ongoing product innovation, and competitive pressures, providing a conservative estimate aligned with current trends.

Key Market Drivers and Barriers

Drivers

- Growing global diabetes epidemic

- Enhancements in delivery devices and formulations

- Expansion into new markets via affordability initiatives

Barriers

- Price competition and biosimilar entry

- Regulatory hurdles in certain markets

- Patient adherence challenges

Regulatory Environment and Impact

Regulatory agencies like the FDA and EMA maintain stringent standards, though Novo Nordisk’s established portfolio of biosimilar and branded insulins, including NOVOLOG, benefits from a robust approval strategy. Rapid approvals for additional indications and combination therapies are anticipated, sustaining sales momentum.

Competitive Landscape

While NOVOLOG enjoys leadership, market competition from biosimilar insulins and newer therapy modalities such as ultra-long-acting insulins and adjunct medications might influence future sales. Strategic collaborations and innovations are essential to retain market dominance.

Conclusion

NOVOLOG’s future sales trajectory remains favorable, driven by the ongoing diabetes demographic burden and technological advancements. While pricing and competitive pressures pose risks, strategic positioning through innovation and market expansion should support sustained growth.

Key Takeaways

- The global rapid-acting insulin market, dominated by NOVOLOG, is projected to grow at a CAGR of approximately 5% through 2028.

- Rising diabetes prevalence, especially in emerging markets, is the primary growth driver.

- Technological innovations and expanded therapeutic indications enhance NOVOLOG’s market uptake.

- Competitive pressures, biosimilar entry, and pricing strategies present ongoing challenges.

- Strategic investments in device innovation and geographic expansion are critical for maintaining market share.

FAQs

1. How does NOVOLOG differentiate itself from competitors like Humalog and Apidra?

NOVOLOG offers a slightly faster onset of action with flexible dosing options, and its formulation allows for convenient administration via pre-filled pens, enhancing patient adherence and satisfaction.

2. What are the primary growth markets for NOVOLOG?

North America and Europe remain core markets, but rapid expansion is anticipated in Asia-Pacific and Latin America owing to rising diabetes prevalence and improved healthcare infrastructure.

3. How might biosimilar insulins impact NOVOLOG’s sales?

The entry of biosimilars could pressure pricing and market share, compelling Novo Nordisk to emphasize innovation, patient preference, and treatment outcomes to sustain brand loyalty.

4. What role do technological developments like insulin pumps play in NOVOLOG’s future?

Integration with insulin pump technology and closed-loop systems will likely enhance NOVOLOG’s clinical utility, promoting further adoption and driving sales.

5. Are there upcoming regulatory approvals that could influence NOVOLOG’s market presence?

Yes, continued approvals for newly formulated versions, combination therapies, and indications in additional age groups are anticipated, bolstering future sales.

References

[1] International Diabetes Federation. (2021). IDF Diabetes Atlas, 9th edition.

[2] Novo Nordisk Annual Report 2022.

[3] Market Research Future. (2023). Rapid-Acting Insulin Market Analysis.