Last updated: July 29, 2025

Introduction

Enalapril, an angiotensin-converting enzyme (ACE) inhibitor, is widely prescribed for hypertension and congestive heart failure management. Since its approval in the early 1980s, enalapril has become a cornerstone in cardiovascular therapy, owing to its proven efficacy and favorable safety profile. This report provides a comprehensive analysis of the current market landscape for enalapril, evaluating its competitive position, growth drivers, challenges, and future sales forecast.

Market Overview

Historical Context and Regulatory Status

Originally developed by Merck & Co., enalapril was approved by the FDA in 1985. It gained rapid adoption due to its ability to reduce mortality rates in heart failure patients. Over the decades, patent exclusivity has expired worldwide, leading to numerous generic formulations that dominate the market, significantly impacting branded sales.

Key Market Segments

The enalapril market primarily serves data-driven segments:

- Hypertension Management: Enalapril's antihypertensive efficacy supports its widespread use for blood pressure regulation.

- Heart Failure Treatment: Its proven mortality benefit positions it as a first-line agent.

- Renal Protection in Diabetic Patients: As part of renoprotective strategies, especially in diabetic nephropathy.

Geographical Market Dynamics

The global market divides into:

- North America: Leading market with high prevalence of cardiovascular diseases and mature healthcare infrastructure.

- Europe: Similar to North America, with extensive use of ACE inhibitors.

- Asia-Pacific: Fastest growth driven by rising cardiovascular disease epidemiology and expanding healthcare access.

- Rest of World: Emerging markets showing increasing adoption of affordable generic ACE inhibitors.

Competitive Landscape

Generic Dominance

The expiration of enalapril’s patent has catalyzed a shift towards generics, which now hold over 90% of sales worldwide. Major manufacturers include Teva Pharmaceuticals, Sun Pharmaceutical Industries, and Novartis, offering cost-competitive options.

Brand vs. Generic

While brand-name products like Vasotec (novartis) still exist, their market share is minimal compared to generics. Cost savings significantly influence prescribing patterns, especially in primary care settings and healthcare systems with budget constraints.

Emerging Alternatives

Newer classes of antihypertensives, such as angiotensin receptor blockers (ARBs) and direct renin inhibitors, compete with enalapril, impacting its market share in certain regions.

Market Drivers

- Prevalence of Hypertension and Heart Failure: Elevated global hypertension rates (over 1.3 billion adults) and aging populations drive demand.

- Cost-Effectiveness: Generics' affordability sustains enalapril’s widespread utilization.

- Established Efficacy and Safety: Long-standing clinical data reinforce its position.

- Guideline Recommendations: Major treatment guidelines endorse ACE inhibitors as first-line therapy, bolstering prescription rates.

Market Challenges

- Side Effect Profile: Cough and angioedema limit use in some patients, prompting clinicians to prefer ARBs.

- Low Differentiation: Minimal innovation reduces incentives for new formulations.

- Regulatory and Patent Landscape: While patents have expired, regulatory hurdles in some regions impact market entry for competitors.

Sales Projections

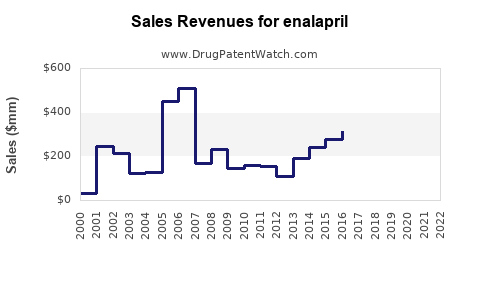

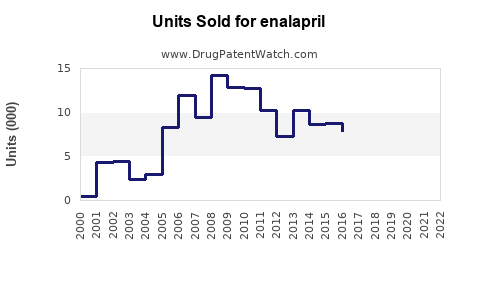

Historical Sales Trends

From peak sales in the late 1990s, enalapril’s global sales have declined substantially due to patent expiries and generic competition. However, the global ACE inhibitor market remains robust, with estimated revenues around $4.2 billion in 2022, predominantly driven by generic sales.

Forecast for the Next Five Years

Based on current trends, the following projections are made:

| Year |

Estimated Global Sales (USD billion) |

Growth Rate |

Key Factors |

| 2023 |

$3.8 billion |

-4.9% |

Continued generic dominance, slow growth in developing markets |

| 2024 |

$3.9 billion |

+2.6% |

Market stabilization, increased use in emerging markets |

| 2025 |

$4.0 billion |

+2.6% |

Rising prevalence of hypertension, improved accessibility |

| 2026 |

$4.1 billion |

+2.5% |

Growing awareness and guideline endorsement |

| 2027 |

$4.2 billion |

+2.4% |

Market maturation, potential penetration of biosimilars or new competitors |

Regional Breakdown

- North America: $1.5 billion (slight decline, market mature)

- Europe: $1.0 billion (stable, driven by aging demographics)

- Asia-Pacific: $800 million (rapid growth, expanding access)

- Rest of World: $700 million (emerging markets)

Factors Influencing Growth

- Population aging increases demand for cardiovascular therapies.

- Generic pricing pressures limit margins for manufacturers.

- Emerging market expansion provides growth opportunities.

- Potential biosimilar development might influence future pricing dynamics.

Implications for Stakeholders

Pharmaceutical companies focusing on enalapril must navigate a market characterized by high competition, commoditization, and decelerating growth. Strategies should emphasize expanding access in emerging markets, optimizing manufacturing costs, and leveraging clinical guidelines to maintain relevance.

Conclusion

Enalapril’s market landscape remains competitive yet mature, predominantly driven by generics with limited growth potential. Its essential role in cardiovascular disease management ensures baseline demand, but innovation stagnation and competitive pressure persist. Steady sales are projected through 2027, with regional growth driven primarily by demographic trends and healthcare access expansion.

Key Takeaways

- Market Maturity: Enalapril’s market is mature with declining sales in developed regions due to generic competition and low differentiation.

- Growth Opportunities: Significant expansion can occur in emerging markets where cardiovascular disease prevalence rises and healthcare infrastructure improves.

- Competitive Strategies: Companies should focus on cost-effective manufacturing, regional market penetration, and complementing existing products with innovative delivery methods or formulations.

- Regulatory Environment: Patent expiries facilitate broad generic adoption, but regulatory changes and quality standards are critical factors influencing supply.

- Future Outlook: Sales are expected to stabilize around $4.2 billion globally by 2027, with incremental growth driven by demographic and healthcare access factors.

FAQs

1. How has patent expiration affected enalapril’s market share?

Patent expiry led to the proliferation of generic versions, drastically reducing prices and shifting market dominance from branded to generic manufacturers, thus decreasing branded sales but expanding access globally.

2. What are the main competitors to enalapril in hypertension management?

ARBs such as losartan and valsartan serve as alternatives, especially in patients intolerant to ACE inhibitors. Newer therapies and combination drugs also influence prescribing trends.

3. Are there ongoing innovations or formulations for enalapril?

Currently, the market is saturated with generics; however, research focuses on fixed-dose combinations, improved delivery methods, and biosimilars to enhance adherence and efficacy.

4. What regional markets present the highest growth potential for enalapril?

Emerging markets in Asia-Pacific, Latin America, and Africa offer substantial growth opportunities due to rising disease burden and increasing healthcare access.

5. How might regulatory changes impact enalapril sales?

Stricter quality standards, approval of biosimilars, or new safety guidelines could influence manufacturing costs and market dynamics, potentially fostering competition or restricting market entry.

Sources:

- World Health Organization. (2021). Hypertension Fact Sheet.

- EvaluatePharma. (2022). Global Cardiovascular Market Report.

- FDA. (2021). Enalapril Product Information.

4.IMS Health. (2022). Market Data and Sales Analysis.

- GlobalData. (2023). Future Market Trends in Cardiovascular Drugs.