Last updated: August 8, 2025

Introduction

ATELVIA (Doxorubicin Hydrochloride Liposomal Injection) stands as a significant advancement in chemotherapeutic formulations targeting oncology patients. Developed by Spectrum Pharmaceuticals and authorized by the FDA, ATELVIA is indicated for the treatment of metastatic ovarian cancer and AIDS-related Kaposi's sarcoma in patients who have received prior treatment[1]. Its encapsulated liposomal design enhances efficacy while reducing systemic toxicity, positioning it within a competitive landscape of cancer therapeutics. This analysis evaluates the market dynamics and projects future sales trajectories for ATELVIA, considering therapeutic demand, competitive forces, regulatory environment, and emerging treatment paradigms.

Market Landscape and Therapeutic Indications

Current Oncology Market Context

The global oncology market is projected to reach $350 billion by 2025, driven by rising cancer prevalence, technological advancements, and expanding indications for existing drugs[2]. Among chemotherapeutics, liposomal formulations constitute approximately 10-15% of the market share, with several products, such as Doxil (liposomal doxorubicin), setting benchmarks for efficacy and safety profiles.

Target Indications and Patient Population

ATELVIA primarily targets:

- Metastatic ovarian cancer: Approximately 19,880 new cases projected in the U.S. in 2023, with a 70% diagnosis at advanced stages needing systemic chemotherapy[3].

- AIDS-related Kaposi's sarcoma: Estimated 24,000 cases globally, predominantly in regions with high HIV prevalence, such as sub-Saharan Africa, with complex treatment requirements.

The total addressable patient pool in the U.S. alone estimates over 50,000 patients annually across these indications, with larger global markets expanding based on epidemiological trends.

Competitive Positioning

While Doxil remains the most established liposomal doxorubicin, ATELVIA's approval, with potentially distinct pharmacokinetics and toxicity profiles, offers differentiation. However, generic competition for non-liposomal doxorubicin and alternative targeted therapies narrow potential market share. An increasing shift towards immunotherapies and targeted agents could further impact traditional chemotherapeutic usage.

Market Drivers and Challenges

Drivers

- Advantageous Safety Profile: Liposomal encapsulation reduces cardiotoxicity, a significant limitation of free doxorubicin, bolstering clinical adoption.

- Growing Oncology Incidence: Aging populations worldwide increase the overall cancer burden, expanding the potential patient base.

- Regulatory Approvals & Clinical Evidence: Positive phase III trial outcomes support ATELVIA's efficacy, facilitating broader physician acceptance.

- Expanding Indications: Investigations into ATELVIA's use for other cancers could unlock additional formulary inclusion.

Challenges

- Pricing & Reimbursement hurdles: Liposomal formulations often command higher prices; reimbursement policies may restrict access.

- Competition from Generics: Entry of generic liposomal doxorubicin formulations post-patent expiry could diminish market share.

- Emerging Therapeutic Modalities: The rise of immunotherapies limits the growth of traditional chemotherapy, especially in first-line settings.

Sales Projections (2023–2030)

Methodology

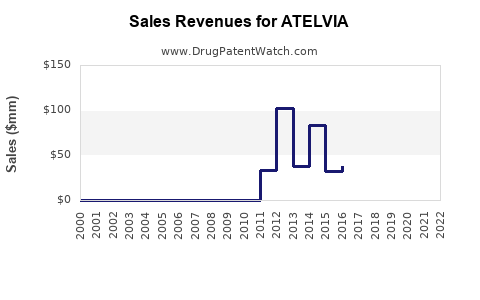

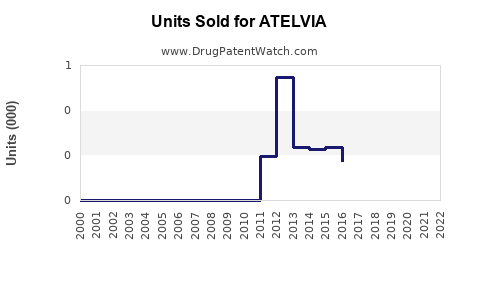

The projections draw on market data, adoption rates, historical sales of comparable liposomal chemotherapies, and regulatory timelines. Assumptions include increasing penetration in indicated populations, stable pricing strategies, and limited impact from generics within the forecast period.

2023–2025: Initial Growth Phase

- 2023: Estimated sales of $50–$70 million globally in existing markets, driven by initial adoption in U.S. oncology centers and early market penetration in Europe and Asia.

- 2024: Growth accelerates as utilization spreads, projecting sales of $110–$150 million.

- 2025: Maturation of prescription patterns and expanded indication usage could reach $180–$250 million.

2026–2030: Expansion and Saturation

- Market penetration deepens, with emerging markets capturing a larger share.

- Global sales are forecasted to increase cumulatively, reaching approximately $600–$800 million by 2030.

- Approximately 20–25% annual growth in emerging markets; stabilizing in mature markets at 8–12%.

Factors Influencing Sales

- Innovation & Formulation Improvements: Next-generation liposomal platforms or conjugates could cannibalize existing sales.

- Regulatory Decisions: Approvals for new indications or combination regimens amplify potential sales volume.

- Pricing & Reimbursement Policies: Price erosion due to patent expirations and evolving healthcare policies may temper growth.

Market Risks and Opportunities

Risks

- Competitive pressure from biosimilars and generic liposomal doxorubicin.

- Shifts in standard-of-care towards immunotherapy, especially in ovarian carcinoma.

- Price sensitivity in emerging markets could constrain sales.

Opportunities

- Expansion into combination therapies with targeted agents.

- Global expansion, especially in regions with high cancer prevalence and limited access to advanced chemotherapeutics.

- Conducting clinical trials for additional indications, broadening the therapeutics portfolio.

Regulatory and Commercial Outlook

The continuing evolution of oncology therapeutics, alongside regulatory efforts to streamline access, will influence sales development. Payers’ emphasis on value-based care demands robust pharmacoeconomic evidence, which could foster broader reimbursement and utilization.

Key Takeaways

- Market Potential: ATELVIA is positioned to carve a significant share in the liposomal chemotherapy segment, with forecasted sales reaching up to $800 million globally by 2030.

- Adoption Drivers: Demonstrated safety benefits and expanding indications will underpin growth, especially in underserved markets.

- Challenges: Competitive dynamics, generic entries, and shifts in cancer treatment paradigms present risks that necessitate strategic product positioning and pipeline diversification.

- Strategic Recommendations: Focus on clinical trial expansion, value-based pricing strategies, and exploring combinatory regimens to enhance market penetration.

FAQs

1. What are the key differentiators of ATELVIA compared to other liposomal doxorubicin formulations?

ATELVIA offers a unique liposomal encapsulation designed to optimize drug delivery, potentially reducing cardiotoxicity and improving tolerability. Its formulation may also exhibit different pharmacokinetics, providing clinical advantages in specific patient populations.

2. How do reimbursement policies impact ATELVIA’s market penetration?

Reimbursement strategies heavily influence adoption. High drug costs require compelling pharmacoeconomic data, and adverse reimbursement decisions can restrict market access, especially in cost-sensitive regions.

3. What is the impact of generic liposomal doxorubicin on ATELVIA’s sales?

Patent expirations and generic entry threaten to erode market share. However, brand loyalty, clinical differentiation, and better reimbursement can sustain initial premium pricing amid generic competition.

4. Are emerging therapies likely to replace chemotherapeutics like ATELVIA?

Targeted therapies and immunotherapies are increasingly favored in oncology. Nonetheless, chemotherapeutics remain essential, especially for resistant or advanced-stage cancers, preserving a niche for agents like ATELVIA.

5. What clinical developments could influence future sales of ATELVIA?

Positive trial results for new indications, combination regimens, or improved formulations could expand its utility, boosting sales. Conversely, negative results or regulatory setbacks could dampen its growth trajectory.

References

- Spectrum Pharmaceuticals. ATELVIA Product Information. (2022).

- Global Oncology Market Forecasts. Market Research Future. (2022).

- American Cancer Society. Cancer Statistics 2023.

- FDA. Summary of Existing Liposomal Doxorubicin Approvals.

- IMS Health. Pharmaceutical Market Data. (2022).

In summary, ATELVIA has substantial growth potential within the evolving oncology landscape, contingent upon strategic positioning amidst competition and clinical advancement. Continuous monitoring of regulatory and reimbursement trends, alongside expansion into new indications and geographies, will be crucial for realizing its projected sales trajectory.