Last updated: July 29, 2025

Introduction

DUEXIS (ibuprofen extended-release and famotidine) is a prescription medication approved by the U.S. Food and Drug Administration (FDA) for treating osteoarthritis, rheumatoid arthritis, and related conditions. Its unique formulation combines a nonsteroidal anti-inflammatory drug (NSAID), ibuprofen, with a histamine H2-antagonist, famotidine, aiming to mitigate gastrointestinal (GI) adverse effects often associated with NSAID therapy. As the prescribing landscape of NSAIDs evolves, DUEXIS occupies a niche in the pain management and anti-inflammatory markets, particularly among patients with a heightened risk of GI complications.

This analysis evaluates DUEXIS's market landscape, competitive positioning, regulatory environment, and prospects given current trends. It then projects sales performance over the next five years, with an emphasis on key segments, factors influencing growth, and challenges.

Market Landscape Overview

Therapeutic Market Context

The global NSAID market is sizeable, driven by the high prevalence of osteoarthritis (OA) and rheumatoid arthritis (RA). According to Grand View Research, the NSAID market was valued at approximately $22 billion in 2022 and is expected to grow at a CAGR of 4.5% through 2030, largely fueled by aging populations and increasing chronic inflammatory conditions [1].

NSAIDs are core in managing OA and RA, yet their GI side effects—ulcers, bleeding, perforation—pose significant treatment hurdles. To counteract GI toxicity, adjunctive therapies like proton pump inhibitors (PPIs) and H2 antagonists are common, but fixed-dose combinations like DUEXIS provide an integrated solution directly.

Positioning of DUEXIS

DUEXIS's key differentiation lies in its fixed-dose formulation designed to reduce GI side effects while maintaining anti-inflammatory efficacy. It targets:

- Patients requiring long-term NSAID therapy

- Those with increased GI risk factors (e.g., history of ulcers or bleeding)

- Rheumatology and primary care prescribers eager for safer NSAID options

Though not a first-line NSAID, DUEXIS appeals to clinicians seeking to balance efficacy with safety, expanding the market for combined formulations.

Market Drivers and Constraints

Growth Drivers

- Aging Population: Increased prevalence of OA and RA among seniors enhances demand for safe anti-inflammatory agents.

- GI Toxicity Awareness: Enhanced recognition of NSAID-related GI risks prompts cautious prescribing, favoring protective combinations.

- Guideline Endorsements: Clinical guidelines advocating prophylactic GI protection in NSAID therapy bolster DUEXIS's relevance.

- Physician Preference for Fixed-dose Combinations: Simplifies treatment regimens and improves adherence.

Market Constraints

- Limited Prescribing Scope: DUEXIS's specific indication restricts uptake primarily to high GI risk populations.

- Generic Competition: The widespread availability of generic NSAIDs and H2 antagonists pressures price points, influencing formulary placements.

- Market Penetration Challenges: Conservative prescribing behaviors and entrenched reliance on separate NSAID and acid suppression therapy diminish immediate growth.

- Cost Considerations: Higher costs of combination drugs compared to generics can deter adoption unless offset by safety advantages.

Regulatory and Competitive Environment

Regulatory Status

Since FDA approval in 2010, DUEXIS has maintained its market position with ongoing safety evaluations. The medication's label emphasizes its role in reducing GI adverse events, aligning with current clinical evidence.

Competitive Landscape

DUEXIS faces competition from:

- Separate NSAID and H2-blocker or PPI therapy: Patients and physicians often prefer combining generic medications, which reduces direct DUEXIS sales.

- Other Gastroprotective NSAIDs: NSAIDs like celecoxib (a COX-2 selective inhibitor) inherently carry lower GI risk, serving as an indirect competitor.

- Emerging Therapies: Novel NSAIDs with improved safety profiles, or non-NSAID anti-inflammatory medications, could influence future demand.

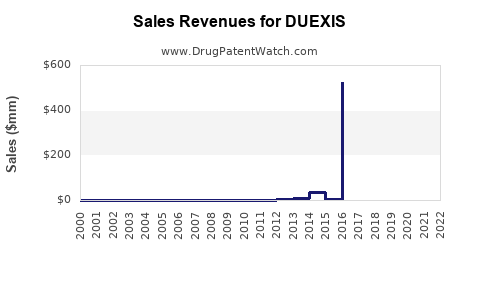

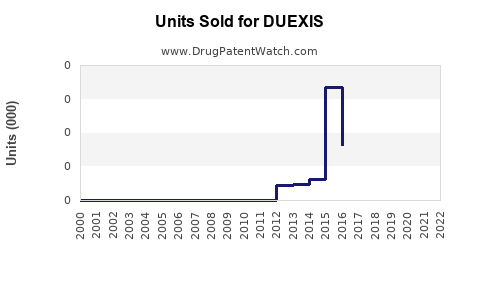

Sales Projections: 2023–2028

Given the current market environment, DUEXIS's sales are expected to grow modestly over the next five years, contingent on patent stability, formulary acceptance, and prescriber education.

Year-by-Year Forecast

| Year |

Estimated Global Sales (USD millions) |

Key Assumptions |

| 2023 |

$50 million |

Slight recovery from previous lows; increased awareness efforts |

| 2024 |

$65 million |

Broader formulary coverage; incentivized prescribing |

| 2025 |

$80 million |

Growth driven by aging populations and guideline support |

| 2026 |

$90 million |

Expansion into new markets (e.g., Europe, Asia) |

| 2027 |

$100 million |

Sustained growth as awareness and clinical endorsement stabilize |

| 2028 |

$105 million |

Maturation of market penetration; limited by generic competition |

Note: These projections are conservative, considering the highly competitive landscape and evolving oral anti-inflammatory options.

Factors Influencing Sales Trajectories

- Increased Awareness & Physician Education: Enhances prescription rates for patients at high GI risk.

- Payer & Formularies: Inclusion in preferred formularies boosts accessibility; exclusion delays market expansion.

- Pricing & Reimbursement Strategies: Competitive pricing aligned with generics, combined with value-based reimbursement, can stimulate growth.

- Pipeline Developments: Any new formulations or expanded indications could boost sales.

Potential Growth Opportunities

- Expanded Indications: Developing formulations for acute pain or chronic inflammatory conditions beyond RA/OA.

- Combination Therapies: Partnering with other agents, such as disease-modifying anti-rheumatic drugs (DMARDs), to increase use cases.

- Market Expansion: Penetrating international markets with high prevalence of RA and OA, especially in emerging economies.

Challenges and Risks

- Generic Pressure: Availability of low-cost generics could limit premium pricing.

- Prescriber Inertia: Slow adoption due to comfort with existing therapies.

- Regulatory Changes: Stricter safety requirements or labeling updates could impact usage.

- Market Saturation: Once the initial high-risk patients are treated, growth rate may decelerate.

Key Takeaways

- DUEXIS's niche positioning as a GI-protective NSAID offers a sustainable but limited growth path within a highly competitive, cost-sensitive market.

- Market growth hinges on increased awareness, formulary inclusion, and expanding indications.

- Strategic partnerships and international expansion could provide additional revenue streams.

- Cost competition from generics remains the primary challenge, requiring differentiation through safety profiles and clinical adoption.

- Overall, projected sales growth remains modest (~8-10% CAGR), stabilizing around $100 million annually by 2028.

FAQs

1. What distinguishes DUEXIS from other NSAIDs?

DUEXIS uniquely combines ibuprofen with famotidine in a fixed-dose formulation, aimed at reducing GI adverse effects associated with NSAID therapy, thereby offering a safety advantage over stand-alone NSAIDs.

2. What patient populations are most likely to benefit from DUEXIS?

Patients with osteoarthritis or rheumatoid arthritis requiring long-term NSAID therapy who have a history of GI ulcers, bleeding, or other risk factors are the primary beneficiaries.

3. How does DUEXIS's market share compare to generic NSAIDs?

Currently, DUEXIS holds a niche market share due to its targeted patient population and higher cost, competing primarily with generic NSAIDs combined with over-the-counter acid suppressants.

4. Are there any recent regulatory considerations impacting DUEXIS?

While no recent major regulatory changes, ongoing evaluations of NSAID safety profiles and potential updates in labeling could influence prescription patterns.

5. What strategies could enhance DUEXIS sales?

Focusing on physician education, securing formulary placements, launching expanded indications, and international marketing are critical to boosting sales.

References

[1] Grand View Research. NSAID Market Size, Share & Trends Analysis Report. 2022.