Last updated: July 27, 2025

Introduction

MIRENA (levonorgestrel-releasing intrauterine system, LNG-IUS) stands as a leading contraceptive device with additional therapeutic indications, including heavy menstrual bleeding and endometrial protection during hormone therapy. Since its FDA approval in 2000, MIRENA has cemented itself as a dominant player in the intrauterine device (IUD) market, driven by innovative technology, expanding indications, and demographic shifts. This report presents a comprehensive market analysis and sales projection for MIRENA, considering current trends, competitive landscape, and regulatory dynamics.

Market Overview

Global Contraceptive Market Context

The contraceptive market, valued at approximately USD 22 billion in 2022, is projected to grow at a compound annual growth rate (CAGR) of 6%, reaching USD 31 billion by 2030 [1]. Enhanced awareness, increasing acceptance of long-acting reversible contraceptives (LARCs), and advances in device safety fuel this growth.

MIRENA’s Market Position

MIRENA commands a significant share within LARC segments, attributable to its proven efficacy, longevity (3-5 years), and dual functionality for contraception and treatment of heavy menstrual bleeding. Its user profile spans women aged 18-45 seeking reliable contraception, with particular expansion into postmenopausal women and patients requiring endometrial protection.

Market Drivers

- Rising contraceptive demand: Increasing awareness of LARCs' superior efficacy compared to oral pills [2].

- Expanding indications: Label expansions for heavy menstrual bleeding and endometrial protection broaden potential user base.

- Patient preference: Preference for non-daily, discreet methods contributes to steady adoption.

- Healthcare provider endorsement: Favorable clinical data and guidelines favoring LARC methods bolster provider recommendations.

Market Challenges

- Patient hesitation: Concerns about insertion discomfort, side effects.

- Regulatory intricacies: Variations in approval statuses across regions.

- Competitive alternatives: Other hormonal IUDs, copper IUDs, implants, and emerging contraceptive technologies.

Competitive Landscape

MIRENA's primary competitors include:

- Kyleena: Lower-dose IUD with a 5-year lifespan.

- Liletta: US FDA-approved, cost-effective alternative with similar efficacy.

- Skyla: Smaller device suitable for nulliparous women.

- Copper IUDs: Non-hormonal alternatives (e.g., ParaGard).

Manufacturers such as Bayer, Allergan (now part of AbbVie), and other regional players contribute to competitive dynamics, impacting pricing strategies, market share, and promotional efforts.

Regulatory and Geographic Market Trends

- United States: MIRENA remains one of the most prescribed LARCs; U.S. sales constitute approximately 30-40% of global revenue [3].

- Europe: Favorable reimbursement policies and progressive regulatory environments support adoption.

- Emerging Markets: Rapid growth potential due to expanding healthcare infrastructure and contraceptive awareness.

Sales Analysis

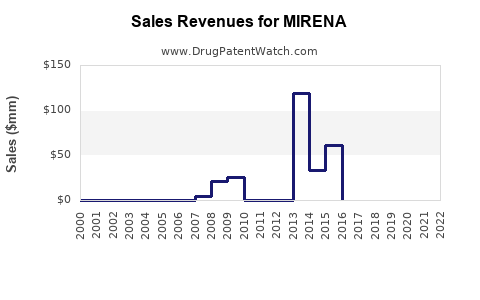

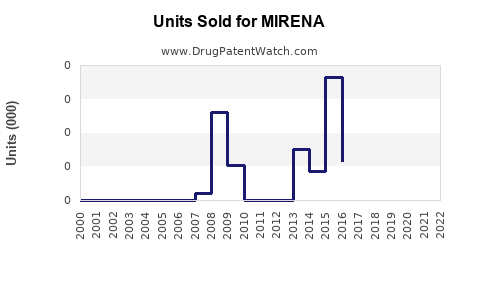

Historical Performance

From 2018 to 2022, MIRENA's annual sales globally grew at a CAGR of approximately 5%, driven by rollout expansion and indication diversification. In 2022, global sales approached USD 1.2 billion, with North America accounting for roughly USD 480 million, Europe USD 320 million, and emerging markets the remainder [3].

Factors Influencing Past Growth

- Incremental market penetration in mature markets.

- Increased prescribing for heavy menstrual bleeding.

- Endorsements from medical societies supporting LNG-IUS efficacy.

Forecasting Methodology

Sales projections consider:

- Market penetration rates based on demographic trends.

- Growth in contraceptive acceptance globally.

- Regulatory approvals expanding indications.

- Competitive pressures and pricing strategies.

- Healthcare infrastructure improvements in emerging markets.

Applying a conservative CAGR of 6% over the next five years aligns with global market growth, augmented by increasing adoption rates and indication expansion.

Sales Projections (2023–2028)

| Year |

Projected Sales (USD Millions) |

Assumptions |

| 2023 |

1,272 |

Continued penetration in existing markets; stabilization of growth rate. |

| 2024 |

1,348 |

Expanded indications; increased adoption in emerging regions. |

| 2025 |

1,427 |

Greater physician awareness; regulatory approvals in additional regions. |

| 2026 |

1,510 |

Increased usage for endometrial protection; potential new formulations. |

| 2027 |

1,597 |

Entrenchment in emerging markets; possible pricing adjustments. |

| 2028 |

1,689 |

Maturation of markets; healthcare infrastructure advancements; competitive dynamics. |

These projections consider a steady increase in market share, adoption in new regions, and an expanding user base due to demographic shifts. Notably, technological advancements or regulatory changes could alter this trajectory significantly.

Strategic Opportunities and Risks

Opportunities

- Indication expansion: Continued evidence supporting additional uses could open new patient segments.

- Market penetration: Focused efforts in Asia-Pacific, Latin America, and Africa, where contraceptive access is improving.

- Product innovation: Development of longer-lasting devices or combination formulations to boost sales.

Risks

- Regulatory delays or unfavorable rulings impair market expansion.

- Competitive innovations may reduce MIRENA’s relative market share.

- Pricing pressures driven by generic or alternative products could impact margins.

- Patient preferences shifting toward newer methods or non-hormonal options.

Conclusion

MIRENA’s strong clinical profile, established market presence, and expanding indications position it favorably for sustained growth. The product's sales are projected to increase by approximately 6% annually, reaching nearly USD 1.69 billion by 2028. Strategic focus on indications expansion, geographic penetration, and educational initiatives among healthcare providers can further amplify growth trajectories. Adaptation to regulatory shifts and competitive landscape nuances remains essential to maintaining and expanding market share.

Key Takeaways

- Stable Growth Outlook: MIRENA’s global sales are expected to grow at a CAGR of 6%, reflecting its market dominance in LARCs.

- Expanding Indications: Uses beyond contraception, notably heavy menstrual bleeding and endometrial protection, will bolster sales.

- Regional Expansion: Emerging markets present significant growth opportunities driven by increasing contraceptive awareness and healthcare improvements.

- Competitive Dynamics: Ongoing competition from newer IUDs necessitates strategic innovation and marketing.

- Strategic Focus Areas: Collaborations with healthcare providers, patient education, and regulatory engagement are critical for long-term success.

FAQs

1. What factors have contributed most to MIRENA’s market success?

MIRENA’s success stems from its efficacy, long-lasting contraceptive properties, dual therapeutic indications, and strong endorsement by clinical guidelines, making it a preferred choice among healthcare providers and patients.

2. How will regulatory changes impact MIRENA's sales projections?

Regulatory approvals or restrictions directly influence market access. Approvals for new indications or in emerging markets can significantly boost sales, while restrictions may slow growth.

3. Which regions are best poised for MIRENA’s growth?

Emerging regions such as Asia-Pacific, Latin America, and parts of Africa offer substantial growth potential owing to rising contraceptive awareness and infrastructure improvements.

4. How does competition affect MIRENA’s future sales?

Competitive products, especially newer hormonal IUDs and non-hormonal options, could impact market share. Price competition and innovation will be key to maintaining leadership.

5. What role does technological innovation play in MIRENA’s future outlook?

Advances such as longer-lasting devices, improved insertion procedures, or combined therapeutic features can enhance user experience and expand market share.

References

- MarketWatch. "Global Contraceptive Market Size, Share & Trends Analysis Report," 2022.

- World Health Organization. "Family Planning/Contraception Factsheet," 2021.

- Bayer Annual Report, 2022.