Last updated: July 29, 2025

Introduction

Amphetamine, a central nervous system stimulant, has a long-standing history in both medical and illicit markets. Legally, it is primarily prescribed for Attention Deficit Hyperactivity Disorder (ADHD) and narcolepsy; however, high abuse potential and regulatory restrictions influence its commercial viability. This analysis explores current market dynamics, regulatory landscape, clinical applications, competitive environment, and future sales projections, providing business professionals with a comprehensive understanding of the amphetamine market.

Market Overview

Historical Context and Current Use

Amphetamine-derived medications, including formulations like Adderall (amphetamine and dextroamphetamine), have dominated the pharmaceutical landscape for decades. The global ADHD therapeutics market, valued at approximately USD 21 billion in 2022, significantly contributes to the demand for amphetamine-based drugs [1]. The increasing prevalence of ADHD, particularly among children and young adults, drives sustained prescribing trends.

Regulatory Environment

Strict regulatory frameworks govern amphetamine production, distribution, and prescription practices across jurisdictions. Agencies like the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) classify amphetamine as a Schedule II controlled substance, reflecting its high potential for misuse [2]. These controls constrain supply expansion and impact commercialization strategies.

Market Segments and Geography

The primary market segments include:

- Prescription pharma: ADHD, narcolepsy

- Illicit use: Abuse and diversion

Geographically, North America dominates due to robust ADHD diagnosis rates and healthcare infrastructure, accounting for roughly 60% of the global market share. Europe follows, with Asia-Pacific emerging as a growth region owing to rising awareness and increasing ADHD diagnosis rates.

Competitive Landscape

Major pharmaceutical companies control the production and distribution of legally prescribed amphetamine drugs. Leading players include:

- Shire (now part of Takeda Pharmaceuticals): Long-standing market leader with products like Adderall.

- Teva Pharmaceuticals: Generic amphetamine formulations.

- Eli Lilly and Novartis: Other significant contributors.

Research and development efforts focus on:

- Extended-release formulations for improved compliance.

- Novel delivery systems to mitigate abuse potential.

- Alternative compounds with lower regulatory hurdles.

Linguistic and regulatory challenges restrict the entry of new players, funneling the market into existing competitors with established relationships and infrastructure.

Market Drivers and Constraints

Key Drivers:

- Rising ADHD prevalence: The CDC estimates ADHD affects approximately 6.1 million children in the U.S. alone [3].

- Increased awareness and diagnosis: A broader acceptance of mental health issues leads to more prescriptions.

- Innovation in formulations: Extended-release and combination therapies enhance treatment options.

Constraints:

- Regulatory restrictions: Stringent controls hamper manufacturing and distribution.

- Abuse and diversion: The potential for misuse limits prescribing discretion.

- Societal stigma: Negative perceptions impact demand in certain regions.

Sales Projections and Future Trends

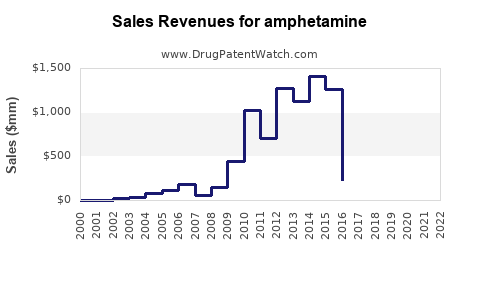

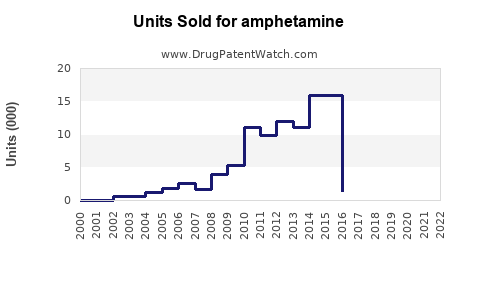

Market Forecast (2023-2030)

Based on current growth trajectories, the global amphetamine market is predicted to expand at a compound annual growth rate (CAGR) of approximately 4.2% through 2030, reaching an estimated USD 31 billion by 2030 [4].

Regional Outlook

- North America: Will continue to dominate due to high diagnosis rates, with projected sales reaching USD 20 billion by 2030.

- Europe: Moderate growth; sales expected to reach USD 5 billion.

- Asia-Pacific: Rapid growth driven by increasing mental health awareness and regulatory reforms, with projections of USD 3-4 billion.

Innovations and New Applications

Emerging formulations targeting abuse deterrence and long-acting delivery systems could capture additional market share. Moreover, the potential approval of new stimulant agents with lower abuse potential may reshape the competitive landscape.

Risks and Opportunities

Risks:

- Regulatory tightening in response to abuse concerns.

- Shifts in prescribing practices due to evolving clinical guidelines.

- Emergence of non-stimulant therapies for ADHD.

Opportunities:

- Development of abuse-resistant formulations.

- Expansion into emerging markets.

- Integration with digital health platforms for better management and adherence.

Conclusion

The amphetamine market remains a lucrative segment within the psychiatric therapeutics industry, driven by persistent demand for ADHD management and narcolepsy treatment. Despite regulatory and societal challenges, ongoing innovation and expanding global awareness provide avenues for steady growth. Companies that focus on developing safer formulations and navigating regulatory landscapes can capitalize on emerging opportunities, positioning themselves favorably for long-term sales.

Key Takeaways

- The global amphetamine market is projected to reach USD 31 billion by 2030, growing at a CAGR of 4.2%.

- North America remains the dominant market, with high ADHD prevalence and prescribing rates.

- Regulatory restrictions and abuse potential significantly influence market dynamics.

- Innovation in abuse-deterrent formulations and extended-release systems offers substantial growth opportunities.

- Emerging markets in Asia-Pacific represent significant, underpenetrated segments.

FAQs

Q1: What are the primary medical uses of amphetamine?

A1: Amphetamine is mainly prescribed for ADHD and narcolepsy, enhancing focus and alertness in patients with these conditions.

Q2: How do regulatory restrictions impact the amphetamine market?

A2: Strict controls on manufacturing, prescribing, and distribution limit supply, constrain market entry for new competitors, and incentivize innovation toward abuse-resistant formulations.

Q3: What are the main challenges facing the amphetamine industry?

A3: The primary challenges include high abuse potential, regulatory restrictions, societal stigma, and evolving clinical guidelines that may favor alternative therapies.

Q4: Which regions are expected to see the most growth in amphetamine sales?

A4: North America will continue to lead, but Asia-Pacific is emerging as a high-growth area due to increasing mental health awareness and regulatory reform.

Q5: What future innovations could influence the amphetamine market?

A5: Development of abuse-deterrent formulations, long-acting delivery systems, and new stimulant compounds with lower misuse potential are key innovation areas.

References

[1] Market Research Future, "Global ADHD Therapeutics Market," 2022.

[2] U.S. Drug Enforcement Administration, "Controlled Substances Schedules."

[3] Centers for Disease Control and Prevention, "Data & Statistics on ADHD," 2022.

[4] Grand View Research, "Pharmaceutical Industry Analysis," 2023.