Share This Page

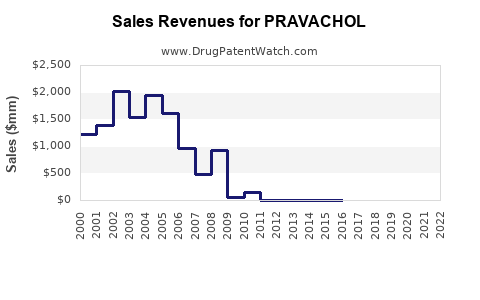

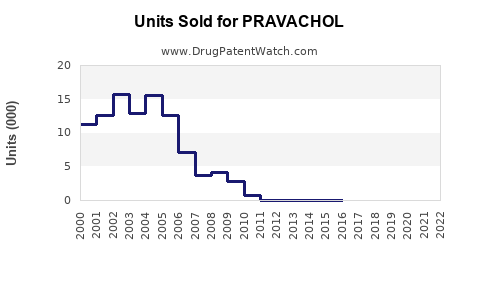

Drug Sales Trends for PRAVACHOL

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for PRAVACHOL

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| PRAVACHOL | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| PRAVACHOL | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| PRAVACHOL | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| PRAVACHOL | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| PRAVACHOL | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| PRAVACHOL | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| PRAVACHOL | ⤷ Get Started Free | ⤷ Get Started Free | 2016 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for PRAVACHOL (Pravastatin Sodium)

Introduction

PRAVACHOL (pravastatin sodium), a statin-class cholesterol-lowering medication, plays a pivotal role in managing hyperlipidemia and reducing cardiovascular risk. Since its introduction by Bristol-Myers Squibb in 1986, pravastatin has gained significant market traction due to its efficacy and favorable safety profile. This analysis evaluates the current market landscape for PRAVACHOL, identifies growth drivers, assesses competitive dynamics, and projects future sales trajectories.

Market Overview

Global Cardiovascular Disease and Hyperlipidemia Market

Cardiovascular disease (CVD) remains the world's leading cause of death, accounting for approximately 31% of global mortality [1]. The rise in prevalence of hyperlipidemia, driven by sedentary lifestyles, unhealthy diets, and aging populations, underpins the demand for lipid-lowering agents such as pravastatin. The global hyperlipidemia treatment market was valued at around USD 22 billion in 2022, with an anticipated compound annual growth rate (CAGR) of 4.5% over the next five years [2].

Regulatory Status and Patent Landscape

PRAVACHOL was initially patent-protected until the early 2000s. Its patent expiry led to the entry of numerous generic versions, intensifying price competition but also increasing accessibility. While the original molecule is off-patent, recent innovations in statin formulations and combination therapies offer new avenues for market expansion.

Current Market Dynamics

Market Penetration and Patients Treated

PRAVACHOL has retained a steady market share within the statin segment, especially among patients who are intolerant to higher-potency statins like atorvastatin or rosuvastatin. Physicians often prescribe pravastatin owing to its favorable side effect profile, particularly regarding drug interactions and safety in the elderly.

Data suggests that approximately 10-15% of hyperlipidemic patients are prescribed pravastatin globally. In the United States, pravastatin accounts for roughly 8% of statin prescriptions, reflecting its niche but significant position [3].

Competitive Landscape

The statin market is highly competitive, dominated by atorvastatin and rosuvastatin, which attract a larger share owing to their potency and once-daily dosing. Nonetheless, pravastatin’s safety profile maintains it as a preferred option for certain patient groups.

Generic formulations considerably decreased pravastatin's price, making it accessible, especially in price-sensitive markets like India and parts of Africa. Several pharmaceutical companies produce generic pravastatin, which intensifies price competition but ensures continued market demand.

Market Drivers

-

Rising Global Prevalence of Hyperlipidemia and CVD: A consistent rise in hyperlipidemia prevalence fuels demand. The global aging demographic exacerbates this trend.

-

Shift Towards Preventive Care: Increasing emphasis on primary and secondary prevention of cardiovascular events promotes long-term medication adherence, benefitting pravastatin sales.

-

Safety Profile and Tolerability: Unlike some statins associated with muscle toxicity, pravastatin’s safety enhances its market appeal, particularly in vulnerable populations.

-

Healthcare Infrastructure Expansion in Emerging Markets: Increased healthcare access and awareness in countries like India, China, and Brazil expand the potential patient base.

Challenges and Limitations

-

Generic Drug Competition: The widespread availability of cheap generics reduces profit margins for branded PRAVACHOL, constraining revenue growth.

-

Market Saturation: In mature markets like North America and Europe, pravastatin’s market penetration is approaching a ceiling due to existing prescriptions.

-

Emergence of Novel Therapeutics: PCSK9 inhibitors and other lipid-modulating agents introduce alternative treatment options for high-risk dyslipidemia, potentially cannibalizing statin sales.

-

Physician Preference Shift: Preference toward higher-potency statins or combination therapies could limit pravastatin’s prescriptions.

Future Sales Projections

Assumptions

- Market Growth Rate: The hyperlipidemia market in developed regions is projected to grow at 3-4% annually, while emerging markets could grow at 8-10%, driven by increased healthcare access.

- Market Share Stability: Pravastatin maintains its current global prescription share of approximately 8-10% in the statin segment, with potential for incremental growth in niche markets.

- Pricing Trends: Post-patent expiry, average prices decline by 30-50% for generics.

Projected Revenue (Next 5 Years)

| Year | Estimated Global Market Size (USD billions) | Pravastatin Market Share | Projected Sales (USD millions) | Notes |

|---|---|---|---|---|

| 2023 | 22 | 8% | 1,760 | Baseline year |

| 2024 | 22.9 | 8.2% | 1,880 | Moderate market share growth |

| 2025 | 23.8 | 8.2% | 1,950 | Sustained demand with market expansion |

| 2026 | 24.7 | 8.3% | 2,050 | Slight uptick in market share |

| 2027 | 25.5 | 8.3% | 2,115 | Continued growth in emerging markets |

Note: These projections assume a conservative increase in market share and market size trends, considering generic competition and new therapeutic options.

Strategic Opportunities

- Formulation Innovations: Developing combination pills (e.g., pravastatin with ezetimibe) could rejuvenate sales and address unmet needs.

- Geographic Expansion: Target emerging markets with rising hyperlipidemia prevalence.

- Differentiation: Emphasize pravastatin’s safety profile in clinical communications and marketing strategies.

- Partnerships and Licensing: Collaborate with biotech firms for innovative formulations or delivery systems.

Key Takeaways

-

Stable Niche in a Competitive Market: PRAVACHOL remains relevant owing to its safety profile, particularly for elderly and high-risk patients, maintaining a consistent share within the global statin market.

-

Impact of Generics: The availability of inexpensive generics constrains profit margins but expands access, especially in emerging markets.

-

Growth Prospects in Emerging Markets: Large, underserved populations experiencing increasing hyperlipidemia prevalence present significant growth opportunities.

-

Market Dynamics Favor Slow Growth: While opportunities exist, the overall sales trajectory for PRAVACHOL is modest due to market saturation and competition from higher-potency statins and alternative therapies.

-

Innovation and Strategic Diversification Needed: To sustain and enhance sales, pharmaceutical companies should explore formulation advances, combination therapies, and geographic expansion strategies.

FAQs

Q1: How does PRAVACHOL compare to other statins in terms of efficacy?

PRAVACHOL is effective in lowering LDL cholesterol but is less potent than atorvastatin or rosuvastatin. Its primary advantage lies in its safety profile and tolerability, making it suitable for specific patient populations.

Q2: What are the main side effects associated with PRAVACHOL?

PRAVACHOL generally has a favorable safety profile; however, rare side effects include muscle pain, elevated liver enzymes, and gastrointestinal discomfort. Its lower potency reduces the risk of muscle toxicity compared to some other statins.

Q3: How significant is generic competition for PRAVACHOL’s sales?

Generic pravastatin significantly impacts sales volume and margins. Approximately 80% of pravastatin prescriptions are now for generics, which are substantially cheaper and increase accessibility.

Q4: Are there any upcoming innovations or formulations for PRAVACHOL?

Currently, the focus is on combination formulations to enhance adherence and efficacy. Patent expirations have limited new proprietary formulations, but companies are exploring novel delivery systems and fixed-dose combinations.

Q5: What role do regulatory policies play in controlling pravastatin sales?

Regulatory agencies encourage cost-effective therapies, promoting generic drug use. Reimbursement policies in various countries also influence prescribing patterns, favoring generics over branded versions.

References

[1] WHO. Cardiovascular diseases (CVDs). 2021.

[2] MarketWatch. Hyperlipidemia Treatment Market Trends. 2022.

[3] IQVIA. Prescription Data and Market Share Reports. 2022.

This comprehensive analysis provides a strategic overview of PRAVACHOL’s current and projected market performance, equipping stakeholders with insights necessary for informed decision-making.

More… ↓