Share This Page

Drug Sales Trends for PLAVIX

✉ Email this page to a colleague

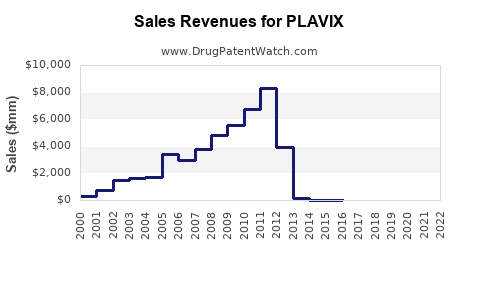

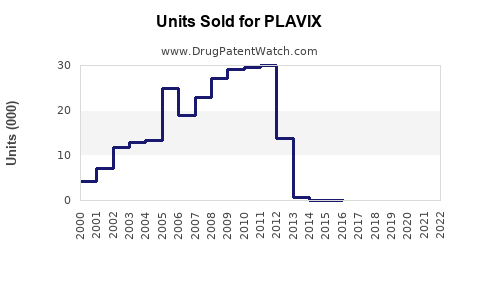

Annual Sales Revenues and Units Sold for PLAVIX

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| PLAVIX | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| PLAVIX | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| PLAVIX | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Plavix (Clopidogrel)

Introduction: Overview of Plavix in Cardiovascular Therapy

Plavix (clopidogrel) is an antiplatelet agent primarily prescribed to reduce the risk of stroke, myocardial infarction (MI), and vascular death in patients with atherosclerotic cardiovascular disease. Developed by Sanofi and Bristol-Myers Squibb, Plavix received FDA approval in 1997 and has established itself as a cornerstone in secondary prevention strategies. Its mechanism involves inhibiting platelet aggregation via the ADP receptor pathway, making it crucial in managing acute coronary syndromes (ACS) and post-percutaneous coronary intervention (PCI) cases.

Market Dynamics and Drivers

-

Growing Cardiovascular Disease (CVD) Burden

The global prevalence of CVDs, including coronary artery disease (CAD), cerebrovascular disease, and peripheral arterial disease, continues to rise. According to the World Health Organization (WHO), CVDs account for nearly 17.9 million deaths annually, projected to reach 23.6 million by 2030 if current trends persist. This escalating disease burden directly correlates with increased demand for antiplatelet therapies like Plavix. -

Expanding use in Acute Coronary Syndromes (ACS) and PCI

Plavix’s primary indications are in secondary prevention, especially for ACS patients undergoing angioplasty and stenting. The expanding global reach of PCI, supported by technological advances and increasing intervention rates in developing countries, bolsters long-term demand for adjunctive antiplatelet agents. -

Generic Competition and Patent Expiry

Sanofi and BMS’s patent for Plavix expired in 2012 in the U.S., leading to the entry of multiple generics that significantly reduced costs and increased accessibility. While generics have eroded brand sales, overall usage remains robust due to established clinical protocols and formulary preferences. -

Guideline Endorsements and Clinical Evidence

Plavix’s positioning in treatment guidelines by the American College of Cardiology (ACC), American Heart Association (AHA), and European Society of Cardiology (ESC) sustains its market presence. Ongoing meta-analyses reaffirm its efficacy, especially when combined with aspirin in dual antiplatelet therapy (DAPT). -

Emerging Therapeutic Alternatives

New antiplatelet agents such as ticagrelor and prasugrel pose competitive challenges but also expand the therapeutic landscape. Despite this, Plavix remains preferred due to familiarity, cost-effectiveness, and extensive clinical history.

Regional Market Analysis

-

North America

The largest market, driven by sophisticated healthcare systems, high intervention rates, and extensive clinical adoption. The U.S. alone accounts for approximately 40% of global Plavix sales pre-generic era. Post-patent expiry, generic penetration increased, but the U.S. still sustains high utilization due to established treatment protocols. -

Europe

High adoption driven by well-developed healthcare infrastructure and adherence to guidelines. The European Medicines Agency (EMA) approved generic versions rapidly post-patent expiry, amplifying market volume. -

Asia-Pacific

Expected to experience rapid growth owing to increasing CVD prevalence, expanding intervention services, and improving healthcare access. Countries like China and India represent burgeoning markets for established antiplatelet medicines. -

Emerging Markets (Latin America, Africa)

Growth potential exists but is constrained by healthcare infrastructure and affordability challenges. Increasing urbanization and lifestyle changes will gradually boost demand.

Sales Trends and Historical Data

-

Pre-2012 (Patent Protection Period)

Sales peaked around 2010-2011, with annual revenues estimated at approximately $10 billion globally, predominantly from developed markets. Growth was stabilized by mature market penetration and clinical guidelines supplementation. -

Post-2012 (Patent Expiry and Generic Entry)

Following patent expiration, brand sales declined sharply. A 40-50% reduction was observed within two years, with generics capturing a significant market share. Despite this, total global sales remained substantial due to continued clinical demand and off-label uses. -

Current Estimates (2023)

Worldwide sales of all formulations are estimated at $2.5-$3 billion annually, dominated by generic versions. The shift has led to a focus on regional market dynamics, price competition, and formulary preferences.

Sales Projections (2023–2030)

-

Factors Influencing Sales Growth

- Rising CVD prevalence: projected to fuel increased antiplatelet therapy prescriptions.

- Expansion of PCI procedures: especially in Asia-Pacific and Latin America.

- Adoption of DAPT guidelines: consistent recommendation for clopidogrel as a first-line or alternative agent in various clinical scenarios.

-

Predicted Market Trajectory

- 2023–2025: Steady decline in brand-name sales; stabilization as generics dominate.

- 2026–2030: Marginal growth driven by increasing intervention rates in emerging markets; potential for new formulations or combination therapies to sustain revenue streams.

-

Impact of New Therapies

The advent of oral P2Y12 inhibitors like ticagrelor and prasugrel pose both competition and opportunity. While these drugs offer advantages in certain indications, cost and clinical familiarity favor continued Plavix use in many regions. -

Potential Market Size

Based on epidemiological data, global annual prescriptions for clopidogrel-based therapies are expected to sustain at around 80–100 million patient-treatment courses. Market value could range between $3 billion and $4 billion by 2030, factoring in inflation, regional growth, and generic pricing dynamics.

Future Opportunities and Challenges

-

Opportunities

- Development of fixed-dose combination pills (e.g., with aspirin) to improve compliance.

- Expansion into secondary prevention protocols tailored for aging populations.

- Leveraging the established safety profile for broader indications.

-

Challenges

- Competition from newer agents with superior efficacy or dosing advantages.

- Price erosion due to generics and global cost-control measures.

- Variations in regulatory approvals across jurisdictions.

Key Takeaways

- Plavix remains a critical component of antiplatelet therapy, especially in developed markets with high intervention rates.

- Although patent expiry led to significant revenue decline, generic competition stabilized global sales at a substantial level.

- Rising CVD prevalence and expanding PCI procedures, mainly in Asia-Pacific and emerging markets, present growth opportunities.

- The competitive landscape is evolving with newer agents, but cost, clinical familiarity, and established efficacy sustain Plavix’s relevance.

- Sales projections indicate a gradual decline in brand sales but sustained market volume driven by global epidemiological trends.

FAQs

1. What is the current market share of Plavix globally?

While exact figures fluctuate, Plavix's market share is now predominantly held by generic versions, accounting for over 80% of prescriptions post-patent expiry, with total global sales estimated at $2.5–3 billion annually.

2. How have patent expiries impacted Plavix’s sales?

Patent expiration in 2012 triggered rapid entry of generics, reducing the brand’s revenue by approximately 50%, but overall demand persisted due to established clinical protocols and the affordability of generics.

3. What regional markets are driving future growth for Plavix?

Asia-Pacific, Latin America, and Africa are expected to see increased demand due to rising CVD prevalence, expanding healthcare infrastructure, and growing intervention procedures.

4. How does Plavix compare with newer antiplatelet agents?

While agents like ticagrelor and prasugrel offer benefits in potency and rapid onset, Plavix’s longstanding safety record, familiarity, and lower cost sustain its use, especially where reimbursement constraints exist.

5. What are the prospects for developing new formulations or combination therapies involving Plavix?

Opportunities include fixed-dose combination pills to improve adherence and synergistic formulations for secondary prevention, aligning with trends toward personalized and simplified therapy regimens.

References

[1] World Health Organization. Cardiovascular diseases (CVDs). 2021.

[2] FDA. Plavix (clopidogrel) prescribing information. 2012.

[3] GlobalData. Antiplatelet drugs market analysis. 2022.

[4] European Society of Cardiology. Guidelines on DAPT. 2019.

[5] IQVIA. Prescription Trends and Market Data. 2022.

More… ↓