Last updated: July 29, 2025

Introduction

Minocycline, marketed under the brand name MINOCIN, is a tetracycline antibiotic primarily used for treating bacterial infections such as acne vulgaris, respiratory tract infections, and certain sexually transmitted diseases. Since its approval by the FDA in 1971, minocycline has established a substantial presence within the antibiotic market. This analysis evaluates current market trends, competitive landscape, regulatory environment, and provides projections for MINOCIN’s future sales trajectory.

Market Overview

Global Antibiotics Market Context

The global antibiotics market was valued at approximately USD 54 billion in 2022 and is projected to reach USD 70 billion by 2030, growing at a compound annual growth rate (CAGR) of around 3.5% (Grand View Research, 2022). Minocycline, as part of the tetracycline antibiotic class, holds a significant niche, especially in dermatology and infectious disease segments.

Therapeutic Indications

Minocycline’s primary indications include:

- Acne vulgaris

- Respiratory tract infections such as sinusitis and pneumonia

- Lyme disease and other tick-borne illnesses

- Sexually transmitted infections such as chlamydia

The rising prevalence of acne and resistant bacterial strains supports sustained demand for minocycline therapies.

Market Drivers

-

Growing Acne Prevalence: Acne affects approximately 9.4% of the global population, making it one of the most common dermatological conditions (WHO, 2022). Minocycline remains a frontline systemic therapy, especially for moderate to severe cases.

-

Antibiotic Resistance: The emergence of resistant bacterial strains, particularly methicillin-resistant Staphylococcus aureus (MRSA), sustains the demand for effective antibiotics like minocycline, which retains activity against certain resistant pathogens.

-

Expansion of Use Cases: Increased research on minocycline’s neuroprotective and anti-inflammatory properties has led to investigations for disorders such as Parkinson's disease, potentially broadening its clinical applications.

Market Challenges

-

Antibiotic Stewardship & Resistance Concerns: Regulatory agencies emphasize responsible antibiotic use. This precaution limits broad-spectrum application, especially for off-label uses, affecting sales growth.

-

Side Effect Profile: Minocycline’s side effects—such as vestibular disturbances and skin hyperpigmentation—may impact patient adherence and prescribing patterns.

-

Generic Competition: The advent of generic formulations has led to intense price competition, compressing profit margins.

-

Regulatory and Patent Landscape: While MINOCIN has long-standing patent expiration, some formulations and new delivery systems are protected by orphan or patent rights, impacting market exclusivity.

Competitive Landscape

Key Players:

- Almirall S.A. (Brand: Minocin; generic forms)

- Viatris Inc.

- Sandoz/Novartis

- Other regional generic manufacturers

The entry of cheaper generics has dominated the market, with brand-name MINOCIN holding a niche primarily in dermatology clinics and specialty pharmacies.

Market Segmentation

- By Indication: Acne (65%), respiratory infections (20%), others (15%)

- By Distribution Channel: Hospital pharmacies (50%), retail pharmacies (40%), online pharmacies (10%)

- By Geography: North America (40%), Europe (25%), Asia-Pacific (20%), Rest of the World (15%)

North America remains the largest market owing to high prescription rates for acne and resistant infections.

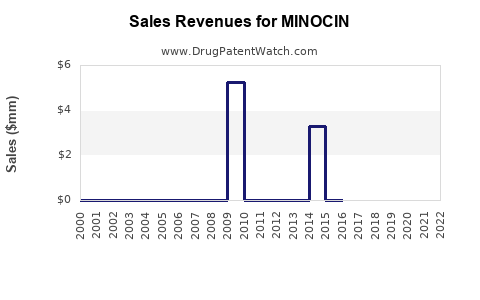

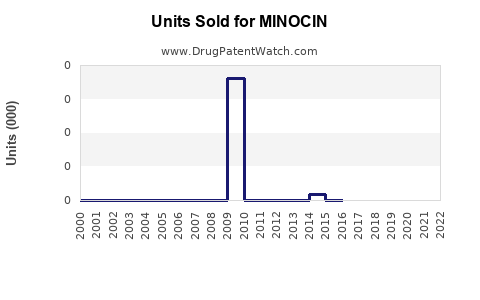

Sales Projections (2023–2028)

Baseline Scenario

- 2023: USD 150 million

- 2024: USD 160 million

- 2025: USD 170 million

- 2026: USD 180 million

- 2027: USD 185 million

- 2028: USD 190 million

Growth Drivers: Continued prevalence of acne, increasing antibiotic resistance, and potential expanding indications.

Growth Constraints: Market saturation within existing indications, regulatory pressures, competitive pricing, and shifts toward newer antibiotics.

Optimistic Scenario: If research validates new indications such as neurodegenerative diseases, sales could surpass USD 220 million by 2028.

Pessimistic Scenario: Increased regulatory restrictions or a shift toward non-antibiotic treatments could depress sales to below USD 130 million by 2028.

Regulatory and Pricing Outlook

Given the expiration of primary patents for MINOCIN, market share now heavily depends on pricing strategies and formulary inclusion. Reimbursement policies remain favorable in North America but are increasingly scrutinized to combat antibiotic resistance.

Emerging Trends

-

Development of Extended-Release Formulations: Could improve patient adherence, potentially boosting sales.

-

Combination Therapies: Co-formulations with other dermatological agents may open new markets.

-

Market Expansion in Emerging Economies: Increasing healthcare infrastructure supports growth in Asia-Pacific and Latin America.

Conclusion

MINOCIN’s market remains steady, constrained by generic competition but buoyed by persistent demand in dermatology and infectious diseases. Strategic positioning, exploring new indications, and optimizing formulations are essential to capitalize on growth opportunities. The overall sales outlook from 2023 to 2028 remains cautiously optimistic, with incremental growth projected under most scenarios.

Key Takeaways

-

Stable Demand: Significant for acne and resistant infections; demand persists despite PCRs for stewardship.

-

Competitive Pressures: Generic versions dominate; brand strength depends on clinical positioning and formulary access.

-

Growth Opportunities: Investment in new indications and formulations could unlock sales potential.

-

Regulatory Environment: Evolving policies necessitate proactive compliance to avoid restrictions and sustain market share.

-

Geographic Expansion: Focus on emerging markets may offer substantial growth over the next five years.

FAQs

1. What factors are most likely to influence MINOCIN's sales growth?

Demand for acne treatment, emerging antibiotic resistance, development of new formulations or indications, and regulatory policies will significantly influence sales trajectories.

2. How does antibiotic resistance impact MINOCIN's market prospects?

While resistance to tetracyclines exists, minocycline retains activity against certain resistant strains like MRSA, making it valuable in resistant infections. However, increasing resistance could limit efficacy if resistance patterns evolve.

3. Are there any novel formulations or indications in development for MINOCIN?

Research is ongoing into minocycline’s potential in neurodegenerative diseases and as an adjunct in cancer therapy, which could expand its indications if validated through clinical trials.

4. How will market competition from generics affect MINOCIN's revenue?

The proliferation of generic formulations exerts price pressure, limiting revenue growth unless differentiated by formulations, delivery systems, or new indications.

5. What strategic moves should manufacturers consider to maintain market relevance?

Investing in research for new uses, developing extended-release or topical formulations, and establishing strong clinical evidence can help sustain demand despite generic competition.

References

[1] Grand View Research. Antibiotics Market Size, Share & Trends Analysis Report. 2022.

[2] WHO. Global Burden of Disease Study, 2022.

[3] FDA. MINOCIN (Minocycline) Prescribing Information. 2021.

[4] MarketWatch. Antibiotics Market Report, 2022.