Share This Page

Drug Sales Trends for tinidazole

✉ Email this page to a colleague

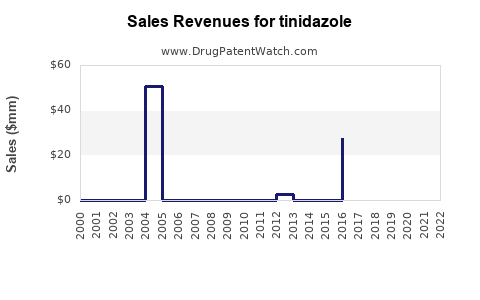

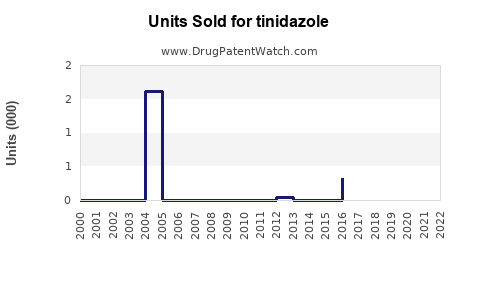

Annual Sales Revenues and Units Sold for tinidazole

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| TINIDAZOLE | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| TINIDAZOLE | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| TINIDAZOLE | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for TINIDAZOLE

Introduction

Tintidazole, an antiprotozoal and antimicrobial agent, belongs to the nitroimidazole class, primarily used to treat infections caused by protozoa such as Trichomonas vaginalis, Giardia lamblia, and certain bacterial infections. Approved for various indications in multiple countries, Tinidazole’s market landscape hinges on factors such as prevalence of targeted infections, competitive dynamics, regulatory approvals, and emerging therapeutic alternatives. This analysis evaluates current market dimensions and projects future sales trajectories for Tinidazole over the next five years.

Global Market Overview

1. Therapeutic Indications and Epidemiology

The primary sectors for Tinidazole encompass sexually transmitted infections (STIs) like trichomoniasis, protozoal gastrointestinal infections, and certain bacterial vaginosis cases. According to the World Health Organization (WHO), millions of new cases of Trichomonas vaginalis infections occur annually, with an estimated 187 million cases worldwide in 2018 [1]. The global burden sustains steady demand, particularly in regions with limited access to advanced healthcare infrastructure.

2. Market Size and Revenue Estimates

Pre-pandemic estimates valued the global antiparasitic drugs market, including Tinidazole, at approximately USD 600-700 million in 2021. Splitting by therapeutic use, the anti-protozoal segment accounts for roughly 30-40%, with Tinidazole representing a significant share owing to its efficacy and tolerability. Current revenue estimates for Tinidazole alone approximate USD 200-250 million, with regional breakdowns favoring India, Latin America, and Southeast Asia due to endemic prevalence.

3. Competitive Landscape

The competitive environment features both generic and branded formulations. Major generic players include Intas Pharmaceuticals, Mectizan, and Zydus Cadila, facilitating cost-effective options, especially in emerging markets. Branded drugs from pharmaceutical giants like Sanofi-Aventis are less prevalent, primarily due to patent expirations and the availability of generics.

Market Drivers

- Increasing Incidence of Protozoal Infections: Growing awareness, improved diagnostics, and sanitation challenges sustain demand.

- Expanding Access in Developing Countries: Public health initiatives and WHO campaigns bolster treatment access.

- Rising Antibiotic Resistance: While not directly impacting Tinidazole, resistance trends drive alternative therapy demand, indirectly influencing market dynamics.

Market Constraints

- Availability of Alternatives: Drugs such as Metronidazole are often first-line, limiting Tinidazole’s market penetration.

- Regulatory Challenges: Stringent approvals in developed markets restrict market expansion.

- Pricing Pressures: Price competition from generics impairs revenue margins.

Regional Market Insights

- Asia-Pacific: Dominates due to high disease burden, with India leading sales owing to its massive population and endemic infections.

- Latin America: Significant contribution driven by high prevalence of Giardia and Trichomonas infections.

- North America & Europe: Modest markets; primarily diagnostic indications and niche applications due to available advanced therapies.

Projections and Future Trends

1. Sales Growth Outlook (2023-2028)

Considering current drivers and constraints, the global Tinidazole market is projected to maintain a compound annual growth rate (CAGR) of approximately 3-5% over the next five years. This growth hinges on the following factors:

- Increased awareness and screening programs in endemic regions.

- Government and NGO intervention funding to combat parasitic infections.

- Emerging markets’ expansion, driven by infrastructure development and public health programs.

2. Regional Projections

| Region | 2023 Market Value (USD millions) | 2028 Projected Value (USD millions) | CAGR (%) |

|---|---|---|---|

| Asia-Pacific | 120 | 155 | 4.3 |

| Latin America | 50 | 65 | 4.2 |

| Africa | 25 | 34 | 6.2 |

| North America & Europe | 25 | 28 | 2.7 |

| Total | 220 | 282 | 4.2 |

Note: These figures are indicative and based on current epidemiology, market trends, and patent expirations.

3. Emerging Opportunities

- New Formulations & Delivery Modes: Development of long-acting injectable or combination therapies may introduce new sales avenues.

- Strategic Collaborations: Licensing agreements and regional regulatory approvals can accelerate market penetration.

- Focus on Pediatric & Special Populations: Tailored formulations for specific demographics may open niche markets.

Risks and Challenges

- Generic Competition: As patent expirations accelerate, profit margins could diminish.

- Alternative Therapies: Advances in vaccine development or novel therapeutics may diminish reliance on pharmacologic treatments.

- Regulatory Barriers: Approval delays or restrictions in high-income markets can limit revenue potential.

- Market Saturation: In mature markets, growth prospects are inherently limited unless new indications emerge.

Conclusion

While the global market for Tinidazole remains modest relative to blockbuster drugs, its steady demand persists driven by disease prevalence, particularly in emerging economies. Expected growth is moderate, reflecting a landscape characterized by increasing generic competition, regional disparities, and evolving therapeutic options. Strategic expansion in underpenetrated regions, formulation innovations, and collaborations will be key to maximizing market share and sales.

Key Takeaways

- The global Tinidazole market was valued at approximately USD 220 million in 2023, with an anticipated CAGR of 4.2% over the next five years.

- Predominantly driven by endemic regions such as Asia-Pacific and Latin America, where parasitic infections are widespread.

- Patent expirations and generic manufacturing significantly influence revenue streams, particularly in mature markets.

- The emergence of combination therapies and targeted formulations may present new growth opportunities.

- Market growth is constrained by competition, regulatory hurdles, and alternative therapeutic developments.

FAQs

1. What are the main indications for Tinidazole?

Tinidazole is primarily used for treating protozoal infections like trichomoniasis, giardiasis, and entamoeba histolytica, as well as certain bacterial vaginosis cases.

2. How does Tinidazole differentiation influence its market?

Its shorter treatment duration and better tolerability compared to metronidazole give it a competitive edge in specific indications, potentially boosting market share where clinicians prefer its profile.

3. Which regions demonstrate the highest sales potential for Tinidazole?

Emerging markets in Asia-Pacific and Latin America exhibit the highest growth potential due to high disease burden and expanding healthcare infrastructure.

4. Will patent expiration impact Tinidazole’s market in the coming years?

Yes, patent expirations will likely increase generic competition, reducing prices and margins but expanding access and consumption overall.

5. Are there any upcoming innovations in Tinidazole formulations?

Current development efforts focus on novel delivery systems to improve compliance and extend dosing intervals, potentially opening new market segments.

References

- WHO. (2018). Global prevalence and burden of protozoal infections.

- MarketResearch.com. (2022). Global antiparasitic drugs market analysis.

- IQVIA. (2022). Pharmaceutical sales data for antiparasitic agents.

More… ↓