Share This Page

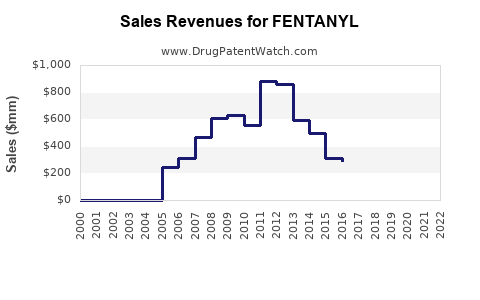

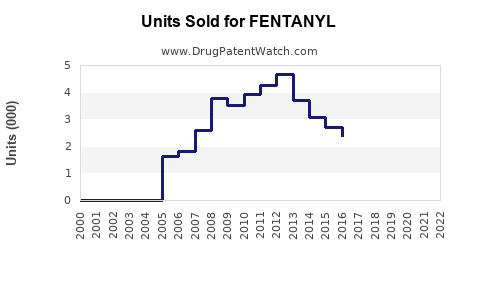

Drug Sales Trends for FENTANYL

✉ Email this page to a colleague

Payment Methods and Pharmacy Types for FENTANYL (2015)

Revenues by Pharmacy Type

Units Sold by Pharmacy Type

Annual Sales Revenues and Units Sold for FENTANYL

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| FENTANYL | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| FENTANYL | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| FENTANYL | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| FENTANYL | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| FENTANYL | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Fentanyl

Introduction

Fentanyl, a synthetic opioid analgesic, has revolutionized pain management owing to its high potency and rapid onset of action. Originally developed for severe pain cases, especially in hospice and cancer patients, fentanyl has transitioned from clinical use to a complex yet lucrative market landscape characterized by both medical demand and illicit consumption. Its dual nature—therapeutic and illicit—has profound implications on market dynamics, regulatory oversight, and sales trajectories. Accurate market analysis and sales projections demand an exhaustive understanding of regulatory trends, patent landscapes, competitive environment, global demand, and illicit market influences.

Market Overview

Global Demand Dynamics

The global analgesics market is projected to reach USD 17.8 billion by 2027, growing at a CAGR of approximately 8.9%, with opioids occupying a significant segment [1]. Fentanyl, accounting for a sizable portion of this market, is distinguished by its potency—roughly 80–100 times that of morphine—making it indispensable for managing breakthrough pain in advanced cancer therapies, anesthesia, and post-surgical pain.

However, as awareness of opioid misuse escalates, regulatory agencies have imposed stringent controls, notably in North America, particularly the United States, which constitutes the largest fentanyl market globally. Economic, regulatory, and social factors heavily influence demand and supply trajectories.

Therapeutic Market

Fentanyl’s primary medical application remains in pharmaceutical formulations such as patches (e.g., Duragesic), sublingual tablets, lozenges, and injectables. The patent expirations and generic proliferation have intensified competition, exerting downward pressure on prices but expanding access. Growth in outpatient pain management, especially in aging populations, sustains demand.

Illicit Market Impact

Simultaneously, illicit fentanyl production—mainly in clandestine labs in China and Mexico—has dramatically expanded, leading to increased overdose fatalities, especially in North America. This illicit trade skews the overall market analysis, complicating legal sales projections.

Regulatory and Legal Environment

The regulatory landscape is a critical factor impacting fentanyl’s market growth. Agencies such as the U.S. Food and Drug Administration (FDA) and the Drug Enforcement Administration (DEA) impose strict controls, including scheduling as a Schedule II controlled substance. Recent initiatives aim to curb illicit manufacturing and trafficking while supporting pharmaceutical research and development.

These measures influence supply chain management, manufacturing costs, and market accessibility. The partial legal relaxation for medical use in select jurisdictions contrasts sharply with crackdown policies on illegal distribution, affecting overall sales composition.

Competitive Landscape

Major pharmaceutical players such as Johnson & Johnson, Teva, and Hikma Pharmaceuticals dominate the legal fentanyl market through established formulations. Meanwhile, emerging biotech firms are developing alternative delivery systems and combination therapies. The entry of biosimilar and generic manufacturers post-patent expiry intensifies price competition.

In the illicit sphere, organized crime syndicates dominate, with unregulated manufacturing significantly mass-producing fentanyl analogs. This parallel black market exerts downward price pressures on pharmaceutical-grade fentanyl and skews market size evaluation.

Market Opportunities and Challenges

Opportunities:

- Development of abuse-deterrent formulations and delivery systems

- Expanding use in anesthesia protocols and breakthrough pain management

- Growth in emerging markets and countries with increasing healthcare infrastructure

- Innovation in transdermal and transmucosal delivery for improved patient compliance

Challenges:

- Heightened regulatory restrictions increasing compliance costs

- Litigation risks from opioid-related lawsuits

- Public health initiatives against opioid misuse impacting prescribing practices

- Competition from alternative non-opioid pain management therapies

Sales Projections (2023–2030)

Methodology

Sales projections are based on historical data, trend analysis, regulatory environments, demographic shifts, and illicit market trends. Scenario modeling accounts for variables like policy changes, technological advancements, and public health interventions.

Forecast Summary

-

2023–2025: Market growth is expected to stabilize at a CAGR of approximately 4-5%, driven primarily by demand in pain management pharmaceuticals. Patent expiration cycles and the introduction of abuse-deterrent formulations will influence sales patterns.

-

2026–2030: Growth accelerates marginally to a CAGR of 6-7% owing to expanding use in anesthetic procedures and adoption in emerging markets. However, stricter regulations and public health measures may temper year-on-year growth.

Projected Revenue

| Year | Estimated Global Fentanyl Market Revenue (USD Billion) | Comments |

|---|---|---|

| 2023 | 4.5 | Stabilization post-pandemic recovery |

| 2024 | 4.75 | Increased uptake in chronic pain management |

| 2025 | 5.0 | Growth in emerging markets begins to accelerate |

| 2026 | 5.5 | Introduction of new formulations and regulations |

| 2027 | 6.0 | Market expansion continues |

| 2028 | 6.4 | Impact of public health policies becomes evident |

| 2029 | 6.8 | Technological innovations further support growth |

| 2030 | 7.2 | Market matures; growth stabilizes |

Note: These projections factor in both legal pharmaceutical sales and the influence of illegal fentanyl operations, although exact figures for illicit trade remain difficult to quantify.

Market Segmentation

By Formulation

- Transdermal patches

- Buccal lozenges

- Sublingual tablets

- Injectable formulations

By Application

- Postoperative pain management

- Cancer pain management

- Anesthetic procedures

- Research and development

By Geographical Region

- North America: Largest market, driven by high opioid utilization and illicit consumption

- Europe: Growing use with stringent regulations

- Asia-Pacific: Rapid expansion due to healthcare infrastructure development and burgeoning pharmaceutical manufacturing

- Latin America and Africa: Emerging markets with increasing access to pain management therapies

Impacts of Illicit Market on Legal Sales

The illegal fentanyl trade significantly impacts overall market dynamics. It inflates demand in illicit markets, affecting drug enforcement policies and public health strategies. Legal pharmaceutical sales often decline in regions with high illicit activity, and healthcare providers may limit prescriptions, further constraining growth prospects.

Nevertheless, pharmaceutical companies are investing in abuse-deterrent formulations and novel delivery systems to mitigate misuse, which can dampen illicit production’s influence over time.

Key Market Drivers

- Increasing prevalence of chronic pain and cancer cases globally

- Aging populations requiring potent analgesics

- Development of novel fentanyl delivery systems

- Expansion of pharmaceutical manufacturing capacity in emerging markets

- Regulatory reforms supporting new formulations for pain management

Key Market Restraints

- Stringent regulatory controls curtailing supply and prescription

- Heightened public awareness of opioid addiction risks

- Legal liabilities linked to opioid misuse

- Competition from non-opioid analgesics and alternative therapies

- Challenges from clandestine illicit fentanyl production

Regulatory Outlook and Future Trends

The regulatory landscape is poised for ongoing tightening, especially concerning opioid prescribing and monitoring. Governments are investing in surveillance systems, prescription drug monitoring programs (PDMPs), and education initiatives to curb misuse. These measures could suppress growth initially but ultimately lead to more controlled, safer market expansion.

Innovation in drug formulations with abuse-deterrent properties will likely catalyze new product approvals, maintaining market relevance. Furthermore, increased focus on international cooperation in suppressing illicit fentanyl production can reshape supply chains.

Conclusion

The fentanyl market remains a complex interplay of medical demand fueled by pain management needs and widespread illicit use associated with overdose crises. While legal sales are projected to grow steadily, especially in emerging markets and through technological advances in formulations, regulatory and societal challenges persist. Stakeholders must navigate these factors prudently, balancing innovative growth strategies with public health objectives.

Key Takeaways

- The global fentanyl market is expected to grow modestly, reaching approximately USD 7.2 billion by 2030, driven by expanding medical applications and technological innovation.

- Regulatory controls and public health initiatives significantly influence sales trajectories, particularly in North America.

- Patent expirations and generic entry will pressure prices but also broaden access, expanding the therapeutic market.

- The illicit fentanyl trade complicates accurate market assessments and underscores the importance of strict enforcement and innovative abuse-deterrent formulations.

- Emerging markets offer substantial growth potential due to expanding healthcare infrastructure but require careful navigation of regulatory and societal challenges.

FAQs

Q1: How does the illicit fentanyl market affect legal pharmaceutical sales?

A1: The illicit market increases overall fentanyl consumption, often reducing demand for legally prescribed formulations, especially in regions experiencing high illegal trafficking, which can suppress legal sales growth.

Q2: What are the key innovations in fentanyl formulations expected over the next decade?

A2: Advancements include abuse-deterrent delivery systems, transdermal patches with improved safety features, and formulations integrating novel routes such as transmucosal delivery to enhance safety and compliance.

Q3: How do regulatory policies influence fentanyl sales globally?

A3: Strict scheduling, prescription monitoring, and enforcement reduce misuse and oversupply, potentially constraining sales but improving safety. Conversely, lenient regulations may increase access but raise abuse risks.

Q4: What markets are projected to see the fastest growth for fentanyl?

A4: Emerging regions in Asia-Pacific and Latin America, driven by infrastructure development and increasing healthcare adoption, are expected to experience the most rapid growth.

Q5: How can pharmaceutical companies mitigate risks associated with opioid litigation and public backlash?

A5: By innovating safer formulations, engaging in responsible marketing, collaborating with regulators, and supporting public health initiatives to reduce misuse and foster a sustainable market presence.

Sources:

[1] MarketsandMarkets, "Analgesics Market by Type, Application, and Region—Forecast to 2027," 2022.

More… ↓