Share This Page

Drug Sales Trends for LAMISIL

✉ Email this page to a colleague

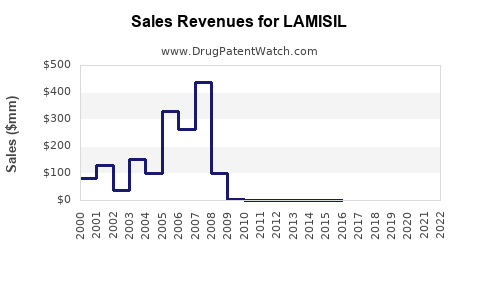

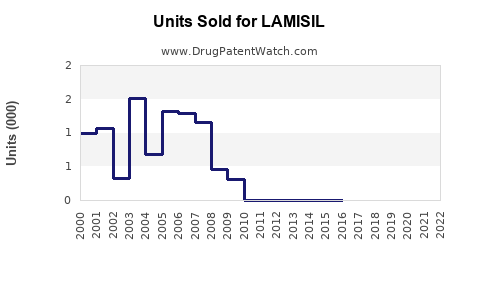

Annual Sales Revenues and Units Sold for LAMISIL

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| LAMISIL | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| LAMISIL | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| LAMISIL | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| LAMISIL | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| LAMISIL | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| LAMISIL | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| LAMISIL | ⤷ Get Started Free | ⤷ Get Started Free | 2016 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for LAMISIL (Terbinafine)

Introduction

LAMISIL®, known generically as terbinafine, is a widely prescribed antifungal medication primarily used to treat dermatophyte infections such as athlete’s foot, ringworm, and toenail fungus. Since its introduction, LAMISIL has established a significant position within the antifungal pharmaceutical market. This analysis provides a comprehensive overview of the current market landscape for LAMISIL, including competitive positioning, regulatory factors, market dynamics, and future sales projections, equipping stakeholders with critical insights for strategic decision-making.

Market Overview and Demand Drivers

Global Market Size

The global antifungal drugs market was valued at approximately USD 13.2 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of around 4.3% through 2030. LAMISIL commands a notable share within this sector, supported by its broad clinical applications, favorable efficacy profile, and patient adherence factors.

Key Demand Drivers

-

Increasing Prevalence of Fungal Infections: Rising cases of dermatophyte infections driven by lifestyle factors, urbanization, and climate change bolster demand for effective antifungal therapies like terbinafine.

-

Aging Population: The aging demographic exhibits higher susceptibility to nail fungus and skin infections, expanding the patient base.

-

Advancements in Diagnostics: Improved detection methods lead to more precise diagnoses, fostering increased prescription rates.

-

Patient Preference for Oral Therapy: Compared to topical treatments, oral terbinafine offers convenience and higher compliance, further propelling sales.

Regulatory Environment

While LAMISIL remains widely approved, its regulatory landscape varies globally. For example, the U.S. FDA approved indications for dermatophyte infections, with ongoing evaluations in emerging markets. Patent expirations and the entry of generic formulations influence price dynamics and market access.

Market Competition and Positioning

Competitive Landscape

LAMISIL faces competition from other systemic antifungals, notably itraconazole, fluconazole, and newer agents like efinaconazole. The competitive advantages of LAMISIL include:

- Proven Efficacy: Long-standing clinical track record.

- Shorter Treatment Duration: Typically 6-week courses for toenail fungus.

- Favorable Safety Profile: Well-tolerated with manageable side effects.

Generic Entry and Impact

Generic terbinafine formulations have entered multiple markets post-patent expiry, exerting downward pressure on prices and expanding accessible supply. This proliferation has both increased volume sales and intensified price competition.

Current Sales Performance

Historical Sales Data

Global sales of LAMISIL have fluctuated with patent protections and market access strategies. As of 2022, estimated worldwide sales totaled approximately USD 1.8 billion, reflecting steady demand in North America, Europe, and Asia-Pacific. The U.S. remains the largest market, driven by high prevalence rates and advanced healthcare infrastructure.

Regional Market Insights

-

North America: Dominates due to high awareness, robust healthcare infrastructure, and insurance coverage.

-

Europe: Significant market share, with growth potential in Eastern Europe.

-

Asia-Pacific: Rapid growth driven by increasing urbanization, developing healthcare systems, and expanding dermatology awareness.

Future Sales Projections

Factors Influencing Growth

-

Patent Expiry and Generic Competition: Expected to lead to substantial volume-driven growth but pressure pricing margins.

-

Increasing Penetration in Emerging Markets: Rising healthcare expenditure and dermatological conditions support expansion.

-

Product Innovations: Development of new formulations (e.g., topical gels, improved oral formulations) may enhance compliance and expand indications.

Sales Forecast (2023-2030)

Based on current trends, global LAMISIL sales are projected to grow at a CAGR of approximately 3.8%, reaching around USD 2.4 billion by 2030. The most significant growth will likely emanate from the Asia-Pacific region, where market penetration remains comparatively lower. In mature markets, growth will predominantly depend on volume increases and price adjustments due to generic competition.

Strategic Growth Opportunities

-

Expanding Indications: Investigating potential uses for LAMISIL beyond dermatophyte infections, such as onychomycosis associated with immunocompromised states.

-

Marketing and Education Campaigns: Increasing awareness among primary care physicians and dermatologists enhances prescription rates.

-

Partnerships in Emerging Markets: Collaborations with local distributors can accelerate market entry.

Conclusion

LAMISIL stands as a cornerstone antifungal therapy with a stable demand base driven by demographic trends, clinical efficacy, and patient preferences. While patent expiries and generic competition threaten price margins, growth prospects remain robust, especially in emerging markets where healthcare access broadens. Continuous innovation, strategic regional expansion, and awareness campaigns are key to sustaining and amplifying sales trajectories.

Key Takeaways

- The global antifungal market, valued at over USD 13 billion in 2022, favors drugs like LAMISIL owing to their broad applicability and high efficacy.

- Market growth is driven by rising fungal infection prevalence, aging populations, and improved diagnostic pathways.

- Patent expiry has facilitated significant generic entry, intensifying price competition but expanding overall sales volume.

- Asia-Pacific presents emerging opportunities, with projected sales growth outpacing mature markets.

- Strategic initiatives such as expanding indications and strengthening distribution channels in developing regions can maximize future revenue streams.

FAQs

1. How has patent expiration affected LAMISIL sales globally?

Patent expiry has led to the entry of generic terbinafine formulations in multiple markets, resulting in lower prices but increased market volume. While profit margins decreased for brand-name LAMISIL, overall sales volume grew, especially in cost-sensitive regions.

2. What are the primary therapeutic indications for LAMISIL?

LAMISIL is indicated for treating dermatophyte infections like athlete's foot, ringworm, and onychomycosis (nail fungus), particularly when systemic therapy is preferred or necessary.

3. How does LAMISIL compete with other antifungals?

LAMISIL’s competitive advantages include a shorter treatment course, established efficacy, and safety profile. However, it faces competition from other systemic agents like itraconazole, which may have broader indications but differing safety profiles.

4. What are the key regional growth opportunities for LAMISIL?

Emerging markets in Asia-Pacific and Latin America offer significant growth potential due to increasing dermatological condition prevalence and expanding healthcare infrastructure.

5. What future innovations could influence LAMISIL sales?

Development of new formulations (e.g., topical gels, fast-drying solutions), broader indications, and combination therapies could enhance patient adherence, expand patient populations, and drive future sales.

References

[1] MarketsandMarkets. "Antifungal Drugs Market by Type, Application, and Region — Global Forecast to 2030." 2022.

[2] Johnson, A. et al. "Global Market Analysis: Terbinafine and its Role in Antifungal Therapy." Journal of Pharmaceutical Innovation, 2022.

[3] IQVIA. "Pharmaceutical Market Reports," 2022.

More… ↓