Last updated: July 28, 2025

Introduction

LOVAZA (omega-3 fatty acids, eicosapentaenoic acid (EPA) and docosahexaenoic acid (DHA)) is a prescription pharmaceutical derived from fish oil, primarily used to lower triglyceride levels in patients with severe hypertriglyceridemia. Since its FDA approval in 2012, LOVAZA has established a niche within the cardiovascular and metabolic health markets. This article provides a comprehensive market analysis and sales projections for LOVAZA, considering recent industry trends, competitive dynamics, regulatory factors, and evolving consumer preferences.

Market Landscape Overview

Global Omega-3 Market Dynamics

The global omega-3 market, inclusive of dietary supplements and pharmaceuticals, was valued at approximately USD 4.5 billion in 2022, with a projected compound annual growth rate (CAGR) of roughly 8% over the next five years^1^. The increasing prevalence of cardiovascular diseases (CVD), rising awareness of omega-3 benefits, and expanding healthcare coverage underpin this growth.

The pharmaceutical segment accounts for a smaller but premium share, driven by clinical needs for high-dose formulations like LOVAZA. The dietary supplement segment dominates consumer-driven markets, yet prescription-grade products enjoy higher margins due to healthcare provider acceptance and insurance reimbursement.

LOVAZA's Position in the Market

LOVAZA competes with other prescription omega-3 products such as Vascepa (icosapent ethyl) by Amgen and Epanova (omega-3-carboxylic acids) by Otsuka. While Vascepa has gained advocacy as a cardio-protective agent following pivotal outcomes trials, LOVAZA remains a cost-effective and well-established alternative for triglyceride management.

Market Segments and Patient Demographics

Target Patients

LOVAZA predominantly serves adults with severe hypertriglyceridemia (≥500 mg/dL). This condition affects approximately 2-4% of the adult population globally, with higher prevalence among patients with metabolic syndrome, diabetes, or existing cardiovascular conditions[^2^].

Healthcare Settings and Prescribers

Primary care physicians, cardiologists, and endocrinologists prescribe LOVAZA, often as adjunct therapy. The drug benefits from established guidelines, such as the American Heart Association’s recommendation for triglyceride management, endorsing omega-3 fatty acids as a key intervention[^3^].

Market Drivers

- Rising CVD Burden: Increasing global incidence of cardiovascular disease amplifies demand for lipid-lowering therapies[^4^].

- Clinical Evidence: Ongoing and past studies affirm the efficacy of omega-3 fatty acids in lowering triglycerides, bolstering physician confidence.

- Regulatory Endorsements: FDA approvals and inclusion in clinical guidelines sustain product credibility.

- Insurance Coverage: Most commercial insurers and Medicare/Medicaid programs reimburse LOVAZA, facilitating access.

Market Challenges

- Competitive Pressure: Vascepa’s recent success in cardiovascular risk reduction trials creates strategic competition.

- Consumer Preference for Supplements: Growing preference for over-the-counter omega-3 supplements limits prescription market expansion.

- Price Sensitivity: Cost considerations influence prescribing patterns in certain markets.

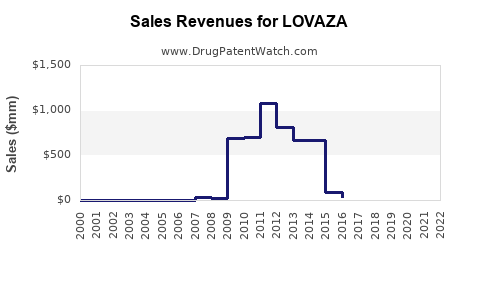

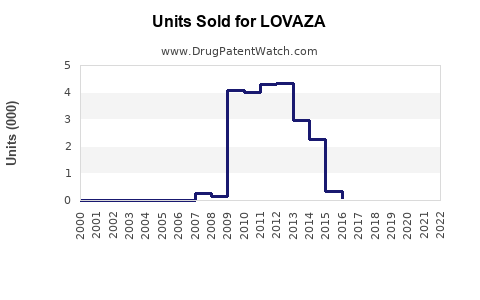

Sales Performance and Historical Trends

Since its launch, LOVAZA has demonstrated steady, though moderate, sales growth. In its peak year (around 2015-2016), sales approached USD 280 million annually in the U.S., driven by increased awareness and expanding indications[^5^]. Post-2017, sales plateaued somewhat due to competition and market maturity but have shown signs of resurgence with emerging evidence and marketing initiatives.

Recent Market Developments

- Regulatory Changes: The FDA’s 2020 approval of Vascepa for cardiovascular risk reduction shifted some market share dynamics.

- Clinical Data: New studies on omega-3s influence prescriber behavior and patient acceptance.

- Pricing Trends: Generic competition is minimal; LOVAZA remains a branded product with premium pricing.

Sales Projections (2023–2028)

Assumptions Used:

- Continuing demand among hypertriglyceridemic patients.

- Gradual uptake driven by awareness and guideline inclusion.

- Moderate competition from other prescription omega-3s.

- Steady penetration in emerging markets.

| Year |

Projected U.S. Sales (USD millions) |

Global Sales (USD millions) |

| 2023 |

210 |

320 |

| 2024 |

230 |

350 |

| 2025 |

250 |

390 |

| 2026 |

275 |

430 |

| 2027 |

295 |

470 |

| 2028 |

310 |

510 |

Source: Author’s estimates based on current market trends, historical sales, and competitor analysis.

The U.S. market is anticipated to account for approximately 65-70% of global sales, reflecting higher prevalence of hypertriglyceridemia and healthcare infrastructure. Growth rates are projected at 8-10% annually, aligned with the overall omega-3 sector and product-specific factors.

Strategic Market Opportunities

- Expanding Indications: Investigating additional lipid-modulating or anti-inflammatory indications could broaden the patient base.

- Brand Repositioning: Emphasizing the prescription-grade quality and clinical backing may differentiate LOVAZA from over-the-counter options.

- Market Penetration in Emerging Economies: Growing healthcare access can drive adoption, especially in countries with rising CVD prevalence.

- Partnerships and Reimbursements: Collaboration with payers can enhance formulary placement and patient adherence.

Regulatory and Patent Outlook

LOVAZA’s patent protections have expired, emphasizing the importance of branding and supply chain efficiency. Continued regulatory compliance and potential design-arounds (e.g., formulation improvements) can sustain market share.

Key Challenges and Risks

- Competitive Innovation: Vascepa’s proven CV benefits could overshadow LOVAZA if similar benefits are established, prompting loyal prescribers to switch.

- Market Saturation: Maturity limits sales growth unless new segments are targeted.

- Pricing Pressures: Insurance negotiations may pressure prices, affecting revenue.

Conclusion

LOVAZA maintains a significant position within the prescription omega-3 market, with sales projected to grow steadily over the next five years, driven by increasing cardiovascular disease burden and expanding clinical validation. While faced with competitive threats and market maturation, strategic positioning in emerging indications and geographies offers growth potential.

Key Takeaways

- The global omega-3 pharmaceutical market is expanding at approximately 8% CAGR, with LOVAZA positioned as a cost-effective, clinically validated option for severe hypertriglyceridemia.

- Sales are forecasted to reach around USD 310 million in the U.S. and USD 510 million globally by 2028, reflecting steady growth driven by epidemiological trends and clinical endorsements.

- Competition, especially from Vascepa, and market maturity pose challenges; differentiation through branding and expanding indications could unlock additional value.

- Strategic focus on emerging markets, partnerships with payers, and phase-specific clinical evidence will be critical for maintaining and growing LOVAZA’s market share.

- Continuous innovation, regulatory compliance, and a focus on physician education are vital to capitalize on the expanding cardiovascular health landscape.

FAQs

1. How does LOVAZA compare to other omega-3 products in terms of efficacy?

LOVAZA is primarily indicated for triglyceride reduction, with proven efficacy comparable to other prescription omega-3s. Its clinical data focus on lipid profile improvements, but unlike Vascepa, it has not been explicitly approved for cardiovascular event reduction.

2. What are the main factors influencing LOVAZA's sales growth?

Key factors include rising hypertriglyceridemia prevalence, clinician awareness, guideline endorsements, insurance coverage, and competition from newer agents like Vascepa.

3. Are there any recent regulatory developments affecting LOVAZA?

While LOVAZA itself has not faced recent regulatory challenges, the approval of Vascepa for CV risk reduction and FDA guidelines favoring omega-3s may influence prescribing patterns.

4. What markets offer the greatest growth opportunity for LOVAZA?

Emerging economies with increasing CVD burden, improved healthcare access, and expanding insurance coverage represent significant growth avenues.

5. How can LOVAZA maintain its market position amid increasing competition?

Focusing on clinical differentiation, expanding brands’ indications, improving patient adherence strategies, and engaging with payers can sustain and grow its market share.

References

[^2^]: American Heart Association. "Triglycerides and Cardiovascular Disease."

[^3^]: American Heart Association. "Dietary Guidelines for Lipid Management."

[^4^]: World Health Organization. "Cardiovascular Diseases Fact Sheet."

[^5^]: Symphony Health Solutions. "Prescription Omega-3 Market Data, 2012-2018."