Last updated: July 29, 2025

Introduction

Propranolol, marketed primarily under the brand name Inderal, is a non-selective beta-adrenergic antagonist first introduced in 1964. It remains a cornerstone in cardiovascular treatment, primarily for hypertension, arrhythmias, angina, and more recently, for managing anxiety and certain neurological conditions. With its extensive indications, established efficacy, and broad global adoption, Propranolol commands a significant position in the generic and branded pharmaceutical markets. This analysis examines current market dynamics, key growth drivers, competitive landscape, regulatory environment, and projected sales trajectories for Propranolol over the next five years.

Market Overview

Global Market Size and Current Status

The global beta-blocker market was valued at approximately USD 4.3 billion in 2022, with Propranolol accounting for over 50% of the segment owing to its first-mover advantage, extensive clinical data, and broad spectrum of approved uses. The market's growth is driven by increasing cardiovascular disease prevalence, expanded clinical indications, and rising awareness of mental health conditions amenable to beta-blocker therapy.

Key Markets

North America, with high adoption rates for cardiovascular therapies and mental health management, leads the market, accounting for roughly 40% of global sales. Europe follows, benefitting from well-established healthcare infrastructure and clinical guidelines endorsing Propranolol's use in multiple indications. The Asia-Pacific region is poised for the fastest growth, driven by increasing urbanization, economic development, and a rising burden of hypertension and neurology-related conditions.

Market Trends

- Generic Penetration: The patent expiry of brand-name formulations has opened the market to generic competitors, reducing prices and increasing accessibility.

- Expanded Indications: Growing evidence supports off-label and new indications, like therapy for migraine prophylaxis and performance anxiety, expanding potential patient populations.

- Formulation Innovation: Development of sustained-release formulations enhances patient compliance, potentially increasing market share.

Competitive Landscape

Major Players

Generic pharmaceutical companies dominate the Propranolol market, with key players including Teva Pharmaceuticals, Sandoz, Mylan (now part of Viatris), and Lupin. These firms leverage cost leadership and extensive distribution channels.

Branded formulations, though declining, are still significant in specific regions, particularly in countries with slower generic penetration or preference for established brands.

Pricing and Reimbursement

Price sensitivity remains high due to product commoditization. Reimbursement policies vary, with broad coverage in the US, Europe, and developed Asia, ensuring steady demand.

Regulatory Environment

Strict regulation in developed countries facilitates high safety and efficacy standards, but also challenges faster market access. Regulatory harmonization efforts, such as ICH guidelines, streamline approval processes for formulations.

Sales Projections (2023-2028)

Forecast Assumptions

- Continued rise in cardiovascular disease prevalence globally.

- Growing acceptance of Propranolol for migraine prophylaxis and performance anxiety.

- Increase in off-label use driven by emerging research.

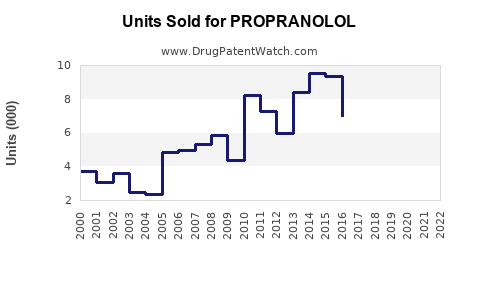

- Sustained generic competition leading to price erosion but higher volume sales.

- Regulatory approvals expanding indications in select markets.

Projected Market Growth

The global Propranolol market is expected to grow at a CAGR of approximately 4.2% from 2023 to 2028, reaching an estimated USD 6.2 billion by 2028.

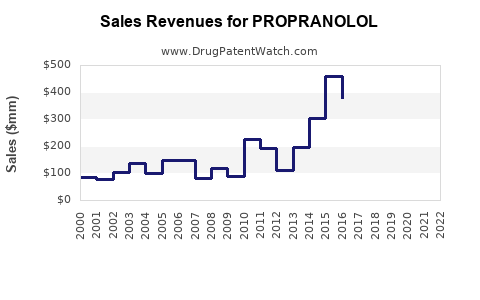

Year-by-Year Breakdown

- 2023: USD 4.8 billion

- 2024: USD 5.0 billion (growth driven by emerging markets and expanded indications)

- 2025: USD 5.3 billion (generic competition stabilizes, but increased volume offsets price decline)

- 2026: USD 5.6 billion (entry into new regulatory-approved indications)

- 2027: USD 5.9 billion (steady expansion in Asia-Pacific and Latin America)

- 2028: USD 6.2 billion

Regional Breakdown

- North America: Dominates with ~40% share, driven by high diagnosis rates and reimbursement stability.

- Europe: Accounts for approximately 25%, with steady growth amid aggressive generic competition.

- Asia-Pacific: Fastest growth, projected CAGR of 6%, driven by expanding healthcare infrastructure.

- Other regions: Latin America, Middle East, and Africa contribute to incremental growth due to increased healthcare access.

Factors Influencing Market and Sales Trajectory

- Disease Burden: Global rise in hypertension and cardiac conditions propels demand.

- Emerging Indications: Evidence supporting use in migraine and anxiety expands patient pools.

- Regulatory Approvals: Approvals for formulations suitable for pediatric and elderly populations could enhance sales.

- Patent and Regulatory Barriers: Patent expirations or new patent protections significantly influence market dynamics.

- Pricing Trends: Price erosion due to generic competition could dampen per-unit revenue but may increase overall volumes.

Challenges and Opportunities

Challenges

- High generic competition and price erosion impact profits.

- Regulatory hurdles in some markets may delay entry for new formulations.

- Off-label use may pose legal and safety concerns in some jurisdictions.

- Competition from newer, more selective beta-blockers and alternative therapies.

Opportunities

- Developing innovative formulations like transdermal or long-acting versions.

- Targeted expansion into emerging markets with rising healthcare budgets.

- Leveraging digital health tools to optimize adherence and outcomes.

- Clinical research to expand accepted indications, enhancing market penetration.

Conclusion

Propranolol's position as a foundational cardiovascular agent, combined with its versatility and affordability, ensures sustained demand globally. Projected modest yet steady growth reflects mature markets’ dynamics and competitive pressures, balanced by emerging indications and expanding geographic reach. Companies strategically investing in formulation innovation, geographic expansion, and clinical research are well-positioned to capitalize on this established but evolving market.

Key Takeaways

- The global Propranolol market is projected to grow at approximately 4.2% CAGR from 2023 to 2028, reaching an estimated USD 6.2 billion.

- Generic competition will dominate, leading to price erosion but increased overall sales volume.

- North America remains the largest market, with Asia-Pacific offering significant growth opportunities.

- Emerging indications like migraine prophylaxis and anxiety management are expanding the Patient Market.

- Continued innovation and geographic expansion are vital to maintaining market share amid commoditization pressures.

FAQs

-

What are the primary therapeutic indications of Propranolol?

Propranolol is chiefly used for hypertension, arrhythmias, angina, migraine prophylaxis, performance anxiety, and certain tremors.

-

How does patent expiration affect Propranolol sales?

Patent expiry has led to widespread genericization, reducing prices but increasing volume and accessibility in various markets.

-

Which regions are expected to see the highest growth for Propranolol?

The Asia-Pacific region is expected to experience the fastest growth driven by expanding healthcare infrastructure and increasing prevalence of cardiovascular diseases.

-

Are there new formulations or indications for Propranolol under development?

Yes, sustained-release formulations and expanding indications, including off-label uses, are areas of ongoing research and development.

-

What challenges does the Propranolol market face going forward?

Challenges include intense price competition, regulatory hurdles, emerging competitors with newer drugs, and concerns related to off-label use.

Sources:

[1] MarketResearch.com, "Global Beta-Blockers Market Size & Share Analysis," 2022.

[2] IQVIA, "Pharmaceutical Market Overview," 2022.

[3] World Health Organization, "Cardiovascular Disease Statistics," 2022.

[4] Evaluate Pharma, "Top Growth Drivers in Cardiology," 2022.