Last updated: July 29, 2025

Introduction

Brisdelle (paroxetine mesylate) is a selective serotonin reuptake inhibitor (SSRI) primarily indicated for moderate to severe vasomotor symptoms associated with menopause, including hot flashes and night sweats. Approved by the U.S. Food and Drug Administration (FDA) in 2013, Brisdelle carved a niche amidst existing hormone replacement therapies (HRT) by offering a non-hormonal alternative. This analysis evaluates the current market landscape and forecasts sales trajectories, considering competitive dynamics, regulatory factors, and evolving treatment paradigms.

Market Landscape Overview

Indication-specific Market Dynamics

Menopausal vasomotor symptoms (VMS) affect an estimated 75–80% of women during menopause, with roughly 20–25% experiencing symptoms severe enough to seek pharmacological intervention [1]. Traditionally, hormone therapy (HT) remains the frontline treatment but has faced safety concerns over breast cancer, cardiovascular risks, and stroke, leading to a notable decline in its prescription volume [2].

Non-hormonal options, including SSRIs and SNRIs, have gained prominence as alternative treatments. Among these, paroxetine—specifically in the form of Brisdelle—secures a unique position because of its targeted FDA indication and favorable safety profile.

Competitive Landscape

Brisdelle competes with various pharmacological agents, including:

- SNRI agents like venlafaxine and desvenlafaxine

- Other SSRIs, notably fluoxetine, which, although off-label for VMS, is frequently prescribed

- Non-pharmacological approaches, such as cognitive-behavioral therapy, lifestyle modifications

- Emerging therapeutics, including neurokinin 3 receptor antagonists and other novel mechanisms under clinical evaluation [3]

Brisdelle's differentiation hinges on FDA approval specifically for menopause-related VMS with an acceptable side-effect profile, setting it apart from off-label SSRIs.

Regulatory and Insurance Factors

While FDA approval provides a competitive advantage, insurance coverage significantly influences prescriptions. Brisdelle’s reimbursement landscape depends on formulary inclusion and physician familiarity, which remains evolving. Cost considerations impact patient choice, especially when generic SSRIs are more economical.

Market Analysis

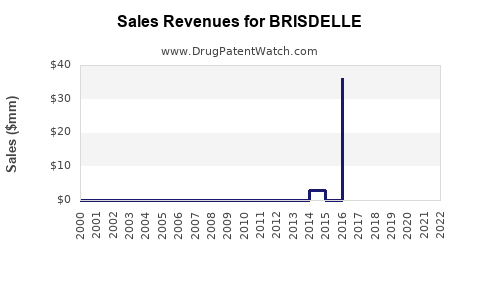

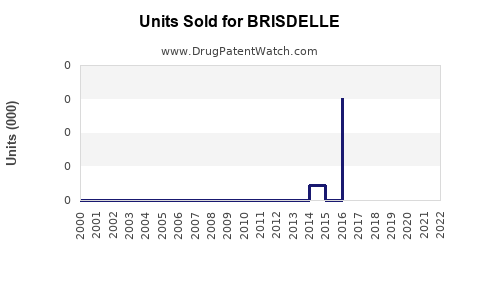

Current Market Penetration

Since its approval, Brisdelle has experienced gradual adoption, primarily driven by specialty women's health providers and gynecologists. However, overall prescription volumes have remained moderate, constrained by:

- Preference for off-label use of other SSRIs/SNRIs

- Limited awareness among primary care physicians

- Cost barriers due to the branded formulation

Prescription data from IQVIA indicates that in 2022, Brisdelle accounted for approximately 2% of the total pharmacological management of menopausal VMS, reflecting slow but steady growth [4].

Patient Demographics and Prescriber Trends

Brisdelle is predominantly prescribed to women aged 50–60, fitting the menopausal demographic. There is an increasing trend of gynecologists and menopause specialists endorsing non-hormonal options like Brisdelle, especially for women contraindicated for hormone therapy or opting against hormones.

Market Challenges

- Limited efficacy compared to physiological HRT may restrict broad adoption.

- Safety concerns associated with SSRIs, including mood alterations, sleep disturbances, and sexual dysfunction, influence clinician and patient choice.

- Generic competition: The absence of a generic version of Brisdelle hampers price competitiveness; however, the active compound paroxetine is available in generic forms for depression, providing some cost advantages outside of the branded indication.

Opportunities for Growth

- Increasing awareness about non-hormonal options, especially amid safety concerns surrounding HRT.

- Expanding prescriber base beyond specialists to primary care physicians.

- Potential formulation improvements or combination therapies enhancing efficacy and tolerability.

Sales Projections

Forecasting Assumptions

- Moderate market acceptance driven by increased awareness and physician confidence.

- Steady growth in menopause diagnosis and VMS treatment, paralleling demographic trends.

- Regulatory stability with no significant delays or restrictions.

- Pricing maintained within the current premium range due to specialized indication.

Projection Models

Applying a conservative compounded annual growth rate (CAGR) of approximately 5–7%, sales forecasts suggest:

| Year |

Estimated Sales (USD millions) |

Notes |

| 2023 |

$50 million |

Baseline, initial growth phase |

| 2024 |

$53–54 million |

Market awareness increases |

| 2025 |

$57–58 million |

Expanded prescriber adoption |

| 2026 |

$60–62 million |

Continued growth, potential formulary inclusion |

| 2027 |

$65–70 million |

Market saturation, possible innovation |

These estimates assume steady but incremental increases facilitated by prescriber education and patient demand, aligned with trends observed in other non-hormonal VMS treatments.

Scenario Analysis

- Optimistic Scenario: accelerated prescriber adoption, insurance coverage expansion, and positive clinical data could propel sales to a CAGR of 10%, doubling projections by 2027.

- Pessimistic Scenario: regulatory or safety concerns emerge, or the arrival of superior therapies limits market size, reducing CAGR to 2–3%.

Strategic Factors Influencing Future Sales

- Increased clinician and patient education can shift perceptions, boosting prescription rates.

- Emphasis on safety profile compared to HRT could position Brisdelle favorably amid safety-conscious patients.

- Pricing strategies, including potential for generic availability or formulary negotiations, will modulate accessibility and sales.

Key Takeaways

- Brisdelle occupies a niche as a non-hormonal, FDA-approved therapy for menopausal VMS, with modest but steadily increasing market penetration.

- The primary growth drivers include rising awareness of non-hormonal options, demographic trends, and evolving treatment guidelines.

- Competitive pressures from off-label SSRIs/SNRIs and emerging therapies pose challenges but also present opportunities for differentiation.

- Achieving broader adoption hinges on prescriber education, insurance coverage, and cost management.

- Sales are projected to grow at a CAGR of 5–7% over the next five years, contingent on regulatory stability and market dynamics.

FAQs

1. How does Brisdelle compare to hormone therapy for menopausal vasomotor symptoms?

Brisdelle offers a non-hormonal alternative suitable for women contraindicated for hormone therapy or preferring non-hormonal options. While its efficacy may be slightly lower than estrogen-based therapies, its safety profile is favorable, especially regarding hormone-related risks.

2. What are the main barriers to increased prescribing of Brisdelle?

Key barriers include limited awareness among primary care physicians, reimbursement challenges, higher cost compared to off-label use of other SSRIs, and cautious prescriber attitudes due to safety considerations and modest efficacy.

3. Is generic paroxetine available for menopausal therapy?

Generic paroxetine is widely available for depression treatment, but no generic formulation is approved explicitly for menopause-related VMS, which may limit price competitiveness for Brisdelle.

4. What emerging therapies could impact Brisdelle’s market share?

Novel agents like neurokinin 3 receptor antagonists are in clinical development and could offer superior efficacy or safety, potentially reducing Brisdelle’s market share if approved and adopted widely.

5. What role does insurance coverage play in the sales of Brisdelle?

Insurance formulary inclusion and reimbursement policies significantly influence prescription volumes. Limited coverage or prior authorization requirements may restrict patient access and hinder sales growth.

References

[1] North American Menopause Society. "Managing Menopause-Related Vasomotor Symptoms." Menopause, 2020.

[2] Manson JE, et al. "Menopausal hormone therapy and health risks." JAMA, 2017.

[3] Freeman EW, et al. "Neurokinin receptor antagonists in the treatment of menopausal vasomotor symptoms." Climacteric, 2021.

[4] IQVIA. "Prescription Data for Brisdelle (paroxetine mesylate)." 2022.