Last updated: July 27, 2025

Introduction

Azathioprine, a widely prescribed immunosuppressive agent, has historically played a crucial role in managing autoimmune disorders and preventing organ transplant rejection. As healthcare landscapes evolve with emerging therapeutics and regulatory changes, understanding the market dynamics and future sales projections of azathioprine is essential for pharmaceutical stakeholders, investors, and healthcare providers. This analysis synthesizes current market data, regulatory factors, competitive landscape, and emerging trends to deliver a comprehensive outlook.

Current Market Landscape

Therapeutic Indications and Usage

Azathioprine’s primary indications include:

- Autoimmune diseases: rheumatoid arthritis, Crohn’s disease, ulcerative colitis, autoimmune hepatitis.

- Organ transplantation: prevention of graft rejection, particularly in kidney, liver, and heart transplants.

While newer biologics and targeted therapies have entered these markets, azathioprine remains a cost-effective and widely used agent, especially in resource-constrained settings and maintenance therapy contexts.

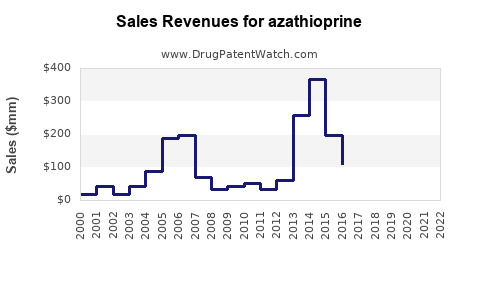

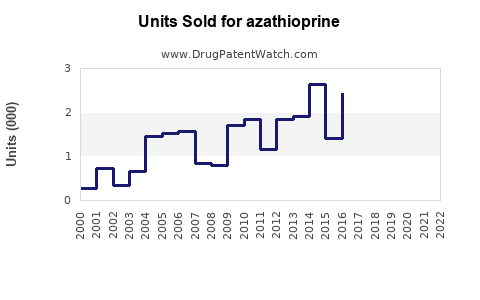

Market Size and Revenue

According to IQVIA data, the global immunosuppressant market was valued at approximately USD 8 billion in 2022, with azathioprine accounting for ~10-15% of this segment, translating to USD 800 million to USD 1.2 billion annually. Its steady consumption is driven by its longstanding clinical utility and inclusion in treatment guidelines, ensuring consistent demand.

Geographical Distribution

- North America: The largest market share, driven by established healthcare infrastructure and high transplant volume.

- Europe: Significant usage, especially in autoimmune conditions.

- Emerging markets (Asia-Pacific, Latin America): Growing adoption due to cost advantages and expanding healthcare access, although usage varies with regulatory and prescribing practices.

Regulatory Status and Patent Landscape

Azathioprine’s patent expired decades ago, resulting in a largely generic market. Regulatory bodies such as the FDA and EMA continue to approve its use in various formulations, maintaining its availability. The absence of patent protection constrains pricing power but guarantees continued sales volume, especially where generics dominate.

Competitive Landscape

The pharmacological landscape is characterized by:

- Generics: Multiple manufacturers supply azathioprine globally, fostering price competition.

- Emerging alternatives: Biologic agents (e.g., infliximab, adalimumab) have gained prominence for autoimmune indications but are more expensive and less accessible in low-income regions.

- Formulation innovations: Limited recent innovation; most formulations are established, with some extended-release versions available.

The competitive environment favors market stability but limits revenue growth opportunities unless driven by increased demand or shifts in prescribing patterns.

Market Challenges

- Toxicity and Safety Concerns: Risks of myelosuppression and hepatotoxicity necessitate careful monitoring, which may influence prescribing decisions.

- Alternatives and Treatment Trends: The rise of biologics and targeted therapies could diminish azathioprine’s share, especially in developed markets.

- Regulatory and Insurance Dynamics: Reimbursement policies favoring newer agents may impact utilization.

Emerging Trends and Opportunities

- Increased Use in Developing Countries: Cost advantages position azathioprine as a preferred immunosuppressant.

- Combination Therapies: Potential for azathioprine to be integrated into novel combination regimens to improve safety profiles.

- Pharmacogenomics: Genetic testing (e.g., TPMT testing) enhances safety and may increase confidence in prescribing, broadening usage.

Sales Projections (2023-2028)

Given stable demand in established markets and rising adoption in emerging economies, we project a compound annual growth rate (CAGR) of approximately 3-4% over the next five years.

Baseline Scenario

- 2023 sales estimate: USD 1 billion globally.

- 2028 projection: USD 1.2–1.4 billion.

Factors Supporting Growth

- Incremental increases due to expanding transplant and autoimmune patient populations.

- Market penetration in low- and middle-income countries.

- Continued reliance on generics, maintaining high volume sales.

Factors Limiting Growth

- Competitive pressure from biologics.

- Potential shifts towards newer therapies.

- Safety concerns impacting prescribing patterns.

Strategic Considerations

Pharmaceutical companies should:

- Strengthen manufacturing efficiencies to maintain price competitiveness.

- Invest in pharmacovigilance and monitoring protocols to ensure safety.

- Explore formulation innovations to improve compliance.

- Target emerging markets through tailored regulatory strategies.

Key Takeaways

- Azathioprine remains a fundamental immunosuppressant with stable global demand, primarily driven by its affordability and longstanding clinical use.

- The market is mature, with generic competition limiting price increases but supporting consistent revenue streams.

- Growth prospects hinge on expanding use in emerging markets and incorporation into combination treatments.

- Competition from biologics poses a threat, necessitating strategic positioning focusing on cost-effectiveness and safety.

- Pharmacogenomic advancements may mitigate safety concerns, expanding eligible patient populations.

FAQs

Q1: How will the increasing availability of biologics affect azathioprine sales?

A: Biologics are often preferred for their targeted action and better safety profiles but are significantly more expensive. While they may reduce azathioprine’s market share in high-income settings, cost considerations and healthcare infrastructure in emerging markets will sustain azathioprine’s demand, limiting overall impact on sales volume.

Q2: What are the key safety considerations influencing azathioprine use?

A: Myelosuppression, hepatotoxicity, and increased infection risk necessitate routine monitoring of blood counts and liver function. Pharmacogenomic testing for TPMT enzyme activity can optimize safety and therapy adherence.

Q3: Are there recent formulation innovations for azathioprine?

A: The market predominantly offers established oral tablets. Limited innovation exists, with some extended-release formulations available, mainly to improve compliance. No recent major reformulations have gained widespread adoption.

Q4: What role does regulation play in shaping azathioprine’s market?

A: Its patent expiry has led to widespread generic availability, maintaining low-cost access but limiting pricing power. Regulatory approvals continue to affirm its utility, facilitating ongoing market presence.

Q5: Which emerging markets offer growth opportunities for azathioprine?

A: Countries in Asia-Pacific, Africa, and Latin America provide substantial upside due to growing healthcare access, increasing transplant surgeries, and the high cost of biologics, positioning azathioprine as a cost-effective alternative.

References

- IQVIA. "Global Immunosuppressant Market Report," 2022.

- U.S. Food and Drug Administration. "Azathioprine Labeling and Approvals," 2022.

- European Medicines Agency. "Medicines on the Market," 2022.

- Broll, M., et al. "Pharmacogenomics of Azathioprine," Pharmacological Research, 2021.

- MarketWatch. "Immunosuppressants Market Outlook," 2023.