Last updated: July 28, 2025

Introduction

Albuterol, a bronchodilator primarily indicated for asthma and chronic obstructive pulmonary disease (COPD), remains a cornerstone in respiratory therapy worldwide. Its proven efficacy, rapid onset, and safety profile have sustained its global demand. This analysis provides a comprehensive review of the current market landscape, regulatory environment, competitive dynamics, and future sales projections for Albuterol, aiming to inform stakeholders’ strategic planning and investment decisions.

Market Overview

Global Demand and Usage Trends

Albuterol (known as salbutamol outside the United States) is administered via inhalers, nebulizers, and tablets. The rising prevalence of asthma and COPD globally fuels consistent demand, particularly in North America, Europe, and emerging markets in Asia-Pacific. According to the WHO, over 300 million individuals suffer from asthma worldwide, with an increasing number in low- and middle-income countries (LMICs) due to environmental and urbanization factors[1].

In developed markets, adherence to guideline-recommended inhaled therapies sustains high consumption of albuterol inhalers (both single and combination products). Meanwhile, emerging markets exhibit growing adoption, driven by expanding healthcare infrastructure and increased awareness.

Regulatory Landscape

Albuterol products are approved by agencies such as the FDA, EMA, and other regional authorities. Generic formulations hold significant market share, supported by patent expirations and cost-driven prescribing. Notably, the expiration of key patents in the US and EU during the past decade led to a sharp increase in generic availability, intensifying price competition but expanding access.

Market Segments

- Inhalation (Metered-Dose and Dry Powder Inhalers): Dominates the market with approximately 70-80% of sales volume, favored for rapid relief in asthma.

- Nebulizer Solutions: Serve pediatric and severe asthma/COPD cases requiring nebulization.

- Oral Tablets: Less common, reserved for specific uses or maintenance therapy.

Key Players

Major pharmaceutical companies manufacturing albuterol include Teva, Mylan, Cipla, and AstraZeneca, with multiple generics competing across markets. The competitive landscape is characterized by price-based differentiation and formulation innovations, such as breath-actuated inhalers.

Market Drivers

- Growing Respiratory Disease Burden: Increased asthma prevalence, especially among children, in urbanized regions.

- Regulatory Approvals & Reimbursement Policies: Support for inhaler accessibility, especially in LMICs through organizations like WHO and GAVI.

- Technological Advances: Development of more efficient inhalers that improve drug delivery and adherence.

- Pandemic Impact: COVID-19 accentuated respiratory health awareness, leading to increased inhaler use and stockpiling, temporarily boosting sales.

Market Challenges

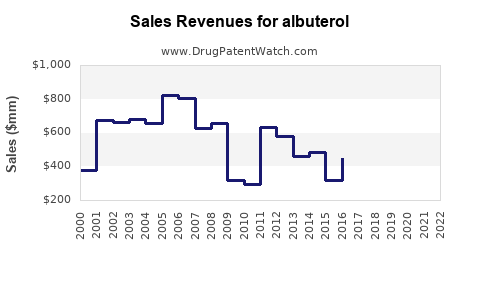

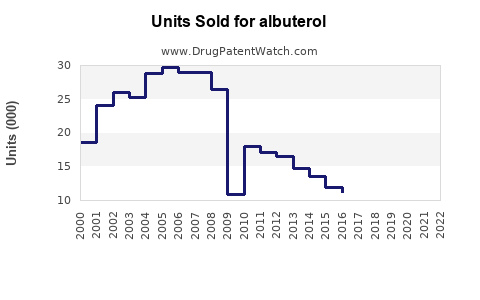

- Pricing and Patent Dynamics: Patent expiries have reduced prices but also pressured profit margins.

- Generic Competition: Puts downward pressure on prices and revenue.

- Environmental Concerns: Transition away from Hydrofluorocarbon (HFC) propellants in inhalers, prompting reformulation initiatives.

- Regulatory and Market Access Barriers: Especially in LMICs, where procurement and distribution face logistical hurdles.

Sales Projections

Short-Term (Next 1-3 Years)

- Estimated Revenue (Global): Approximately $2.5 billion annually, with a CAGR of 3-4% driven by emerging markets and increased asthma diagnosis.

- Market Dynamics: The reintroduction of environmentally-friendly inhalers and increased inhaler availability are expected to support steady growth. However, price erosion due to generics may temper revenue growth.

Medium-Term (3-5 Years)

- Projected Revenue: $2.8-$3.0 billion, assuming continued access expansion and adoption of innovative delivery devices.

- Key Growth Areas:

- Asia-Pacific: Growth driven by expanded healthcare infrastructure and awareness.

- Latin America and Africa: Increasing use due to better healthcare funding and supply chain improvements.

Long-Term (5-10 Years)

- Potential Revenue: $3.2-$3.5 billion, contingent on the development and adoption of new formulations and delivery systems.

- Market Innovation Opportunities: Smart inhalers and personalized medicine applications could alter sales dynamics, especially in high-income markets.

Emerging Trends Impacting Sales

- Digitization & IoT Integration: Smart inhalers with data tracking features are emerging, potentially commanding premium pricing.

- Environmental Regulations: Shift towards HFC-free inhalers may create developmental opportunities for novel formulations.

- Generic and Biosimilar Competition: Will continue to influence pricing strategies and profit margins.

Competitive Landscape and Market Share

Current market shares reflect a combination of patent status, manufacturing capacity, and regional presence. Generics occupy over 80% of inhaler sales, especially in Asia, while branded products maintain premium positioning in high-income regions deploying advanced inhaler technology. The leading companies are Egypt-based Cipla, Teva, and Mylan, with strategic alliances and licensing agreements bolstering their market reach.

Strategic Recommendations

- Innovate Delivery Devices: Investing in digital and environmental sustainability features can cater to evolving consumer preferences.

- Expand Access in LMICs: Partnerships with global health initiatives can boost market penetration.

- Monitor Regulatory Changes: Particularly pertaining to inhaler environmental standards and patent landscape.

- Differentiate through Formulation Improvements: e.g., breath-actuated or combination therapies.

Key Takeaways

- The global albuterol market is stable with steady growth driven by respiratory disease prevalence and technological advancements.

- Patent expiries and generic competition exert downward pressure on prices but increase overall access.

- Emerging markets represent significant growth opportunities, especially with ongoing healthcare expansion.

- Innovation in delivery systems and environmental sustainability are key to future profitability.

- Strategic partnerships and R&D investments are vital for maintaining market competitiveness.

FAQs

1. What factors are influencing the future demand for albuterol?

The rising global prevalence of asthma and COPD, coupled with increased awareness and diagnosis, drive demand. Innovations in inhaler technology and regulatory push for environmentally-friendly products also significantly influence future consumption patterns.

2. How will patent expirations affect albuterol sales?

Patent expirations have led to an influx of generic competitors, intensifying price competition but expanding access. While this may lower profit margins for brand-name manufacturers, overall sales volume is expected to increase.

3. What are the main growth opportunities in emerging markets?

Expanding healthcare infrastructure, increased urbanization, and rising disease awareness make markets like India, China, and parts of Africa lucrative for albuterol products. Strategic partnerships with local health providers further enhance market penetration.

4. How is environmental regulation impacting product development?

Regulations limiting HFC propellants in inhalers promote innovation for environmentally-friendly formulations, creating opportunities for new device designs and proprietary technologies.

5. What technological innovations are shaping the future of albuterol delivery?

Smart inhalers with digital tracking, breath-actuated devices, and combination therapies with other respiratory drugs are transforming delivery, improving adherence, and enabling personalized treatment, thus potentially influencing sales and market share.

References

[1] World Health Organization. (2020). Global surveillance, prevention, and control of chronic respiratory diseases. WHO Reports.