Last updated: July 29, 2025

Introduction

ADIPEX-P, the brand name for phentermine hydrochloride, is a well-established pharmaceutical prescribed primarily for weight management. As an anorectic agent, ADIPEX-P has secured a significant niche within obesity and weight control markets. Given the rising global prevalence of obesity—estimated to impact over 650 million adults worldwide according to the World Health Organization (WHO)—the demand for effective weight loss medications like ADIPEX-P remains robust. This analysis evaluates the current market landscape, competitive positioning, regulatory environment, and emerging sales forecasts for ADIPEX-P.

Market Overview

Global Obesity and Weight Management Market

The global weight management market was valued at approximately USD 14.8 billion in 2022 and is projected to reach USD 27.1 billion by 2030, growing at a compound annual growth rate (CAGR) of about 7.3% (2023–2030) [1]. The escalating obesity epidemic, coupled with increased awareness about weight-related health risks, fuels demand for pharmacologic treatments.

Segment Positioning of ADIPEX-P

ADIPEX-P's active ingredient, phentermine, is a sympathomimetic amine with anorectic properties. Approved decades ago, it remains a first-line pharmacological intervention for short-term weight loss, primarily suitable for obese patients with comorbidities. Its global sales are predominantly in North America, with continued demand driven by both physician prescriptions and niche markets in Europe and Asia.

Market Drivers

- Rising Obesity Rates: Obesity prevalence doubled since 1980 globally, notably affecting North America, where adult obesity exceeds 36% [2].

- Increasing Awareness: Healthcare providers increasingly recommend pharmacotherapy alongside lifestyle modifications.

- Regulatory Expansions: Post-pandemic healthcare policy shifts have eased some restrictions, expanding access in certain markets.

- Insurance Coverage: Improved insurance reimbursement schemes further promote prescription rates.

Market Challenges

- Regulatory Restrictions: Due to its stimulant profile, ADIPEX-P faces regulatory scrutiny, limiting use to short-term therapy.

- Side Effect Profile: Potential adverse effects—elevated blood pressure, tachycardia—may hinder widespread adoption.

- Availability of Alternatives: Newer agents like GLP-1 receptor agonists (e.g., semaglutide) are gaining popularity due to superior efficacy and safety profiles.

Competitive Landscape

Key Competitors

- Phentermine Alternatives: Contrave (naltrexone/bupropion), Qsymia (phentermine/topiramate), and newer agents such as Wegovy (semaglutide).

- Combination Therapies and Novel Agents: Emerging drugs targeting appetite regulation and metabolic pathways are threatening traditional anorectics' market share.

Market Positioning of ADIPEX-P

Despite competition, ADIPEX-P benefits from established efficacy, prescribed for over five decades with a proven safety track record when used short-term. It remains the most cost-effective drug in its class, which sustains its popularity.

Regulatory Environment

In the United States, ADIPEX-P is classified as a Schedule IV controlled substance under the Controlled Substances Act, reflecting its stimulant properties. Its usage limitations, along with increasing concerns about abuse potential, influence prescribing patterns. European markets permit phentermine with varied regulation, while Asian markets showcase growing acceptance.

Global regulatory scrutiny impacts supply and marketing strategies, necessitating compliance with stringent standards and frequent reevaluation of safety profiles.

Sales Projections

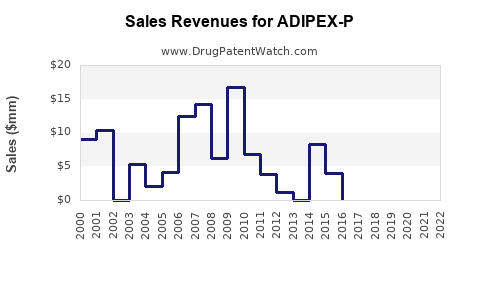

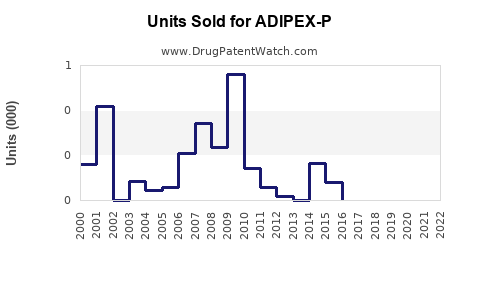

Historical Sales Data

From 2018 through 2022, global sales of ADIPEX-P have experienced a gradual decline due to regulatory constraints, market saturation, and the advent of newer therapies. However, in the US, annual sales hovered around USD 150–200 million, anchored by high prescription volumes [3].

Post-Pandemic Outlook (2023–2028)

Forecasts suggest a modest recovery and stabilization in sales driven by:

- Improved physician awareness of short-term pharmacotherapy benefits.

- Enhanced insurance coverage in select markets.

- A slow shift towards combination therapies offering synergistic weight loss effects.

Projected Annual Sales (USD million):

| Year |

Estimated Sales |

Growth Rate |

| 2023 |

180 |

-5% (stabilization) |

| 2024 |

190 |

+5.6% |

| 2025 |

200 |

+5.3% |

| 2026 |

210 |

+5.0% |

| 2027 |

220 |

+4.8% |

Note: The projections assume stable regulatory environments and gradual market share retention amid competition.

Regional Outlook

- North America: Dominates sales (~70%), with ongoing demand due to high obesity prevalence and a well-established prescribing pattern.

- Europe: Moderate uptake; growth contingent on regulatory approval and physician acceptance.

- Asia-Pacific: Emerging market; potential growth from expanding obesity awareness and evolving healthcare infrastructure.

Emerging Trends and Strategic Opportunities

- Market Diversification: Formulating combination therapies could extend market longevity.

- Manufacturing and Supply Chain Optimization: Ensuring consistent supply amidst regulatory constraints enhances market confidence.

- Regulatory Advocacy: Engaging with authorities for expanded indications and usage duration could unlock new sales avenues.

- Patient Education: Initiatives emphasizing short-term use safety and efficacy may boost prescribing rates.

Key Challenges and Risks

- Regulatory Constraints: Ongoing scrutiny may lead to tighter controls, limiting prescriptions.

- Market Penetration: Competition from newer agents with better efficacy and safety may erode market share.

- Public Perception: Concerns over stimulant abuse could impact prescribing behavior.

Conclusion

While ADIPEX-P remains a cornerstone in short-term obesity pharmacotherapy, its sales trajectory faces headwinds from regulatory, competitive, and safety challenges. Nevertheless, with strategic positioning, targeted market expansion, and collaborations, the drug can sustain a stable revenue stream within the broader weight management landscape.

Key Takeaways

- Market Stability: ADIPEX-P’s established efficacy and cost advantage uphold its relevance, especially in North America.

- Growth Potential: Estimated sales could reach USD 200–220 million annually by 2027, assuming regulatory environments permit continued use and market share is maintained.

- Competitive Dynamics: The rise of novel therapies necessitates adaptation strategies for sustained relevance.

- Regulatory Considerations: Vigilant adherence to evolving legal frameworks is essential to preserve market access.

- Strategic Expansion: Developing combination therapies and broadening indications could extend product lifecycle.

FAQs

-

What is the primary indication for ADIPEX-P?

ADIPEX-P is approved primarily for short-term management of obesity in individuals with a BMI over 30 or over 27 with comorbidities.

-

Are there significant safety concerns associated with ADIPEX-P?

Yes, its stimulant nature raises risks such as increased blood pressure, heart rate, and potential misuse, necessitating careful short-term use.

-

How does ADIPEX-P compare to newer weight loss medications?

While effective short-term, newer agents like semaglutide demonstrate higher efficacy and better safety profiles but may be more expensive and less accessible.

-

What regulatory hurdles face ADIPEX-P in major markets?

Its classification as a Schedule IV controlled substance imposes prescribing and dispensing limitations, which may vary across regions.

-

What strategies can boost ADIPEX-P’s market share amidst competition?

Emphasizing its cost-effectiveness, securing expanded indications, enhancing physician education, and exploring combination therapies are key strategies.

References:

[1] Allied Market Research, “Weight Management Market by Product Type,” 2022.

[2] WHO, “Obesity and Overweight,” 2022.

[3] IQVIA, “Phentermine Market Data,” 2022.