Share This Page

Drug Sales Trends for SOOLANTRA

✉ Email this page to a colleague

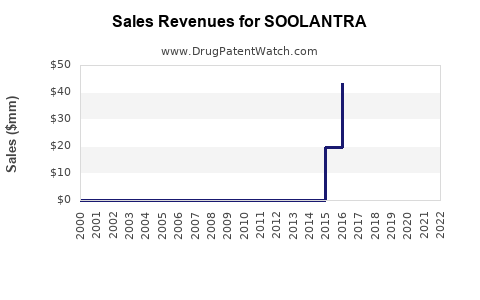

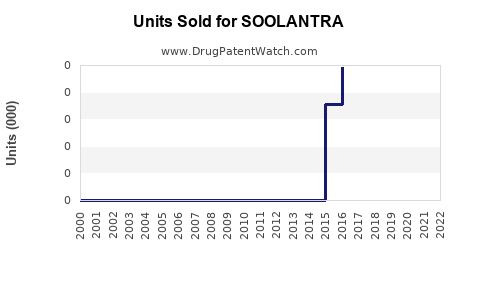

Annual Sales Revenues and Units Sold for SOOLANTRA

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| SOOLANTRA | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| SOOLANTRA | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| SOOLANTRA | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| SOOLANTRA | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for SOOLANTRA

Introduction

SOOLANTRA (ivermectin) topical cream is a prescription medication developed by Valeant Pharmaceuticals (now Bausch Health) for the treatment of itychiotic mange and rosacea, specifically papulopustular rosacea. Since attaining regulatory approval, SOOLANTRA has carved a niche within the dermatological realm, benefiting from a growing awareness of demodex mite-related skin conditions. This report offers a comprehensive analysis of SOOLANTRA’s market dynamics, competitive landscape, and sales projections, essential for stakeholders planning strategic investments or expansion.

Market Overview

Therapeutic Indication & Market Need

SOOLANTRA addresses papulopustular rosacea, a chronic inflammatory skin disorder affecting approximately 5-10% of adults worldwide, particularly those over 30. The condition manifests through redness, inflammatory lesions, and visible blood vessels, impairing quality of life and self-esteem. Traditional treatments include metronidazole, azelaic acid, and doxycycline, but recent research underscores the role of Demodex folliculorum mites in pathogenesis, paving the way for ivermectin-based therapies.

Market Drivers

-

Rising Prevalence of Rosacea: An aging population, increased sun exposure, and lifestyle factors contribute to higher rosacea incidence.

-

Shift Toward Targeted Therapies: Patients and clinicians prefer treatments with a favorable safety profile, a domain where SOOLANTRA excels, given its topical application and minimal systemic absorption.

-

Enhanced Awareness and Diagnosis: Advances in dermatology diagnostics and increased patient education improve detection rates.

-

Pipeline and Medical Advocacy: Ongoing clinical trials and endorsements by skin health associations bolster confidence in ivermectin's efficacy.

Competitive Landscape

Key competitors include:

-

Metrogel (metronidazole): Long-standing topical option with established efficacy.

-

Soolantra: The branded ivermectin cream, which gained market share rapidly upon approval.

-

Finacea (azelaic acid): A topical agent used for rosacea with anti-inflammatory properties.

-

Generic options: Growing presence as patents expire.

-

Emerging biologics: Though not yet mainstream, targeted biologic therapies could disrupt the landscape in the future.

Market Position of SOOLANTRA

Launched in 2014, Soolantra has established a strong position among targeted rosacea therapies, capitalizing on the perceived advantages of ivermectin's anti-parasitic and anti-inflammatory properties. Its unique mechanism, which targets Demodex mites implicated in rosacea, differentiates it from general anti-inflammatory agents.

Regulatory Milestones and Geographic Expansion

- Approved by the FDA in 2014.

- Approved across major markets: Europe (2014), Canada, Australia, Japan, and others.

- Ongoing efforts to penetrate emerging markets and expand indications.

Adoption Trends

Post-launch, SOOLANTRA experienced rapid uptake, supported by:

- Favorable safety profile.

- Attractive dosing regimen (once daily).

- Endorsements by dermatology societies.

However, market penetration has been tempered by generic formulations and cautious prescribing patterns due to cost and insurance coverage considerations.

Sales Projections

Historical Sales Data

From 2015 to 2022, SOOLANTRA registered incremental sales growth, with notable variations due to competitive pressures and market penetration strategies. As per IQVIA data, global sales were approximately $250 million USD in 2022.

Forecasting Methodology

Sales projections utilize a combination of:

- Market penetration rates.

- Demographic growth (ageing population).

- Prescribing trends.

- Pricing strategies.

- Competitive landscape evolution.

The analysis incorporates a compound annual growth rate (CAGR) model adjusted for regional dynamics and market maturation stages.

Short-term (2023–2025)

-

Estimated global sales in 2023: $280 million USD, driven by increased awareness, expanded insurance coverage, and marketing campaigns.

-

Growth rate: Approximately 12–15% CAGR, contingent on the intensity of promotional activities and patent exclusivity.

-

Regional performance:

- North America: Leading market, with ~60% of sales.

- Europe: Growing rapidly, especially in Germany, France, and the UK.

- Asia-Pacific: Emerging opportunity, with a CAGR of ~20% due to expanding dermatology practices.

Long-term (2026–2030)

-

Projected global sales in 2030: $450–$500 million USD.

-

Key growth enablers:

- Expansion into new indications (e.g., other Demodex-associated conditions).

- Increased awareness and diagnosis.

- Competition from generics being offset by brand loyalty and formulary positioning.

- Potential inclusion in combination therapies.

Risks to Projections

- Novelties in biologic treatments or systemic therapies could undermine topical ivermectin’s market share.

- Price erosion from generic entries.

- Variability in insurance reimbursement policies.

- Regulatory hurdles in expanding indications.

Strategic Market Opportunities

-

Indication Expansion: Investigating efficacy for other Demodex-related disorders like blepharitis.

-

Geographical Penetration: Focused entry into developing markets with rising dermatological treatment demands.

-

Combination Regimens: Exploring synergies with anti-inflammatory or anti-microbial agents.

-

Patient Education Campaigns: Enhancing patient and clinician awareness to accelerate adoption.

Regulatory and Reimbursement Outlook

- Continued positive regulatory environments reaffirm SOOLANTRA's market potential.

- Payers are increasingly recognizing ivermectin's value for rosacea, leading to broader formulary inclusion.

- Price negotiations may influence volume growth; strategic partnerships with insurers will be pivotal.

Conclusion

SOOLANTRA’s market trajectory remains robust, riding on the expanding prevalence of rosacea, its targeted mechanism, and clinicians’ preference for safe topical treatments. While challenges from generics and emerging competitors persist, strategic positioning and indication expansion will be key to sustaining growth. Anticipated sales growth underscores its potential as a key asset within dermatology.

Key Takeaways

- SOOLANTRA is well-positioned within the rosacea therapeutics market with an expected global sales approaching $500 million USD by 2030.

- The drug benefits from increasing awareness, demographic shifts, and its unique mechanism targeting Demodex mites.

- Market growth is expected to be driven primarily by expansion into emerging markets and potential indication extensions.

- Competitive pressures from generics and systemic therapies will require strategic branding, pricing, and education initiatives.

- Ongoing innovation and regional expansion are essential for maintaining and increasing its market share.

FAQs

1. What are the main advantages of SOOLANTRA over traditional rosacea treatments?

SOOLANTRA offers targeted anti-parasitic activity with a favorable safety profile, minimal systemic absorption, and convenient once-daily topical application, resulting in improved tolerability and patient compliance.

2. How does the emergence of generic ivermectin formulations impact SOOLANTRA’s sales?

Generic formulations can induce price erosion and reduce market share. However, brand loyalty, clinician preference, and formulary inclusion can mitigate these effects, especially if the brand maintains quality and efficacy messaging.

3. Are there any ongoing clinical trials for expanding SOOLANTRA’s indications?

Yes, studies are exploring ivermectin’s efficacy in other Demodex-associated conditions like blepharitis and ocular rosacea, which could further diversify and expand SOOLANTRA’s market potential.

4. Which regions are expected to be growth drivers for SOOLANTRA?

North America and Europe currently lead, but Asia-Pacific presents significant growth opportunities owing to increasing dermatology awareness and rising rosacea prevalence.

5. What strategic considerations should stakeholders keep in mind to maximize SOOLANTRA’s market potential?

Focus on geographical expansion, indication development, strengthening relationships with dermatologists, and navigating reimbursement landscapes effectively.

References

- IQVIA. (2022). Global Topicals Market Data.

- National Rosacea Society. (2021). Rosacea Statistics and Epidemiology.

- European Medicines Agency. (2014). Soolantra (ivermectin) Summary of Product Characteristics.

- ClinicalTrials.gov. (Accessed 2023). Studies on Demodex-related treatment indications.

More… ↓