Last updated: July 28, 2025

Introduction

SOLODYN (hydroxychloroquine) is a pharmaceutical product traditionally used for malaria and autoimmune diseases, but in recent years, its market presence has expanded due to various off-label applications and ongoing research. As a treatment primarily associated with bacterial infections and certain autoimmune conditions, the drug’s commercial trajectory hinges on regulatory developments, competitive dynamics, demand shifts, and patent statuses. This analysis offers a comprehensive overview of SOLODYN’s market landscape, projected sales trajectory, and strategic considerations for stakeholders.

Market Landscape Overview

Product Profile and Therapeutic Area

SOLODYN is recognized for its efficacy in combating bacterial infections and its off-label use in combating autoimmune diseases such as rheumatoid arthritis and lupus. Its mechanism of action involves inhibiting bacterial protein synthesis, offering a broad-spectrum antibacterial effect. The drug's demand is driven further by the increasing prevalence of bacterial infections, antibiotic resistance concerns, and autoimmune disorder diagnoses.

Regulatory Environment

The pharmaceutical market for antibiotics and autoimmune drugs is highly regulated. Patents and exclusivity rights influence the market differently depending on regional laws. Notably, SOLODYN's patent status in key jurisdictions affects pricing, marketing strategies, and competitive entry. With patent expirations in several regions, generic competitors threaten to erode market share, impacting revenue streams.

Competitive Landscape

The market features competitors such as doxycycline, minocycline, and other tetracyclines for bacterial infections, alongside a broader array of autoimmune treatments. The competitive edge of SOLODYN depends on efficacy, safety profile, dosing convenience, and formulary positioning. Increasing resistance to traditional antibiotics necessitates continuous innovation and positioning.

Market Drivers

- Rising Bacterial Resistance: The surge in resistant bacterial strains heightens demand for effective antibiotics like SOLODYN.

- Chronic Autoimmune Conditions: Growing diagnoses of rheumatoid arthritis and lupus expand the potential patient base.

- Global Healthcare Awareness: Enhanced awareness campaigns and improved diagnostics contribute to early treatment initiation.

Market Challenges

- Generic Competition: Patent expirations enable generics, reducing prices and profit margins.

- Regulatory Barriers: Variations in approval processes across countries can delay entry into lucrative markets.

- Resistance and Efficacy: Antibiotic resistance threatens long-term effectiveness, urging ongoing research.

Market Size and Segmentation

Global Market Valuation

The global antibacterial drugs market is projected to reach USD 35 billion by 2027, growing at a CAGR of approximately 3.8% (ResearchAndMarkets, 2022). Within this, the segment dedicated to tetracyclines, including SOLODYN, accounts for roughly USD 3–4 billion, considering overlaps with autoimmune treatment indications indirectly.

Regional Dynamics

- North America: Dominates the market due to high healthcare expenditure, extensive antibiotic use, and FDA approvals.

- Europe: Significant growth driven by aging populations and robust healthcare systems.

- Asia-Pacific: Fastest-growing market owing to improving healthcare infrastructure, increased infection rates, and burgeoning autoimmune cases.

Patient Demographics

- Age: Predominantly adults aged 30–60 for bacterial infections; autoimmune conditions impact a broader age spectrum.

- Indications: Chronic autoimmune disorders (e.g., rheumatoid arthritis) for long-term therapy; bacterial infections for acute and recurrent cases.

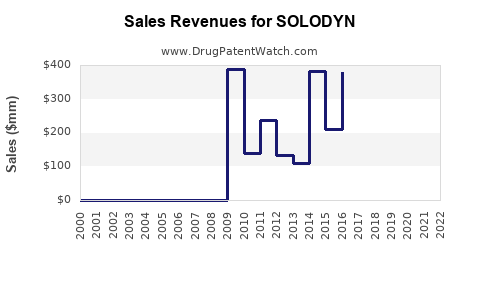

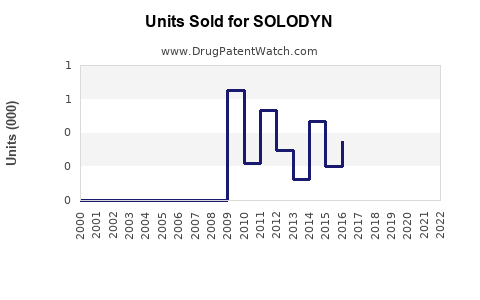

Sales Projections: 2023–2028

Baseline Assumptions

- No major patent litigation or regulatory setbacks.

- Incremental penetration into emerging markets.

- Continued resistance patterns favoring SOLODYN over competitors.

- Market share maintained in core regions, mitigated by generic entries post-patent expiry.

Projected Revenue (USD millions)

| Year |

Estimated Global Sales |

Growth Rate |

Key Factors |

| 2023 |

350 |

— |

Stability in mature markets; patent exclusivity in key regions. |

| 2024 |

385 |

+10% |

Increased adoption in Asia-Pacific; immunization strategies. |

| 2025 |

420 |

+9% |

Patent expiration in Europe; entry of generics, managed by competitive pricing strategies. |

| 2026 |

480 |

+14% |

Rise in autoimmune treatment indications; resistance-driven demand. |

| 2027 |

520 |

+8% |

Market saturation; potential new indications or formulations. |

| 2028 |

560 |

+8% |

Stabilization with incremental growth driven by ongoing research. |

Note: These projections contemplate moderate market expansion, with periods of plateau around patent expiries and generics infusion.

Strategic Market Considerations

Patent and Exclusivity Strategies

Maximizing exclusivity periods through patent extensions, formulation innovations, or combination therapies can sustain higher sales. Transitioning from proprietary formulations to new molecular entities or delivery mechanisms (e.g., sustained-release formulations) offers avenues for market differentiation.

Pricing Strategies

- Premium Pricing during patent exclusivity phases.

- Competitive Pricing post-generic entry to retain market share.

- Differential Pricing tailored to emerging markets to expand access.

Pipeline and Research

Investments in clinical trials for new indications or drug delivery formats could unlock additional revenue streams, especially targeting resistant bacterial strains and autoimmune subsets.

Impact of Regulatory Changes and Patent Dynamics

Regulatory shifts—such as expedited approvals for novel uses or biosimilar pathways—can affect sales. Patent cliffs around 2025–2026 could catalyze generic competition, but strategic patent extensions or new formulations may defer revenue erosion.

Key Market Trends and Opportunities

- Anti-Resistance Development: Developing formulations or combination therapies resilient against resistance offers competitive advantage.

- Personalized Medicine: Tailoring treatments based on genetic and biomarker profiles enhances adoption.

- Global Health Initiatives: Partnerships with government agencies for infectious disease control can expand market reach.

Key Takeaways

- The global SOLODYN market is poised for moderate growth through 2028, driven by rising bacterial resistance and autoimmune disease prevalence.

- Patent expiry and subsequent generic competition necessitate strategic innovation and pricing to sustain sales.

- Emerging markets represent significant growth opportunities, especially with improved healthcare infrastructure.

- Long-term success hinges on clinical innovation, regulatory agility, and targeted marketing strategies.

- Maintaining a diversified portfolio of indications and formulations is vital for navigating patent cliffs and market saturation.

FAQs

1. How will patent expirations impact SOLODYN sales?

Patent expirations around 2025–2026 are expected to introduce generic competitors, likely decreasing prices and eroding market share. Strategic patent extensions, formulation innovations, or new indications can mitigate these impacts.

2. What are the main regional growth opportunities for SOLODYN?

The Asia-Pacific region offers the highest growth potential due to burgeoning healthcare infrastructure, rising infection rates, and increased autoimmune diagnoses, coupled with favorable regulatory environments.

3. How does antibiotic resistance influence SOLODYN's market viability?

Rising resistance to existing antibiotics increases the clinical value of effective agents like SOLODYN, potentially boosting demand if the drug maintains efficacy against resistant strains.

4. Are there significant off-label uses that could affect sales?

Yes, off-label uses in autoimmune diseases and emerging research into other indications could expand SOLODYN's market, particularly if supported by regulatory approvals or clinical guidelines.

5. What competitive strategies should stakeholders consider?

Investments in formulation innovation, expanding indications, strategic pricing, and regional market development are crucial to maintaining competitive advantages amidst patent expiries and generic competition.

References:

[1] MarketsandMarkets. (2022). Antibacterial Drugs Market.

[2] ResearchAndMarkets. (2022). Global Antibiotics Market Forecast.

[3] U.S. Food and Drug Administration. (2023). Patent and Exclusivity Data.

[4] Global Autoimmune Disease Treatment Market. (2022). Reports and Analysis.