Last updated: July 28, 2025

Introduction

RAPAFLO (silodosin) is a selective alpha-1 adrenergic receptor antagonist primarily indicated for the symptomatic treatment of benign prostatic hyperplasia (BPH) in men. Since its FDA approval in 2008, RAPAFLO has positioned itself within the competitive landscape of BPH therapies, which encompasses generic options, other branded alpha-blockers, and emerging treatment modalities. Accurate market analysis and sales projections are essential for stakeholders aiming to capitalize on growth opportunities and mitigate risks in the urology segment.

Market Landscape Overview

The global BPH treatment market has experienced consistent expansion, driven by aging populations and increased awareness of BPH management. According to recent industry reports, the BPH therapeutics market was valued at approximately USD 4.5 billion in 2022, with a compound annual growth rate (CAGR) of around 6% projected through 2028 [1].

The treatment algorithms include alpha-adrenergic antagonists (e.g., tamsulosin, silodosin), 5-alpha-reductase inhibitors (e.g., finasteride, dutasteride), and combination therapies. Among these, selective alpha-1A blockers such as silodosin offer benefits of improved selectivity, resulting in fewer cardiovascular side effects and enhanced tolerability.

Key Market Segments for RAPAFLO

1. Geographic Markets:

- United States: Largest market share due to high prevalence of BPH, advanced healthcare infrastructure, and extensive prescribing of alpha-blockers.

- Europe: Significant growth driven by aging demographics and healthcare modernization.

- Asia-Pacific: Rapidly expanding market, with developing economies increasingly adopting newer BPH treatments.

2. Prescriber Demographics:

- Urologists and primary care physicians form the core prescribing base.

- Increasing awareness campaigns and clinical guidelines favoring selective alpha-blockers boost RAPAFLO prescriptions.

3. Competitive Landscape:

- Major competitors include tamsulosin, alfuzosin, and doxazosin.

- Patent protections have expired or are approaching expiry for many competitors, positioning generics prominently.

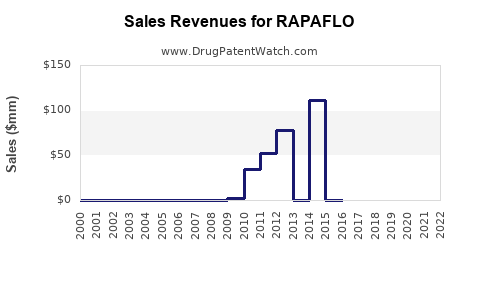

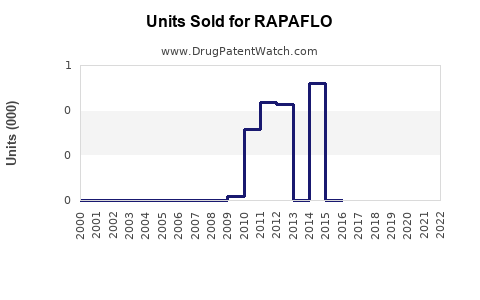

- RAPAFLO was protected by patent until mid-2015; subsequent generic entries have impacted sales but with an ongoing role for branded silodosin in select patient groups.

Market Dynamics and Drivers

1. Demographic Trends:

- The aging male population (over 50) continues to grow, with estimates indicating that approximately 50% of men over 50 suffer from BPH, and prevalence increases to 80% beyond age 70 [2].

2. Efficacy and Safety Profile:

- RAPAFLO's high selectivity for alpha-1A receptors results in fewer cardiovascular and hypotensive side effects, making it preferable for certain patient cohorts.

- Acceptable tolerability supports adherence and sustained use.

3. Prescribing Trends:

- Clinical guidelines favor the use of selective alpha-blockers as first-line therapy.

- Increasing primary care management of BPH reduces referral delays and broadens treatment reach.

4. Patent and Regulatory Influence:

- Patent expirations have introduced generics, reducing unit prices but expanding access.

- Ongoing patent challenges or exclusivity extensions influence market shares and pricing strategies.

Sales Projections (2023–2028)

Baseline Scenario:

Assuming steady growth driven by demographic trends, increased physician awareness, and expanding patient access, total sales for RAPAFLO are projected to grow at a CAGR of approximately 4-6% during 2023–2028.

- 2023: Estimated global sales of USD 400 million.

- 2024–2025: Moderate growth to USD 440–470 million, factoring in increased prescribing and market penetration.

- 2026–2028: Accelerated growth as emerging markets adopt RAPAFLO and brand loyalty sustains higher price points; projections reach USD 530–600 million by 2028.

Considerations Influencing Projections:

- Patent Expirations: Generics entering the market could pressure unit prices, but strategic branding and targeted marketing can mitigate revenue losses.

- Market Penetration Strategies: Collaborations with healthcare providers and patient support programs are vital.

- Regulatory Changes: Approvals of new formulations or indications may boost sales.

- Competitive Responses: Price competition and the introduction of novel therapies (e.g., minimally invasive surgical options, new medications) could impact growth trajectories.

Risks and Challenges

- Generic Competition: Loss of patent exclusivity shortens life cycle but also widens market access.

- Market Saturation: Early adopters may be replaced by cheaper generics, impacting margins.

- Regulatory Hurdles: Potential delays or restrictions on marketing new formulations or indications.

- Patient Preferences: Increasing favorability for minimally invasive procedures may reduce pharmacological treatment duration.

Conclusion

RAPAFLO remains a valuable player within the BPH market, balancing efficacy, safety profile, and prescriber acceptance. Continuous growth hinges on strategic positioning amidst patent expiries, generics' proliferation, and evolving clinical guidelines. An optimistic sales outlook underscores the importance of innovation, targeted marketing, and geographic expansion.

Key Takeaways

- The global BPH market is projected to grow at a CAGR of 6%, with RAPAFLO positioning favorably within this landscape.

- Sales are expected to reach USD 530–600 million by 2028, driven by demographic trends and improved prescriber awareness.

- Patent expirations introduce pricing pressures; effective branding and market differentiation remain crucial.

- Emerging markets offer significant growth opportunities, contingent upon regulatory approvals and healthcare infrastructure investments.

- Competitive dynamics necessitate vigilance regarding generic entries, new therapy modalities, and shifting clinical guidelines.

FAQs

1. How does RAPAFLO compare to other alpha-blockers in terms of efficacy?

RAPAFLO (silodosin) selectively targets alpha-1A adrenergic receptors, offering comparable efficacy to tamsulosin, with a potentially better side effect profile, especially concerning orthostatic hypotension.

2. What impact have patent expirations had on RAPAFLO sales?

Patent expirations around 2015 led to increased generic competition, reducing unit prices but also expanding market access, which has resulted in a moderated but sustained sales performance.

3. Which regions present the most promising growth opportunities for RAPAFLO?

Emerging markets in Asia-Pacific and Latin America demonstrate significant potential due to rising BPH prevalence and improving healthcare infrastructure.

4. What are the main barriers to increasing RAPAFLO sales?

Key barriers include the availability of generics, shifting prescriber preferences toward surgical or minimally invasive procedures, and evolving regulator policies.

5. Are there new formulations or indications for RAPAFLO in development?

As of now, no new formulations are in advanced stages; however, continuous research into combination therapies and newer indications may influence future sales dynamics.

References

[1] Market Research Future. "Benign Prostatic Hyperplasia (BPH) Therapeutics Market," 2022.

[2] Johns Hopkins Medicine. "Benign Prostatic Hyperplasia (BPH): Symptoms and Treatment," 2022.