Share This Page

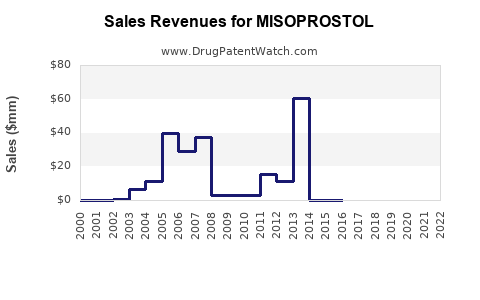

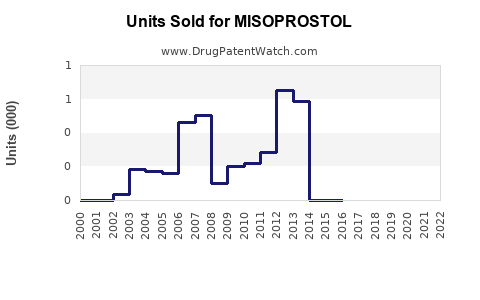

Drug Sales Trends for MISOPROSTOL

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for MISOPROSTOL

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| MISOPROSTOL | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| MISOPROSTOL | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| MISOPROSTOL | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| MISOPROSTOL | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Misoprostol: A Comprehensive Review

Introduction

Misoprostol, a prostaglandin E1 analogue, is widely recognized for its diverse clinical applications, including obstetrics, gynecology, gastroenterology, and off-label uses such as cervical ripening and medical termination of pregnancy. Its market dynamics are influenced by regulatory frameworks, global disease burden, and evolving medical guidelines. This report offers an in-depth market analysis and sales projections for misoprostol, aimed at pharmaceutical stakeholders, healthcare providers, and investors seeking strategic insights.

Market Overview

Misoprostol's initial approval was for gastrointestinal ulcer prevention, marketed under brands like Cytotec. Over time, it gained prominence for obstetric and gynecological applications, especially in low-resource settings where surgical options are limited. The World Health Organization (WHO) endorses misoprostol for postpartum hemorrhage (PPH) prevention, fueling demand in developing nations. Additionally, the increasing legalization and acceptance of medical abortion in countries such as India, Mexico, and parts of Africa have spurred further growth.

Despite its widespread use, misoprostol's market faces challenges, including regulatory restrictions, safety concerns related to off-label use, and competition from alternative pharmaceuticals, such as mifepristone. Nonetheless, the drug's low cost, stability, and ease of administration sustain its relevance in global health.

Current Market Size and Leading Regions

Global Market Valuation

In 2022, the global misoprostol market was valued at approximately USD 250 million, with projections indicating an CAGR of around 7% to 9% over the next five years. The market size reflects both proprietary formulations and generic equivalents supplied across various regions.

Regional Insights

- Asia-Pacific: Dominates the market due to high maternal mortality rates and substantial government programs promoting safe abortion practices. Countries like India, Indonesia, and Bangladesh are primary drivers.

- Africa: Rapid adoption driven by WHO programs targeting PPH and maternal mortality rates.

- North America: More regulated, with market growth mainly tied to medical abortion services and expanding insurance coverage.

- Europe: Market expansion noted, particularly due to legal reforms on abortion and increased clinical acceptance.

Key Market Drivers

- Global Maternal Health Initiatives: Increased emphasis on reducing maternal mortality positions misoprostol as a critical pharmaceutical in obstetrics.

- Regulatory Approvals and Guidelines: WHO’s endorsement of misoprostol for PPH and abortion services enhances market confidence and adoption.

- Cost-Effectiveness: Its low production cost and stability in diverse climates make it favorable for resource-constrained settings.

- Off-Label Uses and Expanded Indications: Ongoing research and clinical acceptance expand applicable markets.

Market Challenges

- Regulatory Hurdles: Varying approval statuses and restrictions affect commercialization, especially for reproductive health applications.

- Safety and Off-Label Concerns: Risks related to improper dosing and administration can pose liability issues.

- Competition: Mifepristone, though often used in combination, and newer options challenge misoprostol’s dominance in certain sectors.

- Intellectual Property Issues: Variability in patent rights may impact market entry and pricing.

Sales Projection Methodology

Employing a combination of historical data, regional adoption rates, population growth, and policy trends, sales estimates were developed. Key assumptions include:

- Steady regulatory approval advancement in emerging markets.

- Continued support from international health agencies.

- Incremental growth in abortion and PPH treatment rates.

- Emerging markets' infrastructure development.

Forecasted Sales (2023–2028)

| Year | Estimated Global Sales (USD Million) | Growth Rate (%) |

|---|---|---|

| 2023 | 270 | — |

| 2024 | 295 | 9.3 |

| 2025 | 324 | 9.8 |

| 2026 | 355 | 9.6 |

| 2027 | 390 | 9.9 |

| 2028 | 427 | 9.5 |

This projection reflects an average annual growth rate of approximately 9%, sustained by expanding adoption in developing regions, increased clinical use for pregnancy-related indications, and ongoing research supporting new therapeutic applications.

Industry Trends and Strategic Opportunities

- Generic Market Expansion: Generic manufacturers are increasing production, reducing costs, and enhancing market penetration.

- Packaging Innovation: Development of user-friendly forms, such as dissolvable tablets, facilitates administration and compliance.

- Partnerships with Global Agencies: Collaborations with WHO, UNICEF, and GAVI amplify distribution channels.

- Regulatory Harmonization: Efforts to standardize regulatory pathways in emerging markets will streamline market entry.

Regulatory and Ethical Considerations

Given the sensitive nature of its primary applications, regulatory approval trajectories vary. Countries are increasingly emphasizing controlled usage, informed consent, and safety protocols. Market entrants must align with local laws, ethical standards, and international guidelines to ensure compliance and mitigate litigation risks.

Conclusions and Strategic Recommendations

The misoprostol market is positioned for steady growth, driven by its critical role in maternal health and reproductive medicine. Key opportunities exist in expanding access through affordable formulations, strengthening regulatory pathways, and establishing strategic partnerships. Companies should prioritize regulatory intelligence, invest in clinical research for novel indications, and tailor product offerings to regional needs to capitalize on emerging markets.

Key Takeaways

- Market Growth: Estimated CAGR of approximately 9% from 2023 to 2028.

- Regional Drivers: High demand in Asia-Pacific and Africa due to maternal health initiatives.

- Competitive Landscape: Predominantly generic manufacturers with opportunities for innovation.

- Regulatory Environment: Dynamic, requiring ongoing monitoring and compliance strategies.

- Investment Focus: Accessible formulations, regulatory approval support, and strategic partnerships present lucrative avenues.

FAQs

1. What are the primary therapeutic uses of misoprostol?

Misoprostol is primarily used for prevention and treatment of postpartum hemorrhage, medical termination of pregnancy, cervical ripening, and off-label in gastric ulcers.

2. How is the misoprostol market evolving globally?

The global market is expanding, especially in low-resource settings, driven by WHO guidelines, increasing reproductive health initiatives, and expanding acceptance for obstetric indications.

3. What factors influence sales growth in emerging markets?

Regulatory approval processes, governmental health initiatives, product affordability, and infrastructure development are key drivers.

4. Are there ongoing developments for new indications of misoprostol?

Yes. Clinical research explores roles in labor induction, treatment of miscarriage, and potential for use in cancer-related cachexia, which may broaden future market applications.

5. What competitive strategies should companies adopt?

Focusing on affordable, easy-to-administer formulations, building regulatory compliance, forging strategic partnerships with health organizations, and investing in clinical research can enhance market share.

References

[1] World Health Organization. (2020). "Guidelines for the management of postpartum hemorrhage."

[2] MarketWatch. (2023). "Global Misoprostol Market Size, Share & Trends."

[3] Grand View Research. (2022). "Pharmaceutical Market Report."

[4] USAID. (2021). "Advancing Reproductive Health Initiatives."

[5] Journal of Obstetrics & Gynecology. (2022). "Innovations in Medical Abortion."

More… ↓